Congruence Bias Puts “Transient” Jay Back Into The Rumsfeld Quadrant

“I don’t know how long it’ll take, and, I don’t know exactly when that will be.” (Jerome H. Powell)

Summary:

· Chairman Powell’s “Hokey-Cokey Foxes” are dancing to the Key Signals forward curve tune.

· Chairman Powell is not dancing, he is being a “Transient Hedgehog”, again, in the “Rumsfeld Quadrant”.

· Chairman Powell’s “Transience” is Congruence Bias.

· Chairman Powell’s “Transience” is incongruent with consumer perceptions of runaway inflation.

· Chairman Powell’s “Transience” is driven by, “One Big Thing” of, the Global Fractional Reserve Central Banking agenda return to solvency through new reserve creation.

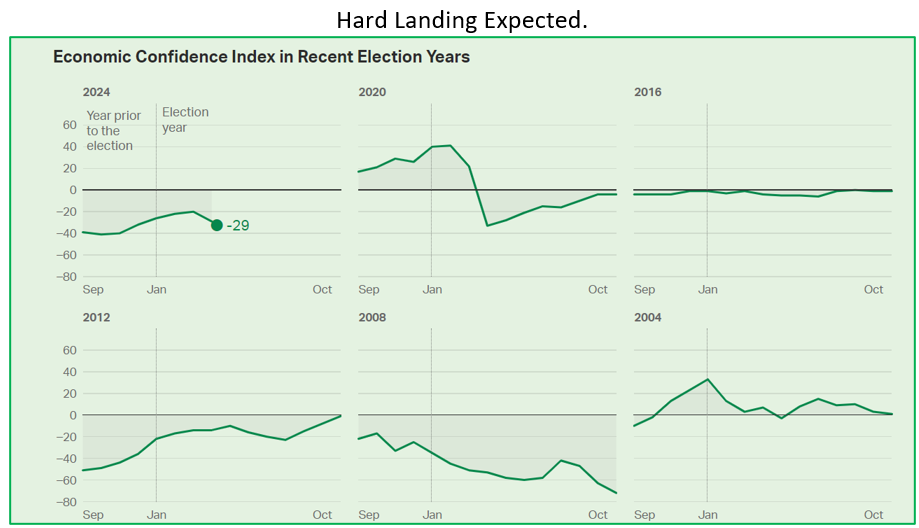

· Gallup-polled Economic Confidence supports the Key Signals 1990s economic thesis.

· Since the Independents have abandoned Biden, on the economy, it is now Trump’s election to lose and/or have stolen.

· Fed “Patriotic Monetary Policymaking” will, inevitably, become “Partisan Monetary Policymaking”; irrespective of who the next POTUS is.

· De Guindos frames the imminent ECB Macroprudential Ease with the causal link between “Shrinkflation” and Financial Instability.

· The Key Signals analysis contradicts Chairman Powell’s rate optimism testimony.

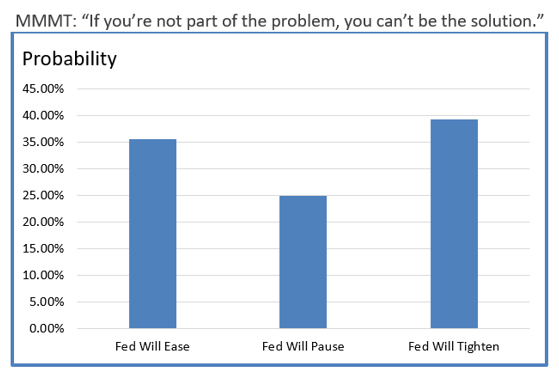

· The Fed may be “not far” from easing, but it is closer to tightening before it eases.

· At this point, the Fed is unlikely to ease, before a new Presidential Cycle has begun unless it is rooting for the incumbent.

· At this point, the Fed is more likely to tighten, into a new Presidential Cycle, before being quickly forced into easing by the hard landing that it has created.

(Source: the Author)

The mechanics, of this process, involve the creation of “deferred assets out of thin air” by the Federal Reserve. These “deferred out of thin air assets” are created, by the Fed, and not the US Treasury, to cover the losses on the central bank’s balance sheet.

(Source: the Author)

Summary:

· Central bankers are admitting their failures, by varying degrees, to pave the way for more failures.

· The Fed is pretending to be in Rumsfeld’s Quadrant of Financial Instability by accident.

· The Fed has deliberately understated financial instability risk because to correctly address it would mean immediately easing monetary policy.

(Source: the Author)

· Fragmentation is being addressed with Fractional Reserve Central Banking.

· Fractional Reserve Central Banking will create new Global Reserves, by fiat.

· New Global Reserves will require each Fractional Reserve Central Bank involved to create new reserves in their respective commercial banking systems.

· New commercial banking system reserves will require new deficit-financing sovereign debt to balance their liability on each central bank balance sheet.

· New deficit-financing sovereign debt will be layered with insolvent lossmaking debt on central bank balance sheets.

· Since developed central banks are, in principle, committed to smaller balance sheets the scope for new banking system reserves is challenged.

· Developed central banks will evade the reserve creation challenge by subcontracting out reserve creation, credit creation, and fiscal deficit financing to the private “Masters of the Asset Class Universe”.

(Source: the Author)

· The 1990s global economic scenario is hiding in plain sight.

(Source: the Author)

· “Patriotic Monetary Policymaking” will oblige the Fed to monetize the Hyper-Milflation fiscal deficit to prevent rising real yields from “shrinking” the real economy.

(Source: the Author)