Independents And Independence Will Have Their Day

“I would like to reiterate the importance of understanding how changes in the global landscape may affect the central role of the dollar in the global economy and financial system.” (C.J. Waller)

Summary:

· Dimon’s elevated hard landing probability converges on the Key Signals forward curve.

· The latest FOMC meeting minutes, evidentially, confirm that the FOMC is on the Key Signals forward curve.

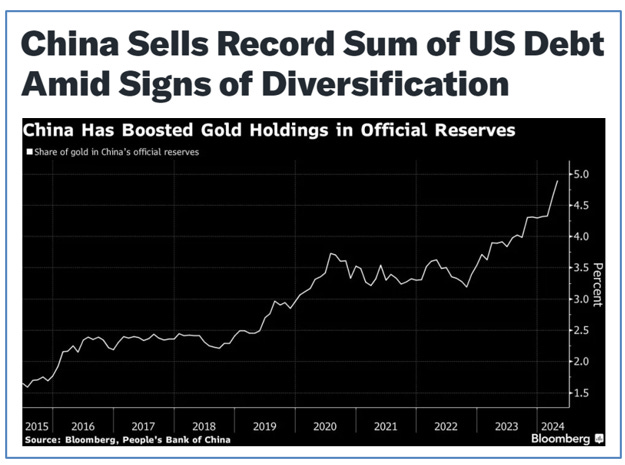

· The Fed faces the dilemma of continued insolvency, through “Transience”, or violent insolvency through US Dollar loss of global reserve currency status.

· Faced with the insolvency dilemma, the Fed has chosen to ease macroprudentially.

· Faced with the insolvency dilemma, some trade partners and adversaries are reducing their US Dollar exposure.

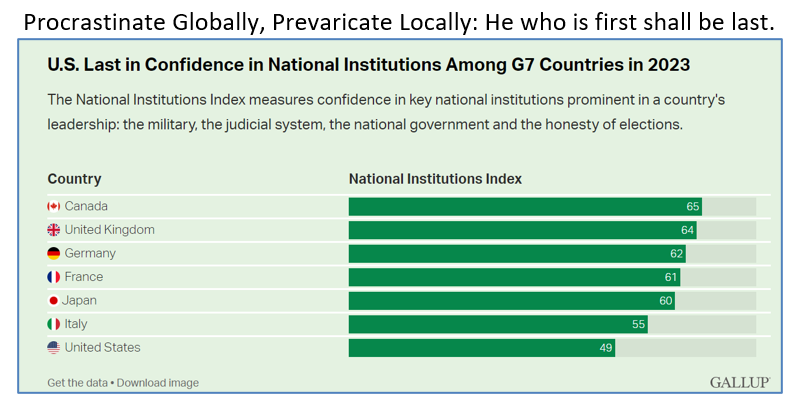

· The “Leader of the Free World” is lagging globally, and domestically, behind its democratic peers and followers, respectively.

· The “Leader of the Free World” is lagging, globally, in the “biggest global election year in history”.

· The anticipated “Unified Reich” will exacerbate the “Leader of the Free World’s” lag.

· A perceived lagging Free World Leader is in a position to have his/her leadership “stolen” and/or lost.

· A successful “stolen”/and or lost US leadership strategy depends upon framing/perception of the Presidential Debates for/by the Independents.

· Independence Day 2024, will be remembered as Independents’ Day 2024 in posterity.

· Rishi has chosen Independents’ Day to comply with the Special Relationship reset timetable imperative.

· Biden’s “OPEC+ October Surprise” mitigation strategy is a fiscal deficit-widening, wealth transfer, from US Voter/Taxpayer to oil producers and oil-producing states.

· Biden’s “OPEC+ October Surprise” mitigation strategy pushes the “surprise” out into the future.

· Governor Bailey’s “bumps” are a nudge for macroprudential policy easing.

· Governor Bailey is earnest about the “importance” of the creation of new reserves by the Fractional Reserve Central Banking System.

Extracts

· The Key Signals analysis contradicts Chairman Powell’s rate optimism testimony.

· The Fed may be “not far” from easing, but it is closer to tightening before it eases.

· At this point, the Fed is unlikely to ease, before a new Presidential Cycle has begun unless it is rooting for the incumbent.

· At this point, the Fed is more likely to tighten, into a new Presidential Cycle, before being quickly forced into easing by the hard landing that it has created.

(Source: the Author)

· Dimon’s Stagflation call is an echo of the recent poor bank earnings season.

(Source: the Author)

· Trusted Sources, and Communicators, are liberating the Fed’s “Prisoners of Transience”.

· Trusted Sources, and Communicators, are, also, rescuing the Fed’s lost guidance tool.

· The Fed signals an intended macroprudential easing, “in lieu of an inflation-challenged monetary policy easing”, through a Trusted Source and a Trusted Communicator.

(Source: the Author)

· Chairman Powell’s “Hokey-Cokey Foxes” are dancing to the Key Signals forward curve tune.

· Chairman Powell is not dancing, he is being a “Transient Hedgehog”, again, in the “Rumsfeld Quadrant”.

· Chairman Powell’s “Transience” is Congruence Bias.

· Chairman Powell’s “Transience” is incongruent with consumer perceptions of runaway inflation.

· Chairman Powell’s “Transience” is driven by, “One Big Thing” of, the Global Fractional Reserve Central Banking agenda return to solvency through new reserve creation.

(Source: the Author)

“Rising geopolitical tensions, sanctions against Russia, China's efforts to bolster usage of the renminbi, and economic fragmentation all can affect the international use of the dollar, most visibly as a store of value and reflected in its use in official foreign exchange reserves.”

(Source: Federal Reserve Board)

· The correlated CIOgnitive dissonance about the US Dollar, and Gold affirms the view that the former is the global reserve medium of “unsanctioned” commercial exchange but not the global reserve of economic value.

· The “CIOgnoscenti” has, so far, missed the key signal that the Fed intends to lead a developed central bank wave of macroprudential policy easing, in lieu of inflation-challenged monetary policy easing.

· The recently reported poor US bank earnings season signals that it is time for macro-prudential policy easing.

(Source: the Author)

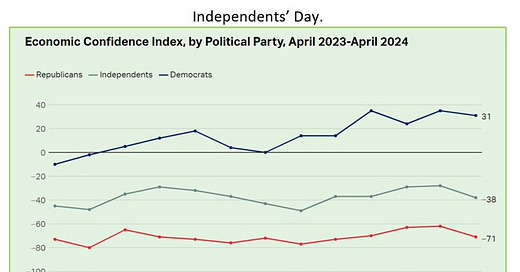

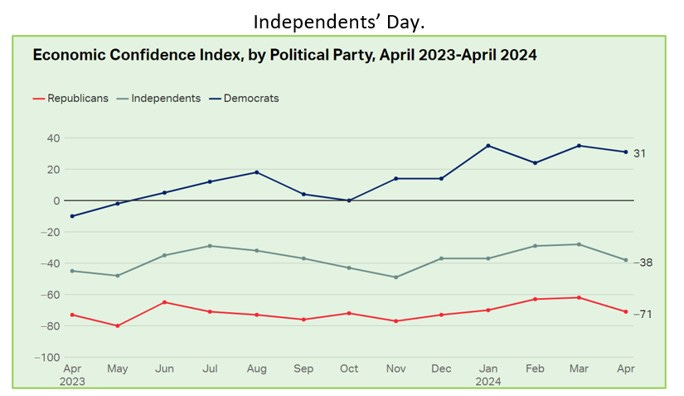

· Since the Independents have abandoned Biden, on the economy, it is now Trump’s election to lose and/or have stolen.

· Fed “Patriotic Monetary Policymaking” will, inevitably, become “Partisan Monetary Policymaking”; irrespective of who the next POTUS is.

(Source: the Author)

· Since the Independents have abandoned Biden, on the economy, it is now Trump’s election to lose and/or have stolen.

(Source: the Author)

· The rekindling of the symbiotic Special Relationship is pending the tall New World Order of the permanent sacking/resignation of the Butler, the conviction of the Oxford Apostles, the UK re-joining the EU, the closure of the VIP Lane, and India leaving the BRICs.

· The rekindling of the symbiotic Special Relationship is also pending the syncretic bicameral Anglo-Saxon political cleansing simultaneously occurring on either side of the Atlantic.

(Source: the Author)

· To gain access to the US technology Crown Jewels, India must go through the Taiwanese “Friend Shoring” gatekeeper, thereby, putting itself into conflict with China.

(Source: the Author)

· Biden’s Strategic Petroleum Reserve repurchase tactic makes Powell’s “Transient” pause structurally permanent.

· Biden’s Strategic Petroleum Reserve repurchase swing signals that the USA has lost its Swing Producer Status.

· The US loss of Swing Producer Status signals the loss of the disinflationary growth initiative.

· The loss of the disinflationary growth initiative signals the Biden loss of the presidential election initiative.

· The “October Surprise” is likely to be withheld OPEC+ supply until Trump is elected.

(Source: the Author)

· The Central Bank (BOE) of the Ungoverned Kingdom (UK)will issue ration cards, in the form of CBDC, to avoid the fiscal war effort crowding out civilian consumption.

· The liability of UK CBDC will be “balanced” by the “asset” of war bonds on the BOE’s balance sheet.

(Source: the Author)

· Fragmentation is being addressed with Fractional Reserve Central Banking.

· Fractional Reserve Central Banking will create new Global Reserves, by fiat.

· New Global Reserves will require each Fractional Reserve Central Bank involved to create new reserves in their respective commercial banking systems.

· New commercial banking system reserves will require new deficit-financing sovereign debt to balance their liability on each central bank balance sheet.

· New deficit-financing sovereign debt will be layered with insolvent lossmaking debt on central bank balance sheets.

· Since developed central banks are, in principle, committed to smaller balance sheets the scope for new banking system reserves is challenged.

· Developed central banks will evade the reserve creation challenge by subcontracting out reserve creation, credit creation, and fiscal deficit financing to the private “Masters of the Asset Class Universe”.

(Source: the Author)