No Time Like The Present (and the 1990s) To Build Back A Better New World Order

‘There’s Gonna Be A New World Order Out There’. (POTUS)

Summary:

· President Biden’s New World Order speech has revealed the 1990s global frame of reference for the perception of current global events.

· The promotion of global free trade, within the New World Order, is being used to stimulate disinflationary economic growth.

· The FOMC may be sacrificing its credibility, in order, to lower price inflation with higher market volatility.

· Aggressive monetary policy tightening may be a vanity project, in pursuit of lost credible commitment, that will undermine the Macklem Doctrine Solution for the New World Order.

· The ultimate New World Order, enabled by Macklem Doctrine, will have its own specific financial bubble in addition to “intransient” structural inflation.

Those three little words that, meant so much in the 1990s, and, now mean so much today ….

The 1990s global economic scenario is hiding in plain sight.

(Source: the Author)

It was only a matter of time before those three little words that mean so much, in the global vernacular, were uttered. Tradition holds that it is the President of the United States of America who has the honor of uttering this global trinity. And, so, it has come to pass that President Biden has made the announcement, to a coalition of willing American CEOs, that “there’s gonna be a New World Order out there”, before taking the trinity on the road to a coalition of willing NATO allies.

After President Biden said the magic words, memories were jogged and the 1990s suddenly appeared at the top of the playbook for how the FOMC might play it going forward. This FOMC playbook will not enthuse the White House, initially, but longer-term it will play right into President Biden’s hands and worldview.

Hitherto, analysts and pundits had opined that the 1970s and 1980s were rhyming and/or repeating. The arrival of the New World Order frame of reference reveals that the 1990s may be a more apposite guide for the perplexed.

It is not certain if President Biden’s original “Build Back Better” initiative also envisaged a global dimension. What is certain is that events in Ukraine have conflated the President’s domestic and global agendas. If the Fed is going to tighten monetary policy, in line with the 1994 thesis currently gaining favor, then the US and global economy will be in need of some building back better therapy, in the near future.

Join the dots to build back a better big picture ….

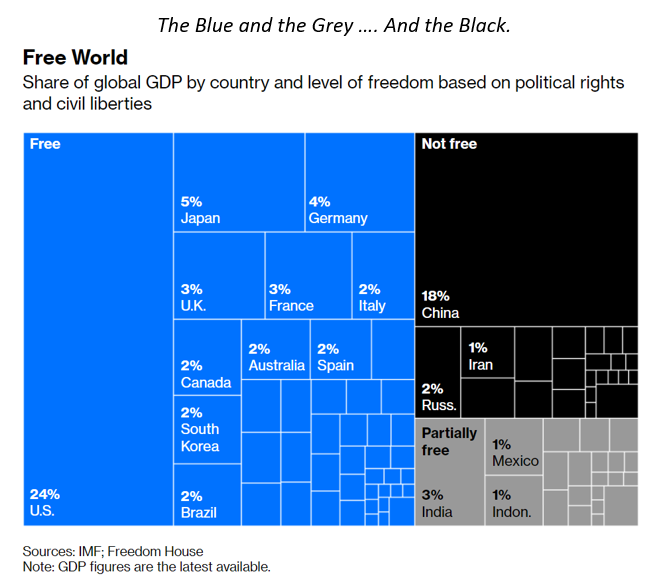

At the turn of the year, the alarming trend of global GDP into the hands of despots and dictators was revealed in the media as a matter of urgency.

China and Russia said putative despots/dictatorial regimes, then hijacked G20.

Summary:

· G7 has canceled the 1970s narrative.

· G7 has canceled G20 and all multipolar initiatives associated with it.

· Regime change by Cancel Culture could be on the G7 agenda.

(Source: the Author)

G7, via NATO, then, responded with proportionate alacrity. The G7 contingent is now actively seeking ways to remove Russia from G20. Since the remaining G20 nations may not assist, the likelihood of a G7 boycott of G20 is an obvious next step. Beyond this, the unprecedented withdrawal from G20, by the G7 group, is the ultimate step. This, however, could leave China in control of the remaining G13 which would be counterproductive for G7. Better, perhaps, for G7 to disrupt and neutralize G20 by remaining one of its influential members. G7 is also putting pressure on OPEC’s producers, with capacity, to increase output to evade a greater oil shock than exists already.

China’s real reaction remains pending, whilst it watches the situation in Ukraine unfold. Seeking parity with America is one thing. Seeking parity with the EU is an additional thing. Seeking parity with G7 is a much taller order. Creating an alternative economic order to G7 may seem an attractive option, under the current circumstances, but the experience of the Soviet Union, and the Warsaw Pact, shows the economic and technological limitations of such a venture.

The Eurozone, inside the Natozone, wrapped in the G7-Zone …. within a Global Free Trade Zone ….

· Ukraine is a diversion via which China’s Belt and Road runs into direct conflict with G7.

(Source: the Author)

It is now evident that the Ukraine crisis is a smaller component, perhaps even the proxy, in a larger global issue currently under negotiation between the G7 economies and China. Chinese deputy foreign minister LI Yucheng confirmed the bigger picture negotiation thesis when he recently opined that NATO is the cause of the Russian invasion of Ukraine.

Having, recently, re-aligned closer to G7, and away from Russia, Germany is now taking a more prominent role in the global dialect.

The German realignment, at the heart of the Eurozone, and G7, post-Merkel, and post-Macron’s failed Euro-Russian gambit were discussed in the last report. German Finance Minister Christian Lindner now wishes to consolidate the German position by re-opening free trade talks, which had stalled during the Trump era, with the United States. The consummation of such a comprehensive deal would further undermine China’s global position.

Not to be outdone, Her Majesty’s Government is also trying to establish the United Kingdom at the heart of G7 global policymaking. Perhaps, reflecting tension over Prime Minister Johnson’s past embrace of all things Trump, the establishment of concord with the Biden Administration is personally challenged. Despite these egotistic tensions, common sense is prevailing so that the two Anglo-Saxon economies have, slowly, been able to start winding down trade tariffs. The Anglo-Saxon trade accord is a work in progress.

In comparison, with the evolving Anglo-Saxon accord, the Euro-American concord is flourishing. Trivializing the Anglo-Saxon, ongoing, trade negotiations the EU and the US have signed a mega-deal to replace Russian gas with US gas. This deal is a precursor to, and guarantee of, a more comprehensive bilateral trade deal.

This energy security deal is an awkward reminder to Prime Minister Johnson that his continued pursuit of the Trump World Order, and Brexit agenda, has real consequences in the New World Order. If G7 is contemplating regime change in Russia, then contemplated regime change in the UK is also an elevated probability. Isolating the UK from the big global economic deals, whilst it is undergoing its own Cost of Living Crisis, is the urbane G7 equivalent of sanctions in the pursuit of regime change. Sterling’s alleged safe-haven status may soon be questioned.

The longer-term knock-on effect, to lower inflation, can, henceforward, flow from these free trade deals. Furthermore, standards and precedents can be set to roll out similar trade deals with other nations and trading blocs. Free trade, lower inflation, and global, not necessarily in this order, cascade from such deals. It’s win, win, win in theory.

China may, soon, be forced to choose between continued support for Russia or pursuit of its greater global ambition. Whilst it is deciding, global supply chains will ossify and inflation will be nudged higher. This latest nudge is, however, a clear global economic headwind of ominous proportions. Developed central banks, who are embarking on monetary policy tightening, should take note and tread cautiously.

(Source: the Author)

The disinflationary forces, exerted by free trade, cannot arrive soon enough for the global economy. The Ukraine situation has thrown up a significant barrier to progress. The last report noted that Chinese support for Russia would “ossify” supply chains running between Europe and China. Evidence of this ossification is now being widely discussed in the media.

Evidence of this ossification is now being widely discussed in the media. China must now weigh, carefully, the benefits of global free trade versus the pursuit of a competing trade bloc of its own through its support of Russia. Access to Russia’s treasure trove of resources is one thing, but if one does not have access to markets for goods manufactured with them it is pointless.

The FOMC has grudgingly admitted that some of the inflation-fighting call is self-inflicted collateral damage for answering the call to defeat COVID-19 aggressively.

Our brand is crisis ….

The FOMC is making hard work out of what is, ostensibly, the simple task of tightening monetary policy to fight inflation.

The FOMC’s problem starts at the top. Deserving of his suffix title Pro Tempore, Chairman Powell is making the heaviest going. There may, however, be some gambler’s fallacy methodology to his perceived madness.

Chairman Powell appears to have become naughty by nature.

Who’s down with “PTC”? Not every F-Omcee!

When delivering the FOMC’s recent 25 basis point interest rate hike, Pro Tempore Chairman (“PTC”) Powell opined his sensitivity to the risk to economic growth from tighter monetary policy and high inflation. In his most recent post FOMC meeting guidance, the Chairman has flip-flopped, and hip-hopped, onto the prospect of a 50-basis point hike at the next meeting. In response, the US bond market has had its worst day in a decade.

It was as if “PTC” would like to create volatility in the bond market, which has the knock-on effect to hit risk assets and commodity prices with brio.

· The Fed is encouraging Mr. Market to create and then converge higher spot volatility basis lower forward volatility.

(Source: the Author)

This author has suspected, for a while, that the FOMC would like to engineer an inverted volatility curve (VIX), as part of an assault on inflation drivers, whilst preserving benign long-term inflation expectations. Chairman Powell’s latest hip-flopping cannot, simply, be to earn himself credibility points since it is having the direct opposite effect.

If “PTC” is deliberately losing credibility in the short-term, in order, to thwart inflation through an inverted volatility and inverted yield curve, then he is a genius! He is also a very desperate gambler, to devalue the central bankers’ currency, of credible commitment, in order to seek his longer-term objective. The risk is that inflation trends higher for the very reason that the FOMC has lost its credibility.

A recent research paper entitled Inflation Levels and (In) Attention, from the Boston Fed, provides further context for “PTC’s” random behavior. The researchers find that inflation expectations rise when inflation is rising. Applying this study, to “PTC’s” latest Hawkish hip-flop, it is quite conceivable that he unintentionally triggers a rise of inflation expectations, because he creates awareness that it is rising, thereby undermining his whole gambit. Better to talk softly and apply the big stick of interest rate hikes, and balance sheet reduction, if “PTC” wishes to be taken seriously. Inflation expectations can then fall because he can justifiably claim that he is doing something to make them fall.

Cleveland Fed president Loretta Mester is down with “PTC”, and is more than happy to say so. She “strongly” supported the latest FOMC decision and, despite the growth headwinds from Ukraine, sees the benchmark interest rate rising, through front-loading, to 2.5% this year. This front-loading is likely to include a fifty basis point rate hike at the next FOMC meeting.

San Francisco Fed president Mary Daly is, also, down with “PTC” and has no further wisdom to impart, about this positioning, than was already imparted by Mester. Although lacking, in new wisdom, Daly is clear with her signaling that both 50 basis points in rate hike and some balance sheet reduction will be on the table at the next FOMC meeting.

St Louis Fed president James Bullard would like it to be known that, in fact, “PTC”, is down with He (Bullard!). According to Bullard’s latest guidance, “the Fed needs to move aggressively to keep inflation under control.”

Atlanta Fed president Raphael Bostic is not one of the FOMC homeys who is down with “PTC”. Prior to the latest FOMC meeting, Bostic had guided that he would be observant and adaptive. Coming out of the meeting, his observation of the developments of the Ukrainian situation has prompted him to adapt. This adaptation will be more circumspect about tightening monetary policy aggressively.

Bostic now appears unlikely to risk economic growth, with a plethora of consecutive 50 basis point rate hikes. It is, therefore, more likely that he will wish to extend the period, and the number of rate 25 basis point hikes, out over time going forward. He now expects six rate hikes, this year, which is less than those anticipated by other committee members.

Chicago Fed president Charles Evans is down with Bostic, but not “PTC”. Evans claims that he had noticed inflation was more widespread, across a basket of all goods and services, back in late summer 2021. Evidently, he did not see this as a problem, at that time, since he has sat on it till now. Furthermore, even as he now sees it as a problem he is not prepared to risk a recession to address it. Consequently, Evans is a gradualist who will not endorse 50 basis point interest rate hikes.

· Neel “Ex Culpa” Kashkari has lost his credibility.

(Source: the Author)

After his recent “ex culpa” episode, that saw him U-turn on the transient inflation thesis, Minneapolis Fed president Neel Kashkari will not undergo further humiliation by being down with “PTC”. He prefers the gradual approach of 25 basis point rate hikes and has penciled in seven of them.

New York Fed president John Williams is down with Evans, rather than “PTC”. Williams makes the incremental rise in yields conditional on the incoming data. This incoming data stream, currently, leaves room for either 25 or 50 basis points rate hikes on the table, but his refusal to endorse the latter immediately stands out in his latest guidance.

There will be blood and Structural Inflation….

Staffers at the Dallas Fed are definitely not amongst “PTC’s” homeys. The unique position of Texas as an oil-producing state provides them with a similarly unique global insight into the economic forces that will, eventually, impact the domestic US economy through the petroleum supply chain. This view is prescient in the wake of the recent US-EU energy supply deal.

In their haste, to get back to the 1970s, and 1980s commodity and inflation shocks, commentators, and analysts, seem to have forgotten the 1990s.

Summary:

· The 1990s global economic scenario is hiding in plain sight.

(Source: the Author)

Interestingly, from this author’s viewpoint, the Dallas Fed staffers immediately default to the 1991 Iraqi invasion of Kuwait, as their baseline model, from which to add contemporary context. Whilst acting as a good baseline model, the staffers believe, however, that it is only a rhyming one.

In the Dallas Fed worldview, there won’t be an exact repeat of the 1990s, this time, since the global economy will not return back to its pre-Ukraine invasion, oil-dependent, status quo as it did after Desert Storm.

The current crisis will act as a catalyst to transform the global economy, and transition it further towards a less hydrocarbon energy-intensive one. Hydrocarbon energy-poor Asia and Europe are obvious leaders of this transition, especially the latter.

The Dallas Fed staffers conclude that the impact of the dislocation, from the embargo on Russia’s crude oil, will be permanent, even if the conflict is swiftly resolved. The global impact will be Stagflationary, on most sectors of the global economy, which will then transmit to the US economy by default.

The implication for “PTC” is that aggressively hiking interest rates just makes the Stag component of the anticipated Stagflation worse, with no corresponding positive inflation outcome. Inflation and oil supply dislocation are already making the Stag worse, by acting as direct economic headwinds to the real global economy. Aggressive interest rate hikes, against this backdrop, would be overzealous, and, potentially more harmful than letting inflation run its course, whilst the global economy adapts and transforms under its own steam.

Of the transition, towards lower hydrocarbon energy intensity, the Dallas Fed staffers do not directly conclude that arrival, at this point, will signal an end to the inflation phase. Consequently, one may conclude that inflation might be baked-in for the long term. This inflation is, however, structural.

Inflation dynamics may have become structurally unhinged from their historically benign trend in October 2021.

(Source: the Author)

The New World Order, currently, under construction, envisaged by the Dallas Fed staffers, has an implicit structural inflation bias. The last report noted that Richmond Fed staff researchers have, also, become acutely aware of this growing bias towards inflation. These staffers note that a quantum shift in this bias change occurred circa October 2021. Structural inflation, of this kind, is a massive permanent tax on consumption. High interest rates would not lower structural inflation, but would just be an additional consumption tax. Thus, despite the clear inflation risk, its structural nature does not militate, strongly, in favor of “PTC’s” monetary policy tightening aggression. On the contrary, it warns against it. High structural inflation will do the monetary policy tightening for “PTC” going forward. “PTC” needs to be more worried about economic growth.

Aggressive monetary policy tightening by the FOMC is, hence, a bit of a vanity project in the pursuit of lost credible commitment. Whilst in pursuit, real economic damage is being done to the global economy and the proto- New World Order. Aggressive monetary policy tightening, ostensibly, following the 1994 Playbook, is just about acceptable. If it weakens economic growth, whilst avoiding a recession, thereby, acting as a precursor to a large fiscal stimulus it is understandable.

· Macklem Doctrine is a catalyst for the long-term disinflationary economic growth forces unleashed from Ukraine.

(Source: the Author)

This author would also note the transition, towards the less hydrocarbon energy-intensive New World Order, in relation to his own thesis on Macklem Doctrine. The supply-side fiscal stimulus, behind Macklem Doctrine, is viewed by some policymakers as the enabler of the kind of transition that the Dallas Fed staffers envisage. Macklem Doctrine is, ostensibly, the enabler of the transition to the New World Order currently envisaged by G7. The vast sums of money involved will need deficit financing at sustainable levels of interest. “PTC”, assuming that he becomes the permanent Fed Chair, will need to be on-hand, with the Fed’s balance sheet, to underwrite the sustainable source of deficit financing.

#Pricediscovery by @CancelCulture, an Inspector Margin calls….

· Inflation is being primarily fought with financial stability policy tightening rather than monetary policy tightening.

(Source: the Author)

In the previous report, it was noted that financial stability policy tightening is, currently, doing more of the heavy lifting than outright monetary policy tightening by the FOMC. This financial stability policy tightening has been executed through the raising of margin requirements and capital requirements. Combined with the threat of aggressive interest rate hikes, and current high price inflation, liquidity conditions have already been tightened to, and beyond, levels anticipated by the signaled interest rate hikes and balance sheet reduction by the FOMC. In effect, the yield curve has already done the tightening that the FOMC is communicating. The yield curve is tightening in real time, hence, its impacts are immediately being felt.

Financial liquidity conditions continue to tighten so that commodity speculators are forced to reduce the size and frequency of their transactions. It will not be long before the tighter financial stability and poor liquidity, in the capital markets and commodities markets, are being felt as chilling headwinds in the US real economy.

No doubt, these headwinds will be framed as a result of the Ukraine crisis. One could say, with evidence, that this framing exercise is already underway. The policy response of Macklem Doctrine will, no doubt, then, be framed as the solution.

#1994Playbook@Macklem Doctrine, a #NewWorldOrderAssetBubble follows ….

The current price discovery has also helped some of those discovering the 1994 Playbook. The ECB’s recent announcement of its intentions and capabilities, to withdraw the pandemic collateral easing measures, will have accelerated the price discovery globally. Now it is being assumed, by a growing consensus, that the aggressive FOMC will weaken the US economy, thereby defeating inflation, but avoiding a recession.

This author would like to point out that the original 1994 Playbook set the stage for the Dot.com Bubble that followed. Buying the current dip, if one is following the 1994 Playbook would make sense. Once bought, it is, however, better to travel than to arrive at the end of the bubble that ensues.

This New World Order asset bubble will be predicated on the view that the assets bought are the best hedges against structural inflation, the Federal Reserve off on a vanity project, and the Evil Empire that threatens the global economy and the American Way. Well, at least, this is, maybe, how the thesis and these assets will be sold.