The FOMC Gets a C+ and Dope Inc. Gets an A*

"No generation can escape history." (George H W Bush)

Summary:

· Loretta Mester’s deliberate ignoring of the employment mandate is professional misconduct, on a par with her previous “broadly inclusive” failure to follow the inflation mandate, rather than a form of clear extended forward guidance.

· The most notable thing about this year’s Jackson Hole symposium was the complete sweeping under the carpet of the issue of the Fed’s, too successful, flexible average inflation targeting (FAIT), monetary policymaking framework.

· Neel “Ex Culpa” Kashkari’s sadistic pleasure in poor Fed communication policy weakens the central bank’s credible commitment even further.

· The ECB’s Draghi Doctrinaire embrace of financial stability policy is, also, like the Fed, going ultra vires at the technical “unrealized” insolvency event horizon, but for rational (political) fragmentation reasons.

· Schnabel’s Ersatz Volcker prescribes Draghi Doctrinaire financial stability policy.

· “Ewig Krieg” is the main ingredient in the “Ersatz Volcker” flavour of the latest “Villeroy and the Bosch” policy brand.

· Supply chain Oligopolists who collude with China are being made to walk the plank.

· It would seem that OPEC and Russia have tipped the Eurozone into becoming the “swing” superpower challenger to the USA.

· Haegeli’s Phenomenology follows the great demand side to supply side rotation thesis.

· Rumour has it that Blue Horseshoe loves papadoms, so India should be worried.

· NAFTA has effectively been re-positioned, by China, as a Belt and Road narcotics free-trade zone.

· A Reverse Opium War chapter has been added to the “Techno-Economic War” chapter in the American thirty-year narrative of the funding and creation of a bipartisan consensus from the perceived Chinese threat via Latin America.

· China’s Belt and Road initiative may soon be officially designated Dope Inc. headquartered in Hong Kong.

· Killer Fro’ replaces Killer Fringe on stage to sing the death of UK Sleasez Faire.

No longer cursed, but not cured either ….

With the notable, exception of BOJ Governor Kuroda, most developed economy central bankers have come out of Jackson Hole looking smug and vindicated. Most even look a little vindictive towards their own real economies. Their vindictive smiles will be wiped off their faces, shortly, as they assume the position and behavior of the BOJ Governor.

There is one eternal smile, that never goes away, much to the Fed Chairman’s chagrin. This smile has broadened, into the familiar smirk, of late.

· Dimon’s Hurrikraine is the Summers’ Curse.

(Source: the Author)

As the marks came in from the panel of judges, of the latest Jackson Hole symposium, there was a brief pensive moment anticipating the grade from Larry “Risus Sardonicus” Summers. As it transpired, Summers effectively graded Chairman Powell a C+, for “being resolute”. Assuming the pass mark is a C, it’s better than a fail (F) and much better than the original curse, but Chairman Powell could do better in the future. Summers will have his recession and eat it, it seems. He now confidently assumes that 6% unemployment is the only cure for inflation.

· The Summers’ Curse becomes the Summers’ Blessing in order to cross the Manchin Tipping Point and receive the blessing to become the next Fed Chairman.

(Source: the Author)

One suspects that Summers believes he would get an A*, himself if given Powell’s job. The sheer optics of Summers being the go-to guy, to grade Powell’s work, already sets the former up as the Shadow Chairman and sets a precedent for the appointment to become official.

The Fed has, apparently, concluded that America is a mature developed economy that cannot become anything else. Consequently, a supply-side revolution, capable of transforming the growth potential of the economy, is going to be thrown out along with a demand-side that is apparently too demanding. These sweeping assumptions, and sweeping consequences, are entirely consistent with the sweep of Fed thinking, and guidance, which, consistently, sweeps the central bank’s prior mistakes under the carpet. As with any bureaucracy, the Fed blindly seeks to perpetuate its existence rather than the economy that should perpetuate the central bank’s existence.

It is said, with great authority, that those who do not learn from the mistakes of history are destined to repeat them. Cleveland Fed president Loretta Mester may be the living proof of this observation.

Imbued with righteous indignation, and determination to defeat inflation, Mester recently stated that she would ignore the incoming employment data when deciding on how much to hike interest rates at the next FOMC meeting.

Mester will, thus, ignore the news, from the latest employment situation report, that American workers are flooding back to the labor pool, in their droves, because they can’t afford to live outside it. The downward force on wage inflation, exerted by this flood, has thus shot straight over Mester’s head. Instead, she wishes to force even more workers back into the pool by making their debts more costly, and, potentially unserviceable at a lower wage rate.

Mester’s anti-inflation zeal reminds this author of the similar broadly inclusive zeal she once, proudly, proclaimed during the height of the pandemic. The resulting inflation, from this oversight, now obliges Mester to be zealous about the inflation mandate.

· Esther George’s sound monetary policy compass will be sorely missed when she retires.

(Source: the Author)

This author would contrast the “binary zeal” of Mester with the consistent credibility of outgoing Kansas City Fed president Esther George. The gulf is massive. It is hard to imagine Esther George unprofessionally abandoning her sworn obligation, to observe her employment mandate commitment, under any circumstances.

Mester’s zeal, ex George, is contagious.

· Neel “Ex Culpa” Kashkari has lost his credibility.

(Source: the Author)

Minneapolis Fed president Neel “Ex Culpa” Kashkari has, also, clearly learned nothing from his past failure to see inflation.

Neither has Kashkari lost his perverse satisfaction in watching Mr. Market, for whom he once worked, go into meltdown. Kashkari once had “zero sympathy” for Mr. Hedge Fund, who was short when the Fed was easing. This ended up with the embarrassment of the admission, about misreading inflation, which earned him the “Ex Culpa” sobriquet.

Kashkari recently renewed his vendetta, with Mr. Hedge Fund, by taking sadistic pleasure in his enemy being long, and wrong, stocks when Chairman Powell tore him a new one, at Jackson Hole. If past performance, is any indication of future performance, once growth risk rotates back into Fed speak, and rate cuts are back on the table, an embarrassing ex culpa from Kashkari will follow.

Kashkari’s style of personal crusading banter is demeaning for the Fed and, frankly, weakens the central bank’s credibility.

At the end of the day, if Mr. Market suddenly reverses his direction it is because Mr/Mrs/Ms. Fed speaker has misled him up to this reversal point. This, hence, says nothing good about Fed communication and/or Fed policymaking. One has never seen Esther George making the same rookie mistakes as Kashkari. What a pity she won’t be around, for much longer, to show him how it is done.

The job (and the criticism) is clearly getting to Kashkari. He should quit, whilst he is just behind before he falls well and truly behind. If he won’t quit, Kashkari, then, needs to mature beyond his childish games with Mr. Market.

Fortunately, the FOMC’s bench is deep and rotates, so that the harm done by the overzealous, and vindictive, children can be mitigated by the adults.

New York Fed president John Williams has recently tried to inject some maturity and, thereby, flexibility into extended forward guidance. This has been achieved with a modicum of opacity, rather than clarity, over the exact path and duration of the rate hiking phase going forward.

Adult forward guidance, in consideration for flexibility, was also injected by Atlanta Fed president Raphael Bostic. Now, in risk management mode, Bostic is becoming more data-dependent in relation to the size of the next rate hike. This dependency is based on both of the Fed’s mandate drivers.

A stoically adult Richmond Fed Governor president Thomas Barkin has suggested that Americans should look on the bright side of the highly likely recession ahead. Allegedly, the recession will be brief and, since they will have less money to spend, the fewer consumables on offer won’t be a problem.

Since she is new to the job and, clearly, eager to fit in, perhaps some slack should be cut to the FOMC newbie Dallas Fed president Laurie Logan. Or perhaps not, because Logan is an old pro from the New York Fed’s markets desk.

Logan’s first utterance, in her new job, was an almost childlike recital of the Fed’s current mantra to focus exclusively on inflation, to the exclusion of the employment mandate. The rookie mistake, of ignoring the employment mandate, is understandable under the circumstances of Logan’s recent arrival. One mistake is allowed. If this continues, however, the criticism will necessarily become as harsh as with Mester and Kashkari.

The accounting fraud involves the Fed creating a “deferred asset out of thin air”. The explanation then completely mistakes this “out of thin air deferred asset” for a Fed liability. The Fed has actually, in practice, issued a bond on behalf of the US Treasury, with no cusip number, that it has then bought, thereby, creating a unit of US currency.

(Source: the Author)

Since she hails from the boiler room, where the Fed’s boiler room balance sheet scam is being run, this author will be watching carefully what Logan says about the Fed’s balance sheet and unrealized losses thereupon.

The FOMC’s over-zealotry cannot hide the elephant in the committee room.

The Fate of the FAIT: The dead Monetary Policy Framework in the committee room ….

The elephant in the room of anti-inflation zeal is the Fed’s new, but rapidly aging, perhaps even dead, monetary policy framework.

The Fed adopted its flexible inflation target overshooting framework with gay abandon before COVID-19 arrived, and then some after it arrived. The ensuing inflation spike illustrates just how successful if that is the word, the Fed’s new monetary policy framework has been. In fact, it would appear that the Fed has been so successful that it has now been abandoned in favor of Paul Volcker’s monetary policy framework.

The most notable thing, for this author, about this year’s Jackson Hole symposium was the complete sweeping under the carpet of the issue of the Fed’s, too successful, flexible average inflation targeting (FAIT), monetary policymaking framework.

· The Fed’s self-embrace of financial stability policy is going ultra vires at the technical “unrealized” insolvency event horizon.

(Source: the Author)

This author believes that the Fed has replaced this framework with a financial stability policymaking framework instead, without telling anybody, least of all Congress from whom the central bank’s legitimacy and authority devolve.

The behavior of the likes of Mester, ostensibly shooting from the hip, without, at least, paying lip service to both Congressional mandates is further evidence of just how out of control the Fed is.

The secret adoption of a financial stability mandate and the creation of “deferred assets out of thin air”, as also noted in the last report, is just the tip of a very large iceberg floating around, out there, wrecking the US economy.

The situation is so out of control, that the Fed now prioritizes saving its own solvency, and operations, at least as high, if not higher than, its inflation mandate and, certainly, higher than its employment mandate.

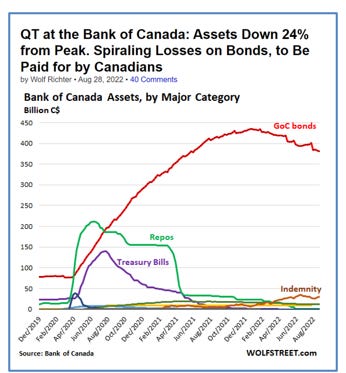

If the reader thinks that the Fed is insidious, he/she should take a look at the Bank of Canada.

When a sale (to the taxpayer) is the best hedge against insolvency ….

North of the border, sleepy Canadian taxpayers are noisily awakening to the fact that they have “indemnified” the Bank of Canada from insolvency. The wily Canadian central bankers, fully understanding that all this COVID stimulus would end in tears, asked the Government to put Canadian taxpayers on the hook for the Bank of Canada’s future insolvency.

The “deferred out of thin air asset”, on the Bank of Canada’s balance sheet, to cover the growing hole, is itemized as an “indemnity”. This “indemnity” is, ostensibly, an IOU written by the Canadian Government. This is not fraud, as is the case of the Fed writing the IOU for the US Treasury. The Bank of Canada and the Canadian Treasury are acting legally. They still have to face their voters, and taxpayers, however.

The cost of “indemnification” is the “deferred out of the Canadian taxpayers’ pockets asset” rising in value, as an asset on the Bank of Canada’s balance sheet, as it quantitatively tightens away the other assets at a loss. Ironically, the “indemnified” asset becomes more valuable the greater the losses on the other assets.

In order to remain solvent, the Bank of Canada has two choices. Either it cuts interest rates, to revalue its balance sheet higher, or it hikes rates to make the value of its “indemnified assets” higher. At no point in this decision tree, of choices, does inflation or economic growth come into consideration. The only decision is on how to stay solvent.

The ECB also appears to have learned the lessons of recent COVID/Ukraine history in relation to the Volcker Era lessons learned by the various disparate national European banks before the monetary union occurred.

Financial Stability Policy 101 (II): Draghi Doctrine Prestige, walking on the beaches looking at the fragmented peaches, and then doing whatever it takes.

The last report discussed the magic trick, performed live on stage, by Chairman Powell, at Jackson Hole, in which disappearing inflation was replaced, with disappearing GDP, in order for the Fed to make “deferred assets out of thin air” on its balance sheet.

Anyone who has vacationed on a Southern European beach, in August, will know, from experience, that the Europeans are less scrupulous about what they reveal in public. Hence, it was no surprise, for this author, to see Ollie “Rehnfeld” Rehn revealing all in the sweltering heat of Jackson Hole.

“Rehnfeld” explicitly revealed that a big rate hike, from the ECB, in September, will not be combined with a shrinking of the balance sheet. Au contraire, le grander le rate hike le grander le balance sheet.

Unlike the Fed, the ECB will not cheat by creating phony balance sheet assets “out of thin air”. The ECB will buy the real thing, in the secondary market, from the nations that are going to suffer the most from its rate hike.

“Rehnfeld’s” revelation is rational. A rate hike, in this environment, will blow Eurozone corporate and sovereign credit spreads out. The weak Eurozone economy will be further weakened, as a consequence, and the threat of fragmentation will loom large.

Financial stability policy requirements demand that the ECB should assume the fragmentation risk onto its balance sheet. And thus, the ECB is confirming that it is actually prioritizing an unofficial financial stability policy mandate, whilst appearing to adhere to its sole inflation mandate. These financial stability policy requirements may be viewed as politically motivated and consistent with Draghi Doctrine to do whatever it takes.

There will be some nutters, most probably German, who will start legal proceedings against the ECB again for going ultra vires and allegedly monetizing fiscal deficits in the nations that face fragmentation. These cases will also get shot down, again, as they have always been.

Je suis Fragmentation ….

ECB Executive Board Member Isabel Schnabel seems to be hell-bent on creating the fragmentation conditions that will oblige the ECB to expand its balance sheet.

Schnabel believes that the combination of the COVID pandemic, and the Ukraine war, has tipped the economy from the “Great Moderation” to the “Great Volatility” epoch. In this fin de siecle, Schnabel believes that central banks should go back to the first principles of the Great Inflation of the late 1970s early 1980s. Without saying it, in so many words, Schnabel prescribes a great recession as the solution.

· The great rotation, from demand side to supply side assets, market call was initiated by Augustin Carstens at Jackson Hole.

(Source: the Author)

It’s effective, but far too simplistic, and completely out of sync with what the great thought leaders in central banking are thinking. The said thought leaders, under the aegis of the Bank for International Settlements (BIS), are recommending that central banks apply monetary policy stimulus to supply-side solutions and drain stimulus from the demand side of the global economy. This nuance would appear to have been lost in translation into whatever language Schnabel speaks.

One hopes, that Christine Lagarde can impart her pearls of wisdom into Schnabel’s blunt trauma monetary policymaking skillset. Lagarde will be aided in the education of Schnabel, by the fragmentation cracks that will open, in due course, from the application of the blunt trauma Ersatz Volcker solution of Schnabel et al.

Governing Council member Francois Villeroy de Galhau has mixed a little sugar into Schnabel’s Ersatz Volcker concoction. Addressing a wider audience, at Jackson Hole, Villeroy argued for a swift return, to the neutral rate, in order to preclude the need for further radical rate hikes next year. He believes that the arrival at R* will occur by year-end.

The views of Villeroy are instructive because his name, and family history, represent what the Eurozone is all about. Villeroy’s legacy and career are based at the heart of the European Union, where Germany meets France. This meeting of the minds used to be a battlefield. Now it is a project. This author has referred to this project as “Villeroy and the Bosch”. Of late, the project has become an awkward balancing act of reconciling the German fear, of Weimar inflation, with French Napoleonic aspirations for a Republican empire. So not much has changed then, except that this time France and Germany are on the same side. Christine Lagarde appears to understand the situation perfectly.

Ewig Krieg: The Cassus Belli for Villeroy and the Bosch (II) ….

· Christine Lagarde has anticipated the bicameral Villeroy and the Bosch Eurozone integration strategy with a tweak to the monetary policy framework at the ECB.

· The Villeroy and the Bosch strategy achieves economic union through the destabilizing of national democracies with EU sanctioned fiscal irresponsibility and central bank moral hazard.

· Villeroy’s New Multipolar World Order (NMWO) seeks to share Liberty, Equality, Fraternity, and the American Exorbitant Privilege to finance fiscal irresponsibility.

(Source: the Author)

Europe has learned the lessons from two world wars, on its own soil, that America has been fortunate to avoid so far. This lesson frames how Europe learns from all crises that follow. Thus, union and fragmentation are the lenses through which Eurozone policymakers peer, and then make policy from.

Macron’s grand strategy is now in ruins. Furthermore, Macron just abused the President of the United States, for the second time, to try and get himself off the hook. Fool me Joe Biden once, shame on you, fool him twice shame on him. There will be no third time. Politically, and metaphorically speaking, the Island of Elba now awaits Macron.

(Source: the Author)

To evade another war, on its soil, a unified Eurozone has appeased, for want of a better word, Russia. This appeasement ran confluent with American appeasement policy, during the Trump interregnum. Emmanuel Macron took it to the next level, by trying to completely disconnect the Eurozone from American influence. The Ukraine war has effectively ended the appeasing version Villeroy and the Bosch model. What is emerging, in its place, remains vague and uncertain. High inflation is exacerbating the uncertainty.

French President Emmanuel Macron has recently informed his entitled consumers, and voters, that their “freedom has a cost”. He has, therefore, finally, decided to test whether the French value their said “freedom” higher (or lower) than Russian gas and all the BS that comes with it. Macron has also indicated that the French economy cannot pay for its entitled energy consumers’ habits.

(Source: the Author)

Macron is having the atypical French leader’s Ledru Rollin moment. He is leading his people by following them. In this modality, he has informed his people that their “cost” of freedom has risen. He is now watching how the democratic process in France values democracy against Russian hydrocarbons before he acts.

The German political executive appears to be bolder than Macron, presumably, because Germany is on the front line against Russia again. German Foreign Minister Annalena Baerbock has opined that the Ukraine war will last for a long time. Thus, the German socio-economic model must change.

Germany would seem to be walking the walk of Baerbock’s talk. The country is already at 85% of its, ambitious, October target for diversifying its gas reserve accumulation away from Russian sources. Germany's electricity pricing is being completely reset, so that the lowest cost provider, in this case, alternative, sets the benchmark market retail price. In addition, a levy has been raised, on hydrocarbon-based electricity producers, that incentivizes investment into lower-cost alternatives.

Finite financial support for German companies, affected by high energy prices, will be rationed so that the German government decides who survives, and who fails, depending upon their assessed importance to the overall economy.

· Disinflation price discovery by Cancel Culture is on the global commodity and capital markets agenda.

(Source: the Author)

The German initiative, on gas pricing, will allegedly soon be reinforced, throughout the European Union (EU), according to Commission President Ursula Von der Leyen. As she sees it: “We (the EU) have to develop an instrument which makes sure that the gas price (Russia) no longer dominates the electricity price” (Author’s parentheses). Spain has already signed up for Von der Leyen’s price formula intervention. One could say, therefore, with some justification that Cancel Culture is alive, and kicking, in the Eurozone political executive.

The EU is also two months ahead of its gas storage target, which, in theory, puts it ahead of Germany.

· The internally conflicted Eurozone will become a managed command economy for the duration of its structural transformation towards a Federal Republic.

(Source: the Author)

Hence, the economic supply side revolution in Germany, and the Eurozone, is structurally underpinned by a sustainable energy policy. It is, thus, fair to say that the Eurozone is confirming the command economy thesis outlined, by this author, as the response to the current global environment. If this thesis is accepted, then the logical outcome of a Eurozone Federal Republic must also be accepted as a highly likely estimative probability. Perhaps, it is now the likeliest probable outcome in the Eurozone.

· Russia, and OPEC, have unwittingly conspired to make the USA the key global swing oil producer during the Ukraine war.

(Source: the Author)

This author noted that OPEC and Russia had, unwittingly, tipped the USA into becoming the global swing oil producer. It would seem that the two have also tipped the Eurozone into becoming the “swing” superpower challenger to the USA.

It is, also, fair to say that Germany is not only leading, from the front but exerting greater control and influence over Eurozone policy. Thus, Germany is leading, whilst France is just getting back from its expensive grandes vacances. There is more “Bosch” than “Villeroy” in the new Eurozone economic model.

A new version of the “Villeroy and the Bosch” model, for the Eurozone Project, is under construction. A forever war, which may lead to forever inflation, has been thrown into the policy mix.

America, already, has its forever war with China, risking forever inflation, in its own mix, which has militated for an inflation-fighting supply-side revolution. Clearly, the next iteration of the “Villeroy and the Bosch” model will also be heavily supply-side weighted. It may also employ the American strategy of “Friend Shoring” away from China. FM Baerbock has already called for the reduction of the German economic dependence on China. Villeroy’s Ersatz Volcker strategy would seem to hit all the right taste buds for the new model to be bought by the Eurozone consumer.

The forever war is also featured in the Asian time zone.

An emerging crack in the BRIC Wall ….

· India has been offered the choice of becoming a player, or a battlefield, in the Sino-American “Techno-Economic War” with the “Triad’s” live sales-demo in Afghanistan.

(Source: the Author)

The slow-motion fall of India, off the BRIC fence, currently, seems to be directionless. A spat between China and India, over whom is the boss of Sri Lanka, seems to have reached a fissile divergence point. This does not, however, mean that India is falling for American technological overtures to join the coalition of the “Free Shoring”. India is literally spinning in mid-air. Economic and political gravitational forces will, however, win in the end.

The highest ranking US Navy officer Admiral Mike Gilday recently confirmed that his preference is for India to become a partner in the war against China. Apparently, he spends more time on India than on any other Asian nation when he is strategizing. This admission, however, also confirms that, because of its position, India will find itself in the heart of the Asian combat zone by default. India’s current mid-air spin, may, in fact, be an attempt to preserve neutrality. This neutrality does not however exist in the calculations of the adversaries who exert the strongest political and economic forces on India.

India is also close to the heart of President Putin. So close in fact, that he includes Indian forces alongside Chinese forces in wargames on Russian soil.

· The BRICs promote an alternative global reserve system based on the Yuan.

(Source: the Author)

According to BRICs President Purnima Anand, the bloc’s member nations are at an advanced stage of accomplishing their own exchange regime that ditches the US Dollar. The plans have already encountered difficulties, that require tweaking since the Chinese economy and the Yuan are weakening. Russia now faces a dilemma of whether to support the Yuan, with reserve buying or to diversify by buying a range of “friendly” nation currencies.

In response, to the conflicted charm offensives, for its strategic favor, India is playing cute by playing the balance of power. Unfortunately, neither conflicted suitor will tolerate this behavior for much longer. India will therefore be dragged off the fence, by kinetic actions if it continues to flatter to deceive. The consequences of kinetic suasion could be more disastrous because they would make India a battlefield rather than a role player.

As the door is left ajar for India to participate, as an ally, in the Sino-American “Techno-Economic War”, China’s technological combat effectiveness has recently been eroded. US officials have prevented Nvidia from exporting two types of AI chips to China. Since these chips are beyond the means of an average Chinese consumer, the target is evidently the State. Apparently, a further Executive Order, from the desk of POTUS, aimed at state-sponsored Chinese technology is pending.

Assets are changing hands, in the global economy, in the line with the political imperative of each nation.

It’s all a big game. Some play to win.

(Source: the Author)

Consistently, and conversely, Speaker Pelosi’s front-running Bottom switched from price to yield, as she sold high, after buying low, in anticipation of this classified news. It’s hard to imagine that when she was establishing the bridgehead, in Taiwan, last month, she was completely unaware of the Nvidia action going forward.

The odds, on Madam Speaker’s next foreign excursion, after some of the usual stock-picking, being to India are shortening.

China has not been idly watching as it is attacked.

Dope Inc. : Belt and Road case study ….

The American thirty-year narrative involves the funding and creation of a bipartisan consensus from the perceived Chinese threat via Latin America.

(Source: the Author)

The author’s American thirty-year narrative and Chinese threat via Latin America have recently been updated with a new episode. The anticipated flash point in Latin America has been ignited.

According to a former State Department official "The Chinese Triads are shipping the chemicals to Mexico. The Mexicans are making the drugs with the Chinese help. The Chinese are using the Latin-American gangs in the U.S. to distribute the drugs. Chinese students and money brokers are picking up the money and getting back to the Mexicans and back to the people in China."

NAFTA has effectively been re-positioned, by China, as a Belt and Road narcotics free trade zone. One can imagine the consternation in Washington when the enormity of this sinks in.

With this news, several red lines have been crossed.

The Sino-American “Techno-Economic War” now conflates with the “War on Drugs”. A conflation with the “War on Terror” is not necessary, under these circumstances, but doesn’t do any harm either. With such a trifecta, or even a duopoly, of threats, the case for a bipartisan consensus and Congressional funding commensurate with the scale of the response needed is a formality.

· The behaviour of the Chinese Diaspora should be observed carefully after the assassination of Shinzo Abe.

(Source: the Author)

This author also notes, with no satisfaction, that the said State Department official identifies the Chinese Diaspora as a key agency in this Reverse Opium War.

· Hong Kong may become a “Trojan Horse” in the global economy.

(Source: the Author)

Whilst on the subject of the Opium Wars, one cannot fail to notice the significance of Hong Kong, where it all began back in the days of the Empire. This author has suggested that Hong Kong is the first, of many, “Trojan Horses” from which China intends to launch subversive global activities.

As confirmation of the author’s “Trojan Horse” thesis, and a declaration of (insidious) intentions and capabilities Vice Premier Han Zheng, speaking at a Belt and Road Summit, lauded the former Opium trading, and trading proceeds money laundering, hub as the “Belt and Road’s Pivotal Gateway”. If ever there was a double meaning, in Chinese policy statements, this was surely it.

Evidently, the said State Department official who originally blew the whistle, in Mexico, is heralding a US foreign policy theme tune that brands the Belt and Road as a vertically integrated state-sponsored narcotics enterprise.

It does not take much imagination, to imagine the proceeds of the Diaspora’s Mexican narcotics trade getting washed in the Hong Kong hub and then being recycled, along the Belt and Road, from the same hub. It is also very easy to believe that China would export narcotics if “Friend Shoring”, by the West, effectively, removes the demand for Chinese manufactured exports.

In addition, to the threat from narcotics smugglers, America is also under attack from pirates sailing under commercial flags.

An Oligopolist, friend of my enemy, is my enemy ….

· Oligopolists are currently defeating Capitalism, possibly for the last time.

(Source: the Author)

The author has already noted that Oligopolists may have had their last rent-seeking payday at the expense of the Western consumer.

POTUS is much happier attacking these metaphorical Pirate Oligopolists, it seems. His warning shot is the incendiary Ocean Shipping Reform Act. This is more than just a warning. It is Federal law and, therefore, impacts all who ship globally to the Federal shore. This dog definitely hunts and may bring sanctions and penalties. It will most certainly give momentum to the “Friend Shoring” process that seeks to relocate supply chain nodes, and operations, back from the lands of piracy to Federal shores.

(Source: the Author)

It was also noted that the passage of the Ocean Shipping Reform Act would allow US Federal Government’s DOJ raiding parties to board the Oligopolists and plunder their treasure.

It is, in this “naughtycal” context, and with great interest, that the author now observes the demonstrable, collusion between the Oligopolists and America’s nemesis that is now receiving the attention of the Federal Government of the United States.

The Chinese quasi-monopoly container manufacturer China International Marine Containers Group Ltd (CIMC) was on the verge of acquiring Maersk’s refrigerated container manufacturing business.

The Maersk shipping line recently boasted of its ability to bake higher long-term inflation expectations, into the global economy, by raising long-term contract prices in the face of short-term declining volumes. Costs were up 21%, volumes were down 7%, but revenue was up 64% thanks to aggressive rent-seeking. Bravo! But there’s not exactly a lot of competition in this space, is there? Shooting fish in a barrel seems to be more like shooting fish in a shipping container in this case.

(Source: the Author)

This is the same Maersk whom the author observed shooting fish in a shipping container in a previous report. Some Oligopolies have no shame!

The acquisition has been stopped in its tracks, ostensibly, for market concentration reasons. The potential deal illustrates how the Oligopolists collude to strengthen their pricing power. Sadly, this collusion has also been used as an economic weapon by China.

Maersk should, therefore, and probably will, be viewed as a hostile actor and treated as such by Western governments. This author assumes that pressure on Maersk will see the divestment “Friend Shored” into a safer pair of hands, no doubt this will be US private equity.

If the (petrol tank) cap fits, wear the global crown ….

This author has anticipated the Cancel Culture, which is now prevalent in policymaking, in an attempt to suppress inflation. Eurozone energy pricing policy, described previously in this report, is consistent with the Cancel Culture thesis.

The Cancel Culture strategy is a G7 initiative. G7 has now unashamedly announced that it will be meeting to discuss the price-capping of Russian crude oil.

· Russia, and OPEC, have unwittingly conspired to make the USA the key global swing oil producer during the Ukraine war.

(Source: the Author)

This author suspects that the price cap threshold will be kept high enough to provide an incentive for US Shale Oil producers to keep pumping.

· US Shale reaches a tipping point that supports the US “Hypergrowth Phase” tipping point and the great rotation theses.

(Source: the Author)

The US has become the global swing oil producer. In addition, a tipping point has been reached at which this swing production is swinging towards US Shale gas. Consequently, the position of US hydrocarbons, priced in US Dollars, has been reinforced in the global economy and capital markets.

The BRIC’s assault on US Dollar hegemony has strategically backfired, at the expense of the global economy. The market share for US hydrocarbons, priced in US Dollars, has been expanded.

· The US “Friend Shoring” valve has tightened from the global singularity to the global economy destructive “Death Star” level.

(Source: the Author)

Furthermore, the “Friend Shoring” of strategic manufacturing, and supply chain, nodes of production, out of China, has been propelled, towards the US, by its hydrocarbon self-sufficiency fundamentals. Twentieth Century history has taught that America always gets a strategic boost from global conflicts which do not occur on its soil. Why would this be any different in the 21st Century?

Fine-tuning Haegeli’s Phenomenology ….

In the last report, the author set out the great demand side to supply side rotation investment thesis. This thesis also applies to monetary policy and central bank balance sheet asset structure.

As a precursor to Macklem Doctrine being rolled out, over an envisaged three-year time horizon, its namesake author Bank of Canada Governor Tiff Macklem had recently been installed in a coordinating position at the BIS.

Since then, the BIS has advanced to contact with the global structural change, and its enemy/enemies. BIS General Manager Augustin Carstens has recently set out the rules of engagement for all the central bankers involved.

(Source: the Author)

This thesis is a direct descendent of the Macklem Doctrinaire approach, to the “Friend Shoring” process, prescribed by Bank for International Settlements (BIS) General Manager Augustin Carstens and his global enforcer Tiff Macklem.

The Fed’s financial stability policy imperative supports the great balance sheet “Friend Shoring” rotation thesis, from demand side to supply side balance sheet assets.

· In essence, supply-side growth stimulus is the whole objective of central bank financial stability policy, pretending to be monetary policy, going forwards.

· Don’t fight the Fed’s great balance sheet rotation, track it with a “Hypergrowth Phase” demand-side to supply-side portfolio rotation instead.

· The great rotation, from demand side to supply side assets, market call was initiated by Augustin Carstens at Jackson Hole.

(Source: the Author)

Carstens reiterated the thesis to the central bankers present at Jackson Hole recently. Mr. Market was too busy dancing to Chairman Powell’s demand side death march tune, to notice the nuanced supply side mood music.

Swiss Re’s Chief Economist Jerome Jean Haegeli appears to have caught the sotto voce nuance. The full libretto is now being examined.

· The ultimate New World Order, enabled by Macklem Doctrine, will have its own specific financial bubble in addition to “intransient” structural inflation.

(Source: the Author)

Haegeli’s synthesis of the demand side thesis, and counter-thesis of the current inflation dialectic, would appear to avoid direct portfolio exposure to the disinflationary light at the end of the tunnel, other than through longer-dated bonds. The exposure to long bonds is, seemingly, driven exclusively by the recession outcome call from the inflation-fighting phase.

Rather than evade inflationary destruction, an investor could, also, gain exposure to the picks, and shovels, which build the tunnel toward disinflation. This supply-side rebirth is, also, disinflationary and gaining strength with each destructive demand-side act of central banks in the present.

The investor may, thus, have to decide if it is better to travel than to arrive. There is also the opportunity, to do both if the investor focuses purely on a supply-side investment thesis.

· The Soft economic landing zone portends a domestic Hypergrowth Phase inflection point, for the US economy, that will be stronger than for its global competitors and trade partners.

(Source: the Author)

This author senses that the financial bubble in the “Hypergrowth Phase”, that he envisions, from all the supply side, investing, and fiscal stimulus mania will lead to the ultimate disinflationary structural outcome where the big money is to be made.

· The US “Friend Shoring” valve has tightened from the global singularity to the global economy destructive “Death Star” level.

(Source: the Author)

Mr. Market, as viewed in the eyes of BofA, is becoming less confused even though he still remains shit-scared.

Through the global chaos, Mr. Market is beginning to understand and, thereby, discount that America comes out of all this “Friend Shoring”/”Techno-Economic War”/ Energy Crisis/ Inflation Spike, etc., etc., etc, as first amongst global un-equals. All the headlines which he digests, and then discounts, simply nudge America ahead of its peers and enemies. Global risk-off is American risk-on.

It is no coincidence that the last 51 years of economics are allegedly dying alongside one of its major political actors. The two deaths are inextricably linked.

Epitaph for the last 51 years ….

The recent passing of Mikhail Gorbachev and the snub from the current Russian president are symbolic of this 51-year ending. They are also inextricably linked to current events and the next 51 years of economic history.

President Putin, evidently, does not wish to make what he believes is the same mistake, of capitulating to Carthago, that Gorby did. Instead, President Putin hopes that he, and the other BRICs, can enforce a Carthaginian peace onto Carthago. This hope ignores the facts of history.

Since the 19th Century, every global conflict has enhanced the global position of America. Thus far, this position has been enhanced in the current phase of global hostilities. When all is said and done, these wars usually are won by the nation that can outproduce the other. The alleged arrival, of the post-industrial age, brings the new challenge of what to do with all the surplus labor. If this labor surplus is not going to be mobilized, on the battlefield, then it needs to be gainfully employed.

The Fed and other developed central banks, with the exception of the BOJ, seem to think that there is not enough labor. Yet curiously, this not enough labor has too much money for the constrained supply available. Too much labor, with not enough money to spend, is apparently the solution that the central banks seek. Unfortunately, this solution involves the creation of even less capital and hence even less supply, through a recession. The unintended consequence, of supply, always running below demand, is, thus, an elevated and elevating probability from the developed central bankers’ prescriptive action.

Productivity, hence technology, should command a premium, in these central-bank enforced circumstances, since it delivers the supply-side solution to the low growth problem created by the central bankers. Mr. Market’s donning of his supply-side rotation hat suggests that he is trying this supply-side solution for size.

Mr. Market has, also, decided that it is time for the UK’s infant economic model to die prematurely.

Have it! The Thin Landy, with the Killer ’Fro, sang ….

Whilst the EU is prepared for a cold winter, the post-Brexit UK is still in heatwave festival mode. Britons have been warned that they will have to turn down the thermostat, and have cold showers, but they remain impervious and seem more interested in getting the Government to pay for their entitlements. Sadly, the Government has no money, and is, instead, simply offering to take less, in taxes, from those who either can’t pay or just don’t want to pay.

· The UK is aggressively 1980s rebooting, Submerging Markets style, whilst its European trade partners reboot in a more peaceful fashion, and America tries to reboot 1990s style.

(Source: the Author)

The UK’s post-Brexit strategy, in essence, was to connect the economy to the allegedly booming emerging market economies that once were the jewels in the crown of the British Empire.

This strategy was partly romantic and much largely predatory. It was, also, euphemistically termed the “Butler” model.

“Butlers” seem to have been recruited, by HMG, based on their ability to pass Norman Tebbit’s cricket fan, nationality test, rather than through due diligence and background checks of potential conflicts of interest. The “Pimp Model” may have been a more apposite description of the end product.

Britain is out of sync with its two main trading partners. It is trying to replace them with former colonies, whose economies are being undermined by exiting capital flight. These emerging economies are becoming submerging economies, in the economic sense. Britain is converging, by submerging, on these submerging economies.

(Source: the Author)

The timing was also poor because this strategy was chosen at a time when G7, led by America, was rebuilding a New World Order that is antipathetic towards the emerging market economies that do not toe the US line on China.

· The rekindling of the symbiotic Special Relationship is pending the tall New World Order of the permanent sacking/resignation of the Butler, the conviction of the Oxford Apostles, the UK re-joining the EU, the closure of the VIP Lane, and India leaving the BRICs.

(Source: the Author)

The predation occurred when elements, within the cabinet, with strong links to certain elements within certain emerging economies began to make policies that favored these said elements and related family interests. The style of predation became infamously known as the reviled “VIP Lane”.

It must be said, although not in defense of the predators, that the predation was not an exclusively emerging market pursuit. Domestic predators also lined their pockets whilst acting as “VIP Lane” conduits.

Tory predation was multi-cultural, in the best traditions of the party.

The result of this strategy and execution sets Britain in decline, recently falling into sixth place below one of its main emerging market predators. This is an entirely logical outcome of a “Butlering” economic policy strategy. One may even say that it is the strategic objective of the ascendant recipient of the “Butlering” services.

The party is now over, and the “Butlers” are being swept away along with the party mess that they have created.

The (Lockdown) Party’s over ….

The UK PM’s fortunes reached a new low with the resignation of two key cabinet members. The Resignators , in addition to showing Prime Ministerial pretensions, also, appeared to be keen to correct the racist misperception that all Asian men are sickos. They may struggle to change the perception that Asian financiers don’t pay their taxes, however.

(Source: the Author)

Another Thin Lady is again singing, at the “Lockdown Party” after party, at the Edinburgh Fringe. Last week, the Thin Lady singer was Emily Maitlis. This week it’s Nadine Malik.

Malik has introduced the inflammatory issue of race into the opened and festering, Tory can of worms. It’s about time, but not because of race. Rather, it’s an abuse of the race card.

Bridgerton Revisited: “Now in Injia’s sunny clime, Where I used to spend my time ….”

The vote-calculating, culturally-obtuse PM recently chose to rekindle the flames of Partition by athletically disporting himself at a manufacturer of machines, which are used to demolish Indian Muslims’ homes, during the Holy Month of Ramadan. Well, “they” all vote Labour, don’t they?

(Source: the Author)

This author hopes that the furor, about the race issue, does not divert attention from the real issue that the Conservative strategy, of reconstructing the Imperial trade model, as an alternative to EU membership, was suborned by the personal/family business agenda of the elitist colonials, in the Cabinet, charged with executing the strategy.

So, cui bono?

The said elitist colonials were happy to ostracise and even export, to Rwanda, the lower castes, in the Imperial milieu, in order, to further not only the Brexit agenda but also their own elitist political and family business agendas.