Villeroy and The Bosch : A Multipolar Bretton Woods II Moment

“US Secretary of Treasury Henry Fowler warned that ‘providing reserves and exchanges for the whole world is too much for one country and one currency to bear.’"(Francois Villeroy de Galhau)

Summary:

· Managed trade and managed FX rates are an elevated probability in response to the disorderly G7 “Friend-Shoring” process.

· As President Putin’s offensive, and his health, dissipate the G7 “Friend-Shoring-Driver” casus belli is pivoting from Russia to China’s “COVID-Zero” policy.

· China’s “COVID-Zero” strategy may now be to mitigate bank runs rather than COVID-19 per se.

· The G7 commitment to keep markets “open” is a commitment to “Friend-Shore” and not a commitment to free trade.

· The “Bullard Put” seeks to avoid recession by promising to ease in 2023.

· FOMC extended forward circumlocution is testing the limits of credulity and credible commitment.

· China has switched its global economic strategy from working through G20 to working through the BRICs.

· Christine Lagarde has anticipated the bicameral Villeroy and the Bosch Eurozone integration strategy with a tweak to the monetary policy framework at the ECB.

· The Villeroy and the Bosch strategy achieves economic union through the destabilizing of national democracies with EU sanctioned fiscal irresponsibility and central bank moral hazard.

· Villeroy’s New Multipolar World Order (NMWO) seeks to share Liberty, Equality, Fraternity, and the American Exorbitant Privilege to finance fiscal irresponsibility.

· UK economic policy seeks to play the balance of power, by pivoting away from domestic Levelling Up, and the EU-USA NMWO, back towards a cocktail of good old Thatcherite austerity with a splash of Johnsonian Sleazez-Faire aka Ripping Off.

Bretton Woods II: A New Multipolar World Order (NMWO) beckons ….

There is no smoke without a fire, as they say. There is also plenty of smoke blowing around the latest G7 meeting. There are also plenty of mirrors too, so prepare for something not entirely unexpected, yet seemingly surprising, to some, nonetheless.

The last report discussed the nudge, of the global economy, towards a new Bretton Woods moment, as it is being promoted by at least one of the architects. This new moment has a more multipolar feel about it than the original. One hopes that this multipolarity will improve its effectiveness and longevity.

Unfortunately, this new multipolarity is currently being resolved through conflict rather than civilized global consensus discussion and negotiation. Therefore, one also hopes that a multipolar solution to the conflict is achieved, first, and soon, to lay the foundation for the effectiveness required to create the longevity desired.

If only the Fed and the Federal Government could find someone else to blame for the global supply chain woes and inflation. If blaming this someone also required disinflationary, deficit-financed, supply-side investment, both could stop blaming each other and get on with the financing.

Which brings both to the war in Ukraine.

Shootin’ Putin ….

The conflict involves the process of naming the problem in order to deliver the solution. As readers know, this author believes that President Putin is the Straw Man in this regard.

Apparently, Treasury Secretary Yellen thinks so too, because she has recently named him as the cause of the imminent World Food Crisis, for which she already has the solution.

Orderly “Friend-Shoring” to halt Global Economic Disorder ….

· The recently released Global Regime Change virus is highly contagious and wildly indiscriminate.

(Source: the Author)

The process of “Friend-Shoring”, of key parts of the global supply chain, away from China, towards G7 compliant recipients, evidently, has become too chaotic to manage. Tighter monetary policy, and ensuing financial instability, have increased the chaos. Policymakers, charged with managing the global economy, are under threat from the forces that they have unleashed. Consequently, policymakers’ ability to manage change is impaired by their need to manage their own political survival first. There is, also, a growing tendency for their individual survival attempts to disrupt cooperation at the global level and, in some cases, to deliberately undermine it.

China has responded by doubling down on its “COVID-Zero” strategy, with associated depressionary economic consequences. These depressionary consequences are contagious for a global economy that has not yet “Friend-Shored” away from China.

· G20 Beggar Thy Neighbor Friend-Shores G7, and itself.

Mas Que Nada ….

This author has noted how the BRICs have an antipathetic attitude, towards the New World Order of “Friend-Shoring”, which has been recently endorsed at the IMF/World Bank Spring Meetings. The B part of the quartet has now become active. It is interesting to note that the B is far more conciliatory than the aggressive R and C, and also less overtly pecuniary than the venal I.

(Source: the Author)

More importantly, China is also responding with alacrity to attempts at “Friend-Shoring”.

China has tweaked its global anti-G7 strategy, from working through the agency of G20 to working through the agency of the BRICs. China is now actively seeking BRIC expansion. In a previous report, this author noted that G20 was undermining China and many of its own emerging nations in the process of the G7 “Friend-Shoring”. Evidently, China no longer views the G20 as a viable platform on which to build an alternative economic system. Consequently, China is falling back upon the BRICs, as its fighting brand of choice.

Under the camouflage of the BRICs, China is also promoting its alternative global economic system to the one currently being promoted by G7. In addition, China has decided to engage in a currency war to protect its depressed economy and to undermine the G7 “Friend-Shorers”. The inflationary consequences of this currency debasement have been negated by the simple processes of price control, in addition to the control of the movement of people and goods through the enforcement of the “COVID-Zero” regime.

Japan was already using this devaluation tactic, and capital flight out of emerging economies has broadened the field of devaluation race runners.

The situation is getting out of control, begging the question of a negotiated compromise solution between all the runners.

Time for a reset, ergo Bretton Woods II rumors.

WTO Deputy Director-General Angela Ellard has framed the global situation as “our Bretton Woods moment”. Such hyperbole, usually, has an agenda behind it. The frame used, also, usually, hints at the desired outcome. Applying this rubric, to Ellard’s hyperbole, one may conclude that a global financial reset, involving exchange rates and trade, has been envisaged. The widely held view is that the global economy, and its supply chains, are unbalanced. This instability has been highlighted by COVID and the Ukraine War. Now it is time to redress the balance, so to speak.

It is now time for rebalancing. President Biden has referred to this rebalancing as a New World Order. This rebalancing is currently becoming chaotic, and, therefore, needs to be managed. A little chaos is good to kickstart the process, but too much chaos will impede progress.

This author has noted the growing tendency towards intervention in markets. This observation infers that the global economy is creeping towards a managed structure. Evidently, the rules of the game are being negotiated in real-time by the various players.

A New World Order through Managed Trade and Managed FX Rates?

Clearly, the current global economic unraveling situation is worrying the IMF. In response, the institution has tried to arrest the fall of the Yuan, and the rise of the US Dollar, by increasing the weighting of the Chinese currency in its SDR basket.

Back in the day, when President Trump was engaging in his own form of “Friend-Shoring”, this author suggested that the outcome would, most likely, be a brief currency war that would lead to a managed trade/FX regime. Under this regime, central banks would become little better than currency boards. Given their recent inflation-fighting performance this is, arguably, all that they are good for. This option now must be placed back on the table, and its level of estimated probability evaluated continuously.

The sudden peddling of the thesis alleging that US Dollar strength is bad for the global economy should heighten suspicions that a managed trade/FX agenda is being rolled out by stealth and guile. It was not so long ago that the strong US Dollar was alleged to be a suppressor of commodity-driven inflation. How swiftly things change.

The recent slide in the Yen, and the fall in emerging market currencies, based on external capital flight to high yielding US Dollar safety, is also bringing the need for a managed solution.

Rumors of an imminent Plaza Accord, in response to the alleged destructive strength of the US Dollar, are emerging in the public domain. The managed trade/FX solution is antithetical to the alleged process of free trade that “Friend-Shoring” has been advertised as. Evidently, free trade is just a label. Rumors of trade and currency accords perennially appear when there is a crisis and an alleged economic reset in the offing. The appearance of such stories, on the eve of G7 meetings, is also grist for the mill. The latest rumors could just be a symptom of the crisis rather than a serious solution.

The Japanese have, however, voiced dissatisfaction with the weak Yen, and emerging nations are very dissatisfied with the capital flying from their economies to higher US yields. Japan Inc. is militantly aggressive against a weak Yen and weak Yen monetary policy. Japanese core inflation just went above target, for the first time in seven years, to the collective dismay of most domestic observers bar the BOJ. The Japanese are, therefore, open to solutions.

With the US economy currently showing signs of decelerating, a stronger US Dollar is an extra headwind. This extra headwind also vitiates the process of “Friend-Shoring” supply chains out of China.

Going into the latest G7 meeting, Secretary Yellen appeared to scotch rumors of an FX accord by re-iterating her commitment to market-determined exchange rates. Yellen’s comment is all well and good, but it is inconsistent with all the intervention, threatened and real, in the price discovery process for commodities. It also contradicts the US President’s attempts to interfere in the price of crude oil and the gasoline refined from it.

· Ukraine is a diversion via which China’s Belt and Road runs into direct conflict with G7.

(Source: the Author)

On the eve of the G7 meeting, Yellen also began to pivot attention away from President Putin’s failing health, and failing Ukraine offensive, toward China. China is the alleged newest blame for high inflation, because of its “COVID-Zero” strategy which is tightening supply chains. This strategy plays right into the hands of those who would “Friend-Shore” supply chains out of China, thereby, creating disinflationary global economic growth. China’s “COVID-Zero” strategy, however, appears more like a circuit breaker, keeping people locked down, in order to avoid bank runs.

The G7 draft communique committed to keep markets open. This is not, however, the same thing as a commitment to free trade. It is a commitment to “Friend-Shore”, by any means possible.

Keeping markets open will require central banks to act as gatekeepers and, thereby, as currency board managers.

A guide for the perplexed Currency Board Operator ….

The Fed’s inertia and ineptitude are certainly going to be good for the sales of Chairman Bernanke’s new book. Momentarily lowering himself into the gutter, with the likes of this author, the former Fed Chair has unprecedentedly criticized the inertia and ineptitude of his successor in responding to inflation. Furthermore, the mudslinging and trash-talking extend to a new volume entitled “21st Century Monetary Policy”. A cynic would say that the trash-talking and sales of the new book are directly correlated.

This author cannot wait for the delivery of Bernanke’s essential beach reading this summer. Hopefully, there will be a guide for the perplexed currency board operator, in its pages, so that Chairman Powell and his team can get up to speed on their new job description.

This author suspects that, in practice, Chairman Powell wants to apply the same monetary policy action used by Alan Greenspan, in the fin de siècle of the 20th Century, but more on this later.

Until Congressmen have read Bernanke’s new book and decided if there is something useful, for the dual mandate, in it, the Fed has little to fear from book reviews by esteemed economists. In the meantime, Chairman Powell sticks to his script and vows to do whatever it takes, because low inflation is “the bedrock of the economy”. Well, it is, at least until conventional economic wisdom decides that increasing labor force participation, and the working man/woman, are the bedrocks of the economy, that is.

The “Fed Put”: A Hyperbolic act of self-preservation ….

· The Fed may embrace Macklem Doctrine when it sees the unrealized losses on its balance sheet from the recent spike in yields.

(Source: the Author)

The last report observed Cleveland Fed president Loretta Mester delicately opening the subject of unrealized losses, in mortgaged back securities, on the Fed’s balance sheet. Said losses could, potentially, be realized, through sales, as the balance sheet is wound down. The author didn’t perceive much appetite to take the losses in view of the associated greater loss of credible commitment incurred. Consequently, the author perceived an appetite from the Fed to support the bond market. This appetite has subsequently become voracious in the form of rhetoric and guidance.

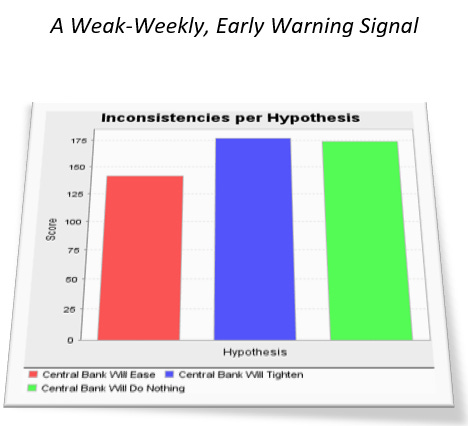

New York Fed president John Williams recently confirmed that there is no appetite to take MBS losses. He may also have observed that the housing market is imploding, and may wish to avoid making it, and its associated economic headwind, even worse. Of said growing economic headwind, Williams seems to be looking down his telescope through his bad eye. According to this cognitive blindness, there are no real economic threats, from tight financial liquidity conditions, and heightened commensurate financial instability, to be seen. The Key Signals proprietary indicator has signaled that the Fed should be easing. Contrary indicators, and contrarian signals, are showing that growth and financial stability risks cannot be blindly ignored in the inflation fight.

Williams may not be ignoring the risks, so much as downplaying them, for now, whilst inflation remains stubbornly high.

In light of the stubbornness of inflation, there may be an already tried and tested plan hiding in plain sight.

Why we care about the 1990s: What John really said ….

· The 1990s global economic scenario is hiding in plain sight.

(Source: the Author)

At the same time, as he was trying to downplay risks, John Williams noted that “we’ve already seen a tightening in U.S. financial conditions that is far greater than what we saw in all of 1994.” From this author’s viewpoint, the mention of 1994 is a key signal. This author has a thesis that the 1994 Greenspan model is being re-applied. Williams’ comments support this thesis.

· The recent Wall Street earnings season-wink signals that the US financial sector has, already, become the medium of economic transfer of the FOMC’s “methodical” and “expeditious” tightening which has only just begun.

(Source: the Author)

Wall Street has very noisily choreographed an economic warning signal, for Williams, some time ago. This message has just been repeated.

The New York Fed is the interface of monetary policy and capital markets. Williams, therefore, cannot have failed to register the Wall Street signals or the growing real economic headwinds. It is more likely, that he wants to get in a couple more rate hikes, for credible commitment’s sake, before he throws in the towel and starts to fight an economic slowdown and the losses on the Fed’s balance sheet. Stopping easing after only one 50-basis points rate hike would just make the Fed into an even bigger laughing stock that isn’t actually funny at all.

There are, however, some FOMC members who do not want Mr. Market to rush off with the idea that a monetary policy easing is possible any time soon.

New York Fed president John Williams is looking forward to inflation, circa 4% by the end of this year, which is finally tamed by 2023, and back at target in 2024. Weak economic growth is a necessary cost of this cleansing process, according to him. Evidently, Williams is willing to gamble with tightening financial stability for a while longer.

(Source: the Author)

Williams wants to finesse his two more rate hikes and his Soft-Landing victory lap. The six months forward expectations indicators, in the New York Fed’s latest Empire State Manufacturing Survey, and Business Leaders Survey, suggest that the landing may be on the harder side of soft. Prices received are leading prices paid lower, implying further margin pressure and a harder landing.

In addition, Williams’ own staff have stated that businesses see inflation moderating. Is he, therefore, cognitively deaf, as well as blind, or is he just obsessed with his two rate-hikes and Soft-Landing victory lap?

When his visible and aural acuity recovers, Williams may, ultimately decide, with hindsight, that inflation was the best monetary policy tightening tool of all!

· Neel “Ex Culpa” Kashkari has lost his credibility.

(Source: the Author)

Williams’ colleague Minneapolis Fed president Neel “Ex Culpa” Kashkari is already in two minds, perhaps even three.

Fool me thrice, still call me a “Neel”, Jan.

Fool me twice, call me a “Neel” ….

(Source: the Author)

Before critiquing Kashkari, this author would advise readers to revisit his previous critique. This author is also wondering if it is possible that Kashkari is a secret Key Signals follower.

Kashkari appears to have simply picked out all the data from the latest New York Fed Quarterly Report on Household Debt and Credit which supports his decision to tighten monetary policy aggressively. A Fed president with a hammer only sees nails. Kashkari certainly does not feel the clearly evident headwinds from the housing sector in the report.

(Source: the Author)

Kashkari recently misread the consumer credit data, assuming that it, wrongly, was a sign of strength. He has since been publicly corrected, by Goldman’s Jan Hatzius, who has ruled that consumers are forced to borrow to subsist on inflation. Kashkari appears to have become very thin-skinned, of late, perhaps, in response.

After this author observed Kashkari’s developing innate dogmatic tendency, to hold his views to the bitter end, this affliction appeared to have suddenly been corrected. When the facts change, Kashkari appeared to change his mind. This author, clearly, has had no part in this change of character. The author suspects that Jan Hatzius has, though. Goldman sees the US economy approaching an inflection point. Kashkari seemed to be beginning to inflect. The recent disastrous earnings reports from retailers may also have influenced his inflection. The reports confirmed that the consumer is now borrowing to finance less purchasing.

On inflection, Kashkari suddenly dropped his Hawkish mantle and openly questioned its veracity. Apparently, “it’s too easy to be a Hawk”. In light of the swiftly decelerating growth data, Kashkari has equally as swiftly embraced Soft-Landing dogma and guidance. This warm embrace seizes upon unknown unknowns, which prompt him to question the need to push the economy into recession, in order, to defeat inflation. Perhaps, with some hindsight, he has also decided that inflation is the best monetary policy tightening tool of all.

Then, just as soon as he began inflecting, Kashkari snapped back to his old dogmatic modus operandi. Snapping back, he doubled down on his view that the consumer’s strong balance sheet is an economic and an inflation tailwind. Based on the unknown unknowns, and his “Ex Culpa” persona, Kashkari then apologized and stated that he no longer knows if a soft landing can be achieved in the fight against inflation. This broad disclaimer may appear to absolve him, but it also destroys the last vestiges of his credible commitment.

Chicago Fed president Charles Evans is, like Kashkari, conflicted and confused by the role of inflation in tightening monetary policy. He has less to worry about, than Kashkari, because he is a short-timer. Nonetheless, Evans is doing the last dance of front-loading rate hikes with the intention of tapering them off in the fall. Evans’ last dance will not, however, involve a victory lap, since he still envisions the need for his colleagues to go above the neutral rate, either on his watch or when he has left.

· The “Bostic Put” joins the “Waller Put” on the list of “Fed Puts” being extensively forward-procrastinated.

(Source: the Author)

The monetary policy tightening tool of inflation has also prompted the appearance of yet another form of “Fed Put”. This new Put is yet another attempt to avoid a recession whilst front-loading monetary policy tightening.

The “Bullard Put” (2023): Front-loaded and lovin’ it.

Inflation as an unintended monetary policy tightening tool has put Bullard into conflict with his innate tendency to wish to overcompensate with large interest rate hikes. This position is a kind of No Man’s Land, where it is difficult to discern if a central bank is behind the curve or not. Indeed, high inflation may put the central banker behind the growth curve. In view of this conundrum, Bullard remains content to stick with the 50-basis points rate hike script and a threat to do more if necessary.

Bullard sets out his stall, to evade recession, where Kashkari effectively gives up on his own attempts to avoid one. Bullard avers that front-loading the tightening, could then swiftly pivot to easing, in 2023, if inflation is falling. The circumlocution, of circular FOMC guidance, seemingly knows no limits.

One Fed speaker is testing the limits of credulity and credible commitment with his own unique circumlocution. A recession is now, apparently, a soft landing.

Recession is the new Soft Landing ….

Philadelphia Fed president Patrick T. Harker is the latest FOMC member to destroy his credible commitment. Harker’s recent remarks were his own, and not the FOMC’s, so the loss of credible commitment is also personal.

Harker seems to believe that a “few quarters” of negative growth are a soft landing because the labor market will be tight throughout this period. A few quarters of negative growth used to be known as a recession.

Harker also blames the Federal Government, unequivocally, for demand-driven inflation. The Fed’s hand in enabling this demand, at affordable rates of interest, to the Federal Government, and also the private consumer, is not a significant detail in his view. But then, Harker believes that by raising interest rates demand can be cooled by the Fed. It’s funny how cutting interest rates doesn’t appear to have boosted demand by applying the same logic.

Harker’s contribution, to guidance, and monetary policymaking, at this juncture, is negligible; other than to confirm that the consensus for two more 50-basis point rate hikes is one that he buys into.

Animal Spirits: An inflation mandate species ….

Kansas City Fed president Esther George believes that the recessionary signal, from recent equity market carnage, is all part of the process of dealing with inflation. This carnage will not deter her from pressing ahead with further interest rate hikes, which will raise the probability of recession.

· Inflation is being primarily fought with financial stability policy tightening rather than monetary policy tightening.

(Source: the Author)

Evidently, Animal Spirits are a useful tool in George’s monetary policy toolbox, although, strictly speaking, they are a financial stability tool. Before the rate hike process began, this author had noted the extensive use of this tool. Clearly, with the threat to growth, from future rate hikes, now in play, the financial stability context becomes more important, at least for George.

A different species of animal is loose, across the Atlantic, in the Eurozone.

From Eurozone to Weimarzone, by way of Kyiv: Divine Intervention ….

· The internally conflicted Eurozone will become a managed command economy for the duration of its structural transformation toward a Federal Republic.

(Source: the Author)

The last report discussed German preparations, and thereby the Eurozone precedent, to declare economic force majeure and then nationalize key inflationary bottlenecks in the economy.

· Faced with populist protest, Eurozone policymakers transfer wealth, for votes, and simultaneously sell Federalism.

(Source: the Author)

It was assumed that the German precedent would be confluent with similar EU plans, thereby, enabling a smoother and deeper integration of national economies into the Federal New Republic of the Eurozone. The EU has now made it known that there is a plan for energy market intervention.

Whilst the EU plays catch up, Germany is asserting itself further. In this assertion, Germany is setting a global precedent that America may follow.

You broke my heart Volodya ….

This author has suggested that the best person to create bipartisan consensus, and fiscal stimulus, in America is President Putin and not President Biden.

Surprisingly, the Germans with their conflicted and compromised relations, through Gazprom and Nordstream, with Russia, have been able to build a bipartisan consensus to blame President Putin for their problems. The Germans haven’t just stopped at their borders, though. Ominously, they are going beyond their borders again.

We’ve been expecting you, Chancellor Scholz ….

Readers should not be too worried, by Germany stepping beyond its borders. Germany chairs the G7 this year, and is, thus, obligated to appear to lead, from the front, by following behind the global consensus. This chair position is, in fact, a nightmare for Germany because it has exposed all the country’s conflicted double-dealing interests in Russia.

The chain of global events, this year, when reviewed, with hindsight, appears to be more than just a coincidence. It is as if God, and Mammon, have chosen this apposite moment in time to make Germany get off the fence, on the side of the Free World, just as the country is rotating into the chair of an organization that governs the developed world. According to Einstein, God does not play dice, so if it is down to the All-Mighty, he appears to have a plan.

For those readers who are not religious, there is, of course, the possibility that a higher power, which sets the global agenda and has a G, followed by a number, from one to twenty, in its name, is pulling the strings. Seven is the number of this beast, not five.

For readers who, like this author, are at the Pareidolian-Apopheniac end (hey it’s just an algorithm!), of the analyst’s spectrum, the conclusion is “elementary”, and “the Game’s afoot”, literally, as a famous literary fellow-sufferer says.

Whatever the reader’s belief system algorithm, and associated level of paranoia, there can be little doubt about how to interpret the latest comments from Germany.

German Foreign Minister Annalena Baerbock has identified the Russian president as global Public Enemy Number One and the bringer of hunger and famine to the world.

Vladimir Putin’s house needs painting too Tiff, capisce?

(Source: the Author)

The removal of this malign individual influence is, hence, not just a European Project but, also, a global one. Presumably, Baerbock wishes this removal to be via the legal process in the Hague rather than Nuremberg. FM Baerbock’s global famine speech, thus, becomes another legal charge for the global plaintiffs.

Putting her taxpayers’ money, where her mouth is, Baerbock has pledged 430 million Euros to starving nations. One cannot knock the sincerity of Germany’s pledge, even if one insists on questioning the ultimate motivation.

Where Germany is successful, in helping other nations, it struggles to become a greater military presence in the global arena. This latter failure is not so much a case of embarrassment about its inglorious past militarism. Rather it is because the weak German coalition government cannot decide on how to spend its growing military budget. German fiscal Black Zero was helped, in no small way, by the country’s failure to meet its NATO threshold membership level military spending. Now, quite literally, German needs to embark on a deliberate policy of militarization, to meet global obligations and does not know where to start because there are so many military things to do.

Where and when Germany fails, it is forced to lean on its greatest ally France. The author’s allegory of Villeroy and the Bosch has come from watching this bicameral disporting.

New Multipolar World Order (NMWO) (I): Made with love by Villeroy and the Bosch ….

By nature of the bicameral disporting mechanism, when Germany makes a move France is swift to follow. Consequently, the epiphany of the French multipolar worldview appeared swiftly after the German military revelation.

This author never fails to be amazed by ECB President Christine Lagarde’s prescience and grasp of the epochal shifts in the global economy. Her well-informed grasp is never beyond her well-manicured reach, despite the occasional yield-spread slip, as her critics always find out, eventually, long after history has moved on her way. Once again, she is spectacularly on point.

Lagarde has positioned for a bicameral Core Eurozone approach to the New Multipolar World Order (NMWO) in advance. Her approach is a tweak to the monetary policymaking process, by reducing the influence of her Executive Board team of Isabel Schnabel and Chief Economist Philip Lane. This makes for, ostensibly, a more demotic process that takes greater account of national central bank views. The devolved legitimacy of the ECB, and its decisions, is, thus, by default, more credible.

A secondary, but by no means trivial, outcome of this demotic monetary policymaking process is that the larger economies will have a greater say in policymaking. Since France and Germany are the largest, they will have the greatest say. The Villeroy and the Bosch allegory is therefore apposite.

Villeroy’s voice, and guidance, is well known in the global economy. Lagarde has diluted her own voice whilst simultaneously promoting that of Bundesbank President Joachim Nagel. At a time of rampant inflation, the embrace of the Bundesbank is critical to the ECB’s credible commitment. By default, therefore, with a bigger Bundesbank input, going forward, monetary policy and the Euro have been hardened. This hardening is, also, critical for what Villeroy has in mind for the global economy.

Lagarde’s move anticipated a similar move, by the European Commission, which then followed. The ECB is, thus, consistent with and, thereby, legitimately devolved from what is going on at the political level in the Eurozone.

The European Commission intends to extend the period of the suspension of EU fiscal limits on national deficits. This extension strengthens the democratic position of the nations involved and reduces antipathy towards Brussels. This status quo is desirable if policymakers intend to engineer economic union via fiscal union. Such a fiscal mess will have a tendency to push up inflation and borrowing, hence the ECB has changed its monetary policy stance, towards tightening, accordingly, also.

The threat from the Oriental Bogeymen, in Russia and China, then plays the role of geopolitical nudge, and distraction, from the principal objective of deeper European integration. Hence economic and political union can be achieved through the strategy of supporting the democratic process (and the fiscal debts) in each nation involved. Eurozone countries are being actively encouraged, to get themselves deeper into fiscal purgatory, with salvation through the joy of ultimate fiscal union. Moral hazard is the new Enlightenment. It’s genius.

The Germans, clearly, are not convinced that this new Enlightenment is genius. They think that it is heresy and Finance Minister Lindner is pushing back, in principle, thereby, indicating that this is a purely French/EU initiative. If the Germans want to wean themselves off Russian gas, gracefully, rather than disruptively, they may, however, be forced to compromise.

The Germans want, what they call a “data-based” approach to fiscal limit governance. This author notes that there are lies, damned lies, and economic data. Since Eurozone economies are diverging, and yield spreads are widening, so is their economic data. Eurozone nations with widening yield spreads, creating fragmentation, have every incentive to spin their data to show that they need fiscal limit extensions. Ostensibly, the Italians have been doing this ever since COVID started. What the Germans are, therefore, in fact, saying is that each nation should have the democratic right to spin the data any way it wants to. What the EU then does about keeping the Eurozone together is a debate for another day and another crisis.

Chapeau Christine! Did you see all this coming, or were you involved in its drafting?

But it gets even better. The French also have a devious plan to get them off the hook when all the newly minted national Eurozone debt threatens to bring the house of cards down. This French plan is a chip off the old, American fiat currency, block to pay credulous creditors with IOUs whilst pricing commodities in the same.

Exorbitantly privileged! Moi?

The French epiphany of the New Multipolar World Order (NMWO) was delivered, appropriately, at the Bank of France 15th Emerging Markets Forum. Where better to deliver a multipolar solution?

Bank of France Governor Francois Villeroy de Galhau did not disappoint with his enlightenment of the epiphany. His vision envisions a greater global role for the Euro currency; and the fully integrated Eurozone economy as a tripole that dilutes the dangerous dynamic of the bipole created by the USA and China. According to Villeroy’s bons mots, le tripole est aussi, beaucoup, sans Crypto et, beaucoup, avec CBDC. Vae Bitcoin!

In effect, Villeroy envisions a Multipolar World Order (MWO) in the Bretton Woods II iteration. The global rules of Villeroy’s envisioned MWO will enshrine a “‘creative frontier’,” and “the idea of a cooperative multilateral International Financial System,” which should, “definitely develop the international role of the Euro.”

According to Villeroy, heavy lies the crown of global reserve currency status on America’s tortured brow. He is overjoyed to announce that “We in the euro area are happy to help,” in sharing this onerous burden and the currency volatility that it entails.

This author noted that Villeroy was, also, keen to get his hands on the “privilege exorbitant” that Valery Giscard d’Estaing accused America of misappropriating for itself at Bretton Woods I. How nice it would be, for Villeroy, to have all commodities priced in Euros, or at least in SDRs with a bigger Euro weighting?

This author thought that he overheard the case for managed trade/FX, resonating loudly, between the lines of Villeroy’s generous offer to share the burden of global reserve currency status.

Talk of sharing the exorbitant privilege takes us across the Atlantic to see the view of the New World Order under construction in Washington.

NMWO (II) “Less of the M, Buddy!”: Built Back Better in the USA ….

Both allies are seeking to find the right balance, of peace with accountability, whilst avoiding a repeat of the mistakes, made at Versailles, which will simply create a bigger monster out of what is left of the war-ravaged Russian political executive. A Marshall Plan, of some kind, would seem to be the logical outcome.

(Source: the Author)

In the last report, this author suggested that the putative Allies, namely the EU and the USA, would reinvent the Marshall Plan to rebuild Ukraine and deliver a peace settlement that was not reminiscent of the failure at Versailles.

It should be understood that the Ukraine Marshall Plan has wider objectives for the Allies. It forms the basis for their own fiscal stimulus plans and strategies to “Friend-Shore” supply chains. For example, America intends to “Build Back Better” through “Made in America”. Spending billions rebuilding Ukraine must broadly deliver benefits that comply with the specific growth agendas of the Allies.

Applied Macklem Doctrine: Crank Up the “Friend-Shoring” via Lend Lease ….

· Mission creep, from Lend Lease to Friend Shore, may drive the next US fiscal stimulus.

(Source: the Author)

America appears to be coming at this strategic alignment through the frame of “Lend-Lease”. The Ukrainian economy will be shackled, through debt, to the US mothership. The World Bank and the IMF will then see to it that the Ukrainian debt-slaves play by the rules.

The EU has the EBRD which will, no doubt, act as the agency for its specific terms and conditions of Marshall aid.

The Allies must, hence, avoid competing with each other and/or undermining each other’s broader agendas. The latest G7 meeting is, therefore, an opportunity to see how the Allies’ Marshall intentions and capabilities will play out. Secretary Yellen is already giving it the Marshall Plan one, so that’s one of the author’s boxes ticked.

How Britain behaves, within G7, is interesting to watch. The country and its elected leader appear to have gone rogue, in the perverse romantic pursuit of times nostalgically remembered. Or maybe it’s just because it’s Jubilee Year and there is a lot of flag-waving going on which obscures the real picture.

Speaker Pelosi has already signaled that Britain will not be allowed to spoil EU-US trade relations and their bicameral vision of the NMWO. There simply is no place for Britain, and no exorbitant privilege either, as an equal of the two. The British PM would be well advised to take care. Instead of taking care, he gambles and plays the balance of power game, seemingly, to make Britain and/or himself seem more relevant than they actually are.

Compared and contrasted, with German generosity, and French creativity, Britain’s attitude towards global hunger and development aid is regressive at best. Britain will finance concentration camps, in Rwanda, for those trying to escape hunger. PM Boris Johnson has a uniquely Anglo-Saxon take on who should be enjoying exorbitant privileges, back in Blighty, and, also, overseas in the Colonies as he fondly imagines. Sterling’s weighting in the SDR basket is challenged by the PM’s regressive worldview.

Guns of Dalston ….

· The UK will become an austere economy with an ungovernable polity.

(Source: the Author)

Britain is becoming ungovernable. The most recent act of rebellion directly correlates with government policy towards those trying to escape hunger.

Britain, or rather the PM, has decided that charity (and political capital) begins at home. Primarily, this charity is directed toward his own government’s indebtedness, rather than to those who are in debt, suffering, and starving.

· The UK is aggressively 1980s rebooting, Submerging Markets style, whilst its European trade partners reboot in a more peaceful fashion, and America tries to reboot 1990s style.

(Source: the Author)

(Source: uncut)

The PM is taking it back to the 80s. History is rhyming and repeating in Britain. It is, therefore, apposite that a new egg-throwing target, in the form, of a statue of Margaret Thatcher, should appear on schedule.

Psst! Wanna buy some UK-Scamcoin ?

Recently commenting, on the prospects, for the City, in the future, as outlined by Prince Charles, the CEO of NatWest has opined that the Square Mile is currently at the epicenter of a banking fraud “pandemic”. This comment makes one wonder just exactly what kind of financial center the PM and the Chancellor are trying to build, and what kind of Empire they also envision.

(Source: the Author)

The last report, noting that the PM and Chancellor are fixated on focusing their economic strategy on the City questioned what kind of strategic intentions and capabilities they harbored. This question was highlighted by the CEO of NatWest’s opinion that the City is the incubator of a “pandemic” of frauds and scams.

It would appear that the PM’s, and the Chancellor’s, prognosis, for the fraudulent “pandemic”, is a “Sleazez Faire” strategy of legislating herd immunity. A light-touch/no-touch financial regulatory regime will be applied, which promotes both legitimate and illegitimate financial conduct of business, to attract and sustain global financial institutions. It is a kind of my word is my bond meets buyer beware compliance regime.

Sleaze is the word of the bond. The policy of “Levelling Up” has, thus, become one of Ripping Off, as the City returns to being a sunny place for shady people.

Evidently, the architects of this plan do not attach much weight to the remedial intervention, that the government was forced into, by way of all the mis-selling scams, and other frauds, that plagued the overweighted/underregulated financial sector of the UK’s economic policy mix. Also evident, is the fact that more than fifty reputable economic experts remember this Wild West period well and have, thus, given the plan the thumbs down. Well, they all vote Labour don’t they?