Shrinkflation Headwinds Blow Macroprudential Tailwinds

“Melancholy and utopia are heads and tails of the same coin.” (Gunter Grass)

Summary:

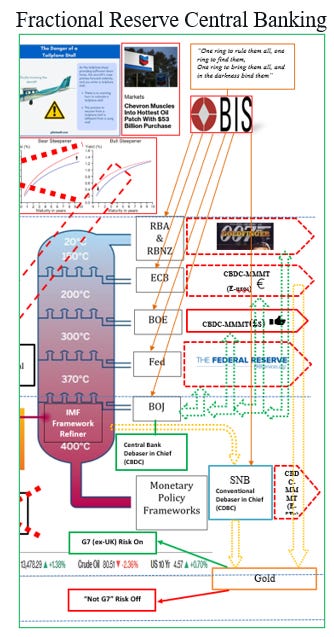

· Post IMF “Fractionation Spring”, the Swiss National Bank (SNB) is the first developed central bank to demonstrate the global process of Fractional Reserve Central Banking.

· The SNB’s actions are consistent with a global response to a global credit event originating in Emerging Markets.

· The SNB’s actions are also consistent with a plan to return developed central banks to solvency through a process of new reserve creation.

· The SNB has “fractionally” created a new liability of new banking sector reserves that it must balance with new sovereign debt “assets”.

· Because the SNB’s new liabilities carry no interest, and it pays no “profit” to the Government, the central bank is quantitatively easing its way back to solvency.

· The SNB is de facto prioritizing its solvency above its de jure inflation mandate.

· “IMF Fragmentation Spring” is consistent with the “IEG April Surprise”.

· “IMF Fragmentation Spring”, and the “IEG April Surprise” are consistent with the “IDR April Surprise”.

· “IMF Fragmentation Spring”, the “IEG April Surprise”, and the “IDR April Surprise” are all points on the basis November 2023, Key Signals “Asian Debt Crisis Rinse and Repeat Moment” (not surprise) trend line.

· The “Asian Debt Crisis Rinse and Repeat” is being managed by the BOJ in real-time.

· BOJ real-time management of the “Asian Debt Crisis Rinse and Repeat” will enable “Friend-Shored” Japan to substitute for China’s Belt and Road.

· “The CIOgnoscenti” have called the case for a Fed macroprudential easing, in lieu of an inflation-challenged monetary policy easing, Stagflation.

· Stagflation is what Key Signals referred to as “Shrinkflation”.

· Dimon’s Stagflation call is an echo of the recent poor bank earnings season.

· The Fed can claim that a macroprudential easing is data consistent rather than a banking system bailout.

Extracts

· The Global Reserve architecture is digitally advancing to contact, with the emerging global financial crisis, through the agency of the SNB, in a process that preserves the US Dollar Global Reserve Currency status.

(Source: the Author)

· The insolvent Swiss National Bank (SNB) intends to return to solvency by a process of financial asset price inflation rather than real economic price inflation.

· The action of the Swiss National Bank (SNB)is a global risk-on signal for developed economies’, ex-Ungoverned Kingdom (UK), asset prices.

· The action of the Swiss National Bank (SNB) confirms the recent behaviour of “He/She/They Gold”.

· The SNB will also embrace the digital currency debasement zeitgeist of the times.

· Rumour has it that the ECB also intends to return to solvency by the same method as the SNB.

(Source: the Author)

· The Swiss National Bank (SNB) confirms that its unofficial mandate to return to solvency, through financial asset price inflation, takes priority over its price inflation mandate.

(Source: the Author)

· Fragmentation is being addressed with Fractional Reserve Central Banking.

· Fractional Reserve Central Banking will create new Global Reserves, by fiat.

· New Global Reserves will require each Fractional Reserve Central Bank involved to create new reserves in their respective commercial banking systems.

· New commercial banking system reserves will require new deficit-financing sovereign debt to balance their liability on each central bank balance sheet.

· New deficit-financing sovereign debt will be layered with insolvent lossmaking debt on central bank balance sheets.

· Since developed central banks are, in principle, committed to smaller balance sheets the scope for new banking system reserves is challenged.

(Source: the Author)

· China is highly likely to be the trigger for an “Asian Debt Crisis rinse and repeat”.

(Source: the Author)

· The BOJ upholds globally coordinated MMMT, which is predicated on a managed foreign exchange rate system that maintains the appearance of US Dollar strength.

(Source: the Author)

· A “Friend-Shored Japan” will substitute for China’s Belt and Road.

(Source: the Author)

· The “CIOgnoscenti” has, so far, missed the key signal that the Fed intends to lead a developed central bank wave of macroprudential policy easing, in lieu of inflation-challenged monetary policy easing.

(Source: the Author)

· The real evidence of Shrinkflation disabuses the developed central bank meme that inflation is falling.

· Shrinkflation confirms that “one gets much less, for a bit less”.

(Source: the Author)

· The recently reported poor US bank earnings season signals that it is time for macro-prudential policy easing.

(Source: the Author)