Congruence Bias Extends, “Transient” Quorum, FOMC Groupthink

“We’re all mostly in agreement that if we get concerning inflation data continued, we’re going to sit where we are for an extended period of time, we can stay here as long as needed.” (Neel Kashkari)

Summary:

· Neel Kashkari communicates, like a “Transient Hedgehog”, on the Key Signals Forward Curve.

· Kashkari prorogues the Fed’s creation of new reserves.

· Kashkari proselytizes the Key Signals 1990s global macro thesis.

· Susan Collins’ “Patience” reflects “Transience”.

· Mary Daly is “Transient”.

· Austan’s and Neel’s “Transient” looks, suspiciously, intransient.

· Bowman’s “Transient” is intransigent.

· Logan’s “Transient” run is becoming a marathon.

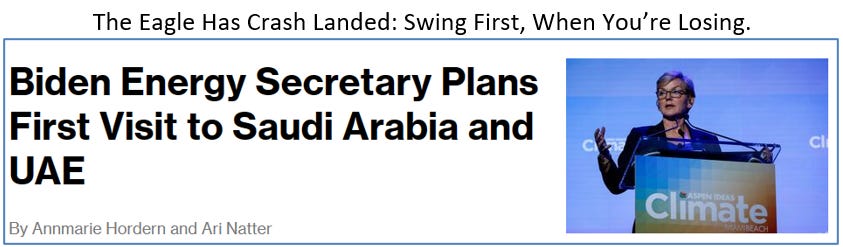

· Biden’s Strategic Petroleum Reserve repurchase tactic makes Powell’s “Transient” pause structurally permanent.

· Biden’s Strategic Petroleum Reserve repurchase swing signals that the USA has lost its Swing Producer Status.

· The US loss of Swing Producer Status signals the loss of the disinflationary growth initiative.

· The loss of the disinflationary growth initiative signals the Biden loss of the presidential election initiative.

· The “October Surprise” is likely to be withheld OPEC+ supply until Trump is elected.

Extracts

· The Key Signals analysis contradicts Chairman Powell’s rate optimism testimony.

· The Fed may be “not far” from easing, but it is closer to tightening before it eases.

· At this point, the Fed is unlikely to ease, before a new Presidential Cycle has begun unless it is rooting for the incumbent.

· At this point, the Fed is more likely to tighten, into a new Presidential Cycle, before being quickly forced into easing by the hard landing that it has created.

(Source: the Author)

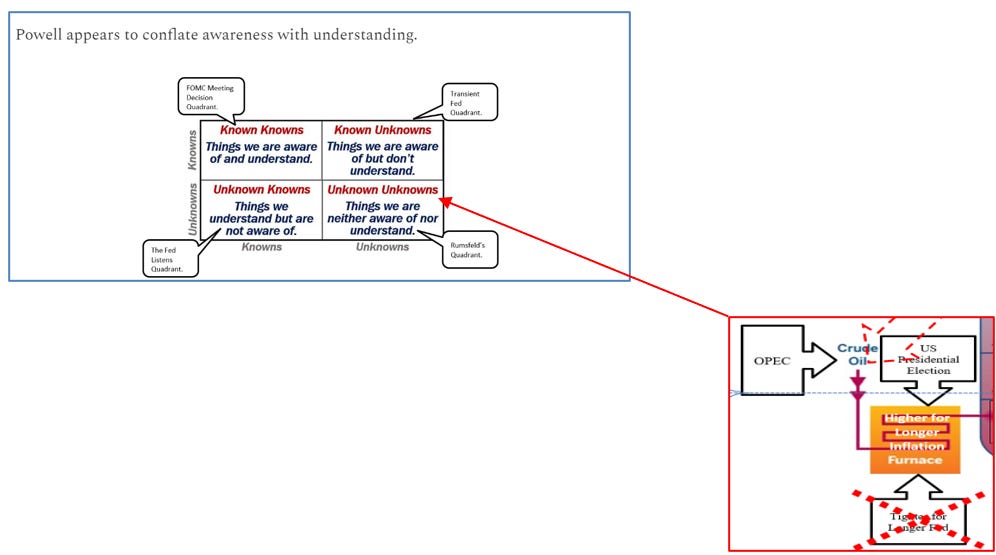

· Chairman Powell is not dancing, he is being a “Transient Hedgehog”, again, in the “Rumsfeld Quadrant”.

· Chairman Powell’s “Transience” is Congruence Bias.

· Chairman Powell’s “Transience” is incongruent with consumer perceptions of runaway inflation.

· Chairman Powell’s “Transience” is driven by, “One Big Thing” of, the Global Fractional Reserve Central Banking agenda return to solvency through new reserve creation.

(Source: the Author)

· The 1990s global economic scenario is hiding in plain sight.

(Source: the Author)

· OPEC’s “ill-advised” response to the “Platts’ Brent Tweak” reinforces the doctrine and dogma of US Friend Shoring, whilst, strengthening and rewarding the Exorbitant Privilege.

· OPEC’s “ill-advised” response to the “Platts’ Brent Tweak” makes the US economy relatively stronger than its trade partners and adversaries.

· The USA has been afforded Swing Producer status, hence, the opportunity to influence short-term inflation expectations in addition to even greater influence over long-term inflation expectations.

· America now has the opportunity to exert greater influence on long-term inflation expectations, and energy security, on China’s front doorstep, in Asian Friend-Shoring supply chains.

(Source: the Author)