Chairman Powell Sticks The Boot (And His Foot) Into The Black Hole (At Jackson Hole) In Speaker Pelosi’s Bottom

“We can’t allow fundamental decisions to be taken by a large male majority; that is simply not on.” (Christine Lagarde)

Summary:

· The Fed’s self-embrace of financial stability policy is going ultra vires at the technical “unrealized” insolvency event horizon.

· MMT lurks beyond the Black Hole in the Fed’s balance sheet.

· Mr. Market is already cool with the Fed’s “binary” financial stability mandate behavior.

· The Fed’s financial stability policy imperative supports the great balance sheet “Friend Shoring” rotation thesis, from demand side to supply side balance sheet assets.

· In essence, supply-side growth stimulus is the whole objective of central bank financial stability policy, pretending to be monetary policy, going forwards.

· Don’t fight the Fed’s great balance sheet rotation, track it with a “Hypergrowth Phase” demand-side to supply-side portfolio rotation instead.

· The great rotation, from demand side to supply side assets, market call was initiated by Augustin Carstens at Jackson Hole.

· US Shale reaches a tipping point that supports the US “Hypergrowth Phase” tipping point and the great rotation theses.

· Russia, and OPEC, have unwittingly conspired to make the USA the key global swing oil producer during the Ukraine war.

· Mercator’s Projection is that compliance with “Xi Jinping Thought” is a direct assault on Western Capitalism.

· India has been offered the choice of becoming a player, or a battlefield, in the Sino-American “Techno-Economic War” with the “Triad’s” live sales-demo in Afghanistan.

· The Thin Lady, with the Killer Fringe, just sang the death of UK Sleasez Faire.

· The unfit UK Government has finally been caught in flagrante delicto.

Jackson Hole: Casting pearls of wisdom before the swine’s lies ….

Representatives of the global central banking community, ranging from St Louis Fed president James Bullard to ECB President Christine Lagarde, were, seemingly, very eager to frame the upcoming Jackson Hole symposium as the global stage at which the commitment to defeat inflation would be reiterated. Anyone who believes their sincerity needs, his/her head examined.

Central bank balance sheets are so big, that their hosts face an existential dilemma.

Should they defeat inflation, with higher interest rates, thereby, making themselves insolvent?

Or, should they save their balance sheets and themselves?

As is their MO, the central bank attendees would have their audience believe they can do both.

Some of them can, if they act fraudulently. Some of them can, if they act deceptively. Most likely, all of them will try a combination of both.

Judging from the agenda, and attendee list, this year’s pearls of central banking wisdom would be sold along with the vestiges of greater diversity. Whether this packaging enhances the credibility of the message is debatable. But, as Simone Veil warned and Christine Lagarde, resplendent in pearls, recently, reiterated, “we can’t allow fundamental decisions to be taken by a large male majority; that is simply not on.”

The sacred feminine was a sublime theme, running through the Jackson Hole symposium, in a similar manner to the way that it ran through the COVID-19 pandemic and the economic recovery.

Despite the trappings of liberty, equality, and diversity it was Lagarde’s dreaded “large male” majority who ultimately called the shots. They may well, however, have shot themselves in the foot.

Madam Hostess, with the mostest, says do a little more harm ….

· Esther George’s sound monetary policy compass will be sorely missed when she retires.

(Source: the Author)

It was a bit poignant, for this author, to see the outgoing Kansas City Fed president Esther George presiding over an event in which the pearls, and noble lies, would be sold to the global masses.

George is, in this author’s opinion, the doyenne of central bankers. This year’s summit is below her dignity and an unfitting end to a glittering central banking career.

Comparing the website photos of Esther George and Christine Lagarde, the observer can see fewer pearls in the former and more pearls in the latter. The French are, however, known for their ostentation. The pearls of wisdom count, between the two central bankers, are surprisingly even by this author’s, back of the envelope, calculation.

She might wear more jewels, but Lagarde is, in this author’s view, like Madame Sosostris, the wisest woman in Europe.

Whilst her Hawkish, and predominantly male, colleagues have focused, exclusively, on alleviating the Wasteland of inflation, with the Wasteland of a recession, Lagarde has always seen the bigger picture, of the Eurozone’s place in the global polity, as the biggest arbiter of economic fortune in the bloc. Who better, therefore, than Lagarde to save the Wasteland of a Eurozone that has been ravaged, sequentially, by a pandemic and a war?

George has remained consistent, and incremental, in her approach to the monetary policy responses to the great recessions and great inflations of our recent times. Had her colleagues followed her example, the peaks, and troughs, and their mistakes, most likely, wouldn’t have been as exaggerated. Who better than, George, to Chair the Fed? Sadly, this is pure conjecture, since she is retiring.

This year, George obliged her guests to believe that they can get away with fraud and defeat inflation in the process. Doubtless, she will not view this as the high point of her career.

According to George, interest rates are not yet high enough to create a recession, so her guests have room to maneuver. Once again, she advises cautious incremental moves, but her guests seem hell-bent on bigger steps. James Bullard, for example, is still in “front-loading” ecstasy.

Philly Fed president Patrick T. Harker assumes that George’s invitation is an opportunity for him to take his time, deciding on whether to hike 50 or 75-Basis points and then waste further time, with Fed Funds above 3.4%, without the economy showing visible signs of deceleration. In his view, the US economy is so strong that he may actually decide to hike further. Atlanta Fed president Raphael Bostic is similarly undecided on the size of the next rate hike.

Whilst the FOMC members deliberate, and procrastinate, the Fed’s balance sheet is making up their minds for them. They will, then, have to appear to be surprised by the decision to ease and expand the balance sheet further.

The procrastination is, presumably, supposed to make the observer confident that the FOMC’s actions are working so that the committee can finesse its execution. A look at the Fed’s balance sheet may convince the same observer that the FOMC is lying and that monetary policy is being controlled by financial stability policy imperatives. The main imperative being the Fed’s own solvency and, hence, its ability to operate.

Through the Central Bank Black Hole at Jackson Hole ….

· Monetary Policy tightening is ending because the Fed has reached the technical “unrealized” insolvency event horizon.

(Source: the Author)

The last report discussed the options for the Fed, and other central banks, that have reached the technical “unrealized” insolvency event horizon. At this place, the losses on their balance sheets from the spike in yields, which they have spiked, create unrealized losses greater than their current liabilities, thereby, rendering them insolvent in accounting terms.

A former Fed operative, nicknamed Fed Guy, from the central bank’s Markets Team, pulled back the curtain, recently, confirming the arrival at the event horizon, in addition to revealing the accounting fraud that will now be deployed to prevent the technical insolvency from becoming real insolvency.

Negative carry is handled by the Fed through a special form of accounting that allows monetary policy to continue uninterrupted. The Fed will continue to pay its interest expenses, but will finance it by creating a “deferred asset” out of thin air. The deferred asset is essentially an IOU the Fed writes against its future income. The Fed expects to eventually have positive net interest income again when it cuts rates during the next economic downturn. Those earnings will first go towards repaying the deferred asset before being remitted to the U.S. Treasury.

(Source: FedGuy)

The accounting fraud involves the Fed creating a “deferred asset out of thin air”. The explanation then completely mistakes this “out of thin air deferred asset” for a Fed liability. The Fed has actually, in practice, issued a bond on behalf of the US Treasury, with no cusip number, that it has then bought, thereby, creating a unit of US currency.

The Fed, by this point, is, thus, acting ultra vires as an agency of the US Treasury. The Fed has, in fact, printed money which it is not supposed to do.

The Fed handles capital losses with the creation of a deferred asset. Private businesses may write down equity when they realize capital losses, but the Fed does not write down its equity. Instead, the realized losses will be recorded as a “deferred asset” and repaid with future net interest income. Realizing a loss may be politically troublesome, but it does not have any operational implications for monetary policy. At most, it reduces future remittances to Treasury and so slightly increases the future budget deficit.

(Source: FedGuy)

Fed Guy then explains how this same accounting fraud is used to cover the losses on the Fed’s mortgage agency-backed holdings.

Fed Guy is a charlatan, at best, and a deliberate misinformation source at worst.

· The Fed may embrace Macklem Doctrine when it sees the unrealized losses on its balance sheet from the recent spike in yields.

(Source: the Author)

Thus, the Fed covers the losses on its assets, by creating more assets (“out of thin air”) which hypothetically produce revenues, to cover the losses, except these assets and their revenue streams don’t actually exist anywhere except on the Fed’s ledger. These revenues do not exist, so, they are appropriated, from other balance sheet assets, thereby, creating a real negative cash flow on the Fed’s operating statement. This negative cash flow must be covered, with real cash-yielding assets, at some point. Thus, the Fed is guaranteed to expand its balance sheet again to replace the “deferred out of thin air” negative cash flow with real US Treasury security cash flow.

The real fun comes with the prestige of this accounting magic trick. The new “out of thin air deferred asset” will, also, deliver a profit equal to the Fed’s original loss, because the Fed will be obliged to cut interest rates to come up with the accounting book entry profit.

The Fed, thus, covers its loss on one asset by buying another asset, thereby, doubling up on its balance sheet risk.

Hence the Fed has to bail itself out, by cutting interest rates, in order to create the book entry profits equal to the losses on its balance sheet. So, not only does the Fed have to buy real cash flow-yielding assets, but it also has to cut interest rates to balance its books. The combination of buying more assets and cutting interest rates is what some people call Modern Monetary Theory (MMT). This author calls it accounting fraud and cover-up.

The reader should, therefore, understand that a central bank will at some stage always have to abandon monetary policy tightening even if inflation remains undefeated. Central bankers then talk, with brio, about the supply-side nature of inflation, and the need for supply-side fiscal stimulus with structural reforms. If one listens, carefully, this is what, in essence, is being said right now.

(Source: the Author)

By this point, the reader may be confused. He/she, however, should accept the author’s contention that the Fed is now in the business of making monetary policy to balance its own books rather than to follow its dual mandate.

· Jackson Hole should probably be renamed Central Bank Black Hole.

(Source: the Author)

What this all means is that the Fed has a business model that is, potentially, fraudulent and geared towards printing money, which over time leads to an ever-expanding balance sheet and rate cuts immediately after rate hikes.

· The Fed’s expanding balance sheet is a black hole that is pulling the central bank toward exclusive Financial Stability Policymaking to the exclusion of Monetary Policymaking.

(Source: the Author)

The Fed is discovering this new modus operandi and embracing financial stability policy with greater strength than it embraces its dual mandate. The reader should be under no illusion that this embrace is to save the Fed’s balance sheet and not the US economy. Too Big To Fail is too close to home for the Fed.

This author has discussed the “binary” nature of this financial stability policy-driven modus operandi. Essentially, the Fed flips from “Hawk” to “Dove” and vice versa, as the financial stability objective of the day sets the tempo.

This binary flipping will continue to erode the central bank’s credible commitment until the Fed is able to extract a defined financial stability policy mandate from Congress.

Financial Stability Mandate 101: Save the Hawk, by acting the Hawk, in order to make the Dove reappear later….

Minneapolis Fed president Neel “Ex Culpa” Kashkari has become a sad, “binary”, figure as he lives up to his sobriquet.

(Source: the Author)

Minneapolis Fed president Neel “Ex Culpa” Kashkari is a living example of the Rake’s Progress, of the FOMC, toward a Congressional Financial Stability Mandate.

Kashkari’s loss of credibility has not resulted in a commensurate loss of animated melodramatic behavior. Quite the opposite, in fact. His latest burlesque involves cosplaying, and squawking, like a Hawk, in an act that he readily admits is “Volkeresque”.

· Neel “Ex Culpa” Kashkari has lost his credibility.

(Source: the Author)

Kashkari ignored rising inflation, in order to, allegedly, boost and preserve financial liquidity, during COVID, until the (re-opened) supply side of the real economy was supposed to do the heavy lifting. It was a simplistic and beautifully transparent plan, for those located at the critical nodes in the plan. Instead of the envisaged outcome, Oligopolists, in the real economy, decided to be greedy, and lazy, by hiking prices rather than paying labor and investing in capital to re-open supply chains that had been closed by COVID policy fiat.

Some Oligopolists even took their governments’ money, called Furlough, to close their supply chains, whilst simultaneously, boosting their prices.

During the pandemic, Oligopolists were remunerated by fiscal and monetary policy stimulus, running straight to the bottom line of the companies at the critical nodes in value chains. The stimulus, thus, went straight into price inflation. The Federal Government, in effect, paid Oligopolists to create inflation. Consequently, Kashkari’s inflation call was totally off the mark.

The stock prices of the beneficiaries of this, egregious, government-sanctioned, global wealth transfer duly responded. This response, then, brought the Fed’s financial stability policy risk into sharp focus.

Since then, some enlightened countries have learned and begun to change the structure of their marketplaces to become more competitive.

The moral majority, it would seem, has not learned. Instead, the moral majority offers fiscal support to consumers, to mitigate price inflation, which will ultimately end up in the bottom lines of Oligopolists.

The current offer from the UK government is, however, still not enough for some voters in the democratically elected political milieu. They want more subsidies and believe that they are somehow entitled to them.

Thus, inflation mitigation policy will, actually, sustain inflation, and corporate profits, in the moral majority of democracies. It may even hasten the demise of the said democracies. This seems to be what Russia and China are betting will happen.

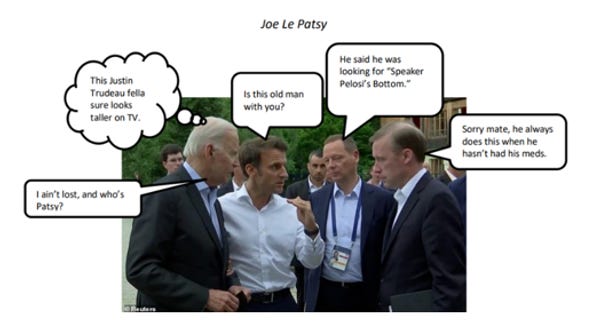

French President Emmanuel Macron has recently informed his entitled consumers, and voters, that their “freedom has a cost”. He has, therefore, finally, decided to test whether the French value their said “freedom” higher (or lower) than Russian gas and all the BS that comes with it. Macron has also indicated that the French economy cannot pay for its entitled energy consumers’ habits.

Macron’s grand strategy is now in ruins. Furthermore, Macron just abused the President of the United States, for the second time, to try and get himself off the hook. Fool me Joe Biden once, shame on you, fool him twice shame on him. There will be no third time. Politically, and metaphorically speaking, the Island of Elba now awaits Macron.

(Source: the Author)

Macron’s Pauline conversion has been a painful one. It was his original strategy that encouraged the habit of reliance on Russian gas, along with, the stated desire to wean the Eurozone away from American influence. Since the Ukraine war started, Macron has paid a heavy price in political terms for his U-Turn on Russia. This cost is now being passed on to French consumers. President Putin is betting that they will not accept the “cost of freedom”, through austerity.

America has gone for the Inflation Reduction Act (IRA) to defeat the Oligopolists. Evidently, the Fed does not think that the IRA will work, hence, it is prescribing a recession just to be sure that inflation falls.

From his personal experience, Neel “Ex Culpa” Kashkari has become “binary”. This “binary” embrace encourages him to act, and sound, like a “Hawk” at present. The outcome for the US economy will, most likely, be a recession, that will then oblige him to become a “Dove”, in order, to deliver those rate cuts and the balance sheet expansion which are the “binary” byproduct of the “Hawkishness”.

Mr. Market takes all this “binary” stuff in his stride and simply switches from risk-off and risk-on depending on the feathers disported by the FOMC. Hence, Mr. Market has already embraced the Fed’s new Financial Stability Mandate, in principle, even though Congress is trailing far behind.

Chairman Powell’s latest speech, at Jackson Hole, simply triggered Mr. Market to go risk-off for the day. As a consequence, the impact of a future economic slowdown was compressed into one trading session’s price action. What you see is what you get, now!

We’ll stick, before we go bust ….

· The Reserve Bank of New Zealand is the first developed economy central to declare insolvency and the restart of the global MMT process.

(Source: the Author)

This author has previously noted that the Reserve Bank of New Zealand is the most uncomfortable about its solvency position and, thus, the continuation of monetary policy tightening.

It was, therefore, no surprise to observe the discomfort of, and the little tell signal from, Governor Adrian Orr, at Jackson Hole, indicating that the Reserve Bank is just about to blink. Governor Orr would have his audience believe that this blink is because inflation is beginning to dissipate. It is also a fact that the pain on the Reserve Bank’s balance sheet, from unrealized losses, is becoming significant.

The reader can choose which fact has motivated Governor Orr to blink live on Bloomberg TV.

Mr. Orr’s blink may have, in fact, been a wince at the prospect of what Chairman Powell is about to do to the New Zealand economy.

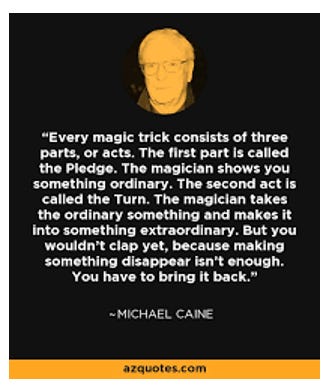

Abracadabra ….

Chairman Powell didn’t blink, like Governor Orr.

Chairman Powell’s audience blinked, instead.

Chairman Powell winked, at his audience, as he made his pledge to make inflation and hence the Fed’s expanded balance sheet, that created it, shrink.

Taciturnly, Powell then unveiled the turn, in which his audience falls for the oldest central banking trick in the book.

Inflation was, rhetorically, snatched away from his audience, by the Fed Chairman, with his verbal guidance signal that interest rate hikes will continue into 2023. In accordance, with this monetary policy tightening, the Fed’s balance sheet should also shrink in value and hence size.

But what of the balance sheet mark-to-market losses?

And, this is where the prestige was delivered by Chairman Powell.

The prestige was delivered by the substitution of inflation, with economic growth, in the audience’s eyes and minds. It helps Chairman Powell, a great deal, that his audience, for the most part, is made up of a bunch of blind algorithms, and trend-following models, which do not scrutinize his motivation. Even those sapient audience members, who are not robots, will guiltily admit to watching price action on screens rather than speeches by central bankers.

Suddenly, growth, and not inflation, seemed to be vanishing before the eyes of Chairman Powell’s Jackson Hole audience. The beguiled audience sold stocks to buy long-duration bonds as an assumed rational response to an emotional trigger from the magician.

Chairman Powell’s little helpers assisted the prestige act, with brio.

Atlanta Fed president Raphael Bostic, pulled back the curtain to reveal that Svengali Powell had already anticipated job losses as a consequence of his actions.

The Hawkish revelations, and revelry, continued from Chairman Powell’s other little helpers.

Cleveland Fed president Loretta Mester revealed that interest rates could rise above 4%, and stay there for all of next year.

Philadelphia Fed president Patrick T. Harker still holds out hope for a “shallow” soft-landing.

Consistent with the prestige act, the Fed’s balance sheet should, soon, appear to grow again to support the desired return of economic growth.

And, thus, a Hawk can be transformed into a Dove before the audience’s very eyes. Now that is magic.

As the audience gasps, and focuses on the rate hike hand, with its fraudulent sleight of the other hand, the Fed can now create “deferred assets out of thin air”, which are already in profit, thanks to the long end of the bond market, perking up, thanks to the audience’s trading reaction to the prestige. The inverted yield curve values the “deferred out of thin air assets” positively, whilst also predicting the future interest rate cut that this positive valuation is predicated upon.

The smoke and mirrors, of the forward curve, are respectively thick and shiny for this part of the magic trick.

As per the accounting fraud process, discussed above, real US Treasury assets will need to be substituted for the “deferred out of thin air” assets, on the Fed’s balance sheet, to cover the fraudulently created hole. Hey presto, the Biden Administration is already hard at work creating these real US Treasuries by the Trillion.

Trillions, Schmillions ….

· Macklem Doctrine ticks all the “friend-shoring” boxes.

· US “friend-shoring” will be achieved with “Build Back Better” and “Make More In America” fiscal drivers.

(Source: the Author)

This next $ Trillion is intended to be spent on infrastructure. The added significance of this is that it is a supply-side stimulus. The Fed is therefore not obliged to crush it in the same way as it will crush demand-side stimulus. On the contrary, the Fed will be obliged to literally buy this stimulus and put it on its balance sheet to replace the “deferred out of thin air” assets from the prestige act. Investors, speculators, and algorithms would be well advised not to fight the Fed on this one. In fact, as will be discussed later, a whole new supply-side investment thesis, being promulgated by the Bank for International Settlements (BIS) is under construction/manipulation here.

Presumably, as anticipated, this economic stimulus, and investment thesis, will be sold as an attempt to mitigate supply-side inflation pressure with monetary inflation focused on alleged bottlenecks in supply chains.

Macklem Doctrine: Your “Friend Shoring” (supply-side) mission should you accept it Tiff ….

Whilst the central bankers, at Jackson Hole, flipped about having to kill the demand side because they can’t do anything about the supply side, the central bank of central banks flopped the other way.

· Macklem Doctrine is a catalyst for the long-term disinflationary economic growth forces unleashed from Ukraine.

(Source: the Author)

This author has identified, what he calls “Macklem Doctrine” as, the process by which “Friend Shoring” is rolled out globally. This process is all supply side and will be coordinated by Tiff Macklem over at the Bank for International Settlements (BIS). Ostensibly, the process will ensure that credit flows freely to those agents of “Friend Shoring” that will unblock supply chains. The risk that inflation remains elevated will, thus, be mitigated through supply-side investment.

· Macklem Doctrine (GHOS Protocol) will roll out in global venues soon and run for three years if successful.

(Source: the Author)

Macklem’s boss, Augustin Carstens, reminded those present, at Jackson Hole, of their obligations not to starve the supply side of the global economy as they strangled the demand side.

It is ironic to find a monetarist gatekeeper, like the BIS, making the case for fiscal stimulus. The case is, however, supply side and, therefore, consistent with the BIS’s mandate.

All this supply side nuance has been lost, on Mr. Market, in his panic to sell the close on Friday, August 26th.

· Rational exuberance is replacing irrational exuberance about “Speaker Pelosi’s Bottom”.

(Source: the Author)

Going forward, the nuance may become clear, again, as central bankers ration credit away from the demand side toward the supply side of the global economy. In essence, this will be the whole objective of central banks’ financial stability policy, pretending to be monetary policy, going forwards.

The Fed will have no shortage of supply-side assets, to direct credit towards, as the Biden “Friend Shoring” fiscal stimulus is legislating them into US Treasury obligations.

· The ultimate New World Order, enabled by Macklem Doctrine, will have its own specific financial bubble in addition to “intransient” structural inflation.

(Source: the Author)

Hence, for Mr. Market, not all assets are created equal. Supply-side assets will command a premium and demand-side assets will command a discount. The great rotation, along the strategic economic reset lines, suggested by Carstens beckons from Jackson Hole.

· The Soft economic landing zone portends a domestic Hypergrowth Phase inflection point, for the US economy, that will be stronger than for its global competitors and trade partners.

(Source: the Author)

A supply-side “Hypergrowth Phase” and corresponding asset bubble may then ensue.

Although the technology sector will feature in the “Hypergrowth Phase” it will not be exclusive. Any “Hypergrowth Phases” require energy. Unsurprisingly, the energy sector is the key node, in global supply chains, which is being targeted for hyper-stimulus. Once again, America is blessed in this respect.

The Shale Oil to Gas tipping point ….

Russia, and OPEC, have unwittingly conspired to make the USA the key global swing oil producer during the Ukraine war. Recent OPEC jawboning, to support oil prices, has simply reinforced America’s position.

Furthermore, American Shale has arrived at an important tipping point, of its own, that is transformational for the US economy and its position in the global economy.

A recent report, from Deloitte LLP, highlights the fact that US Shale Inc. will be debt-free and cash positive, by 2024, at the current rate of profitability. This positive free cash flow position will fund the US hydrocarbon producing industry’s pivot, from oil to gas, as the global economy pivots this way too. This pivot will no doubt, be boosted to “Hypergrowth Phase” status with $ Trillions in Federal stimulus also.

The US economy has, thus, arrived at an additional tipping point that complements the preceding “Friend Shoring” ones. Energy self-sufficiency, and surplus, circa 2024, positions will call for a major re-appraisal and revaluation of US economic fundamentals, the US Dollar, and US asset prices. This appraisal will not wait until 2024, however, it will begin now as the news of this tipping point spreads in the public domain where it can be discounted into asset prices and exchange rates. This is, presumably, the supply-side revolution that Augustin Carstens envisages. As a consequence of this reappraisal, capital will be attracted to the US economy, thereby, supporting the “Hypergrowth Phase” thesis described by this author.

The economic stimulus, and investment thesis, behind the “Hypergrowth Phase”, will also be sold as necessary measures to be taken against an increasingly hostile China. Hostilities ratcheted up during the Jackson Hole symposium.

Bring on the Dancing (Trojan) Horses ….

· “COVID-Zero” is a strategic policy tool, which suggests that COVID-19 is a strategic weapon.

(Source: the Author)

America is directly retaliating, against the weaponized Chinese COVID-Zero policy, in the airline sector, by canceling scheduled Chinese flights. This US retaliation extends to the Chinese aerospace manufacturing sector.

· The enforcement of compliance with “Xi Jinping Thought” is a direct assault on Western Capitalism.

(Source: the Author)

China has warned of an impending response to the latest US additions of Chinese aerospace companies to its restricted trade list. There is, however, already, a background anticipatory response regime framework in place.

This author’s thesis, that China is trying to enforce compliance with its own political governance structure, by fiat, has recently been confirmed, and updated, by the Mercator Institute for Chinese Studies (MERICS).

Using 2018 as its datum, MERICS estimated that the number of cases, consistent with enforced compliance, on foreign companies operating in China, has significantly increased.

The pattern confirms a trend and, hence, a deliberate policy program. This program goes beyond corporate governance best practices and is politically motivated.

This author also believes that the agency of the Chinese Diaspora will be used to stimulate global compliance with the Chinese governance regime.

· Hong Kong may become a “Trojan Horse” in the global economy.

(Source: the Author)

The cascading “Trojan Horse” wave, along China’s Belt, through the agency of the Diaspora, is now breaking in Singapore. The ethnic mixture of the polity, in the city-state, makes for a potentially volatile, maybe even Molotov, cocktail of outcomes.

· The behavior of the Chinese Diaspora should be observed carefully after the assassination of Shinzo Abe.

(Source: the Author)

Visibly worried, by these xenophobic undertones, Prime Minister to be Lee Hsien warned, but did not specify the nationality, of “foreign actors” trying to thwart the city’s policy of trying “our best to avoid being caught up in the major power rivalry” between China and the USA.

India is now clearly caught up in this said “major power rivalry”.

Flying off the shelf, thereby, falling off the fence ….

· It’s time for India to get off the BRIC fence.

(Source: the Author)

The last report suggested that it is India’s time to get off the fence and to decide if it wants to be a BRIC or the developed nation that PM Modi has stated it wants to be.

America would seem to believe that now is the time also, and is sweetening the deal for developed nation status with the allure of drone technology. Such technology would be precluded from falling into Chinese hands, thereby ensuring that India is on the right side of the fence.

The technological charm offensive is not military alone. Apple has, recently, announced that it will manufacture its iPhone-14 in India, just weeks after it was launched in China. Clearly, the carrot of India competing with China ceteris paribus in manufacturing is being dangled. This carrot also reduces American manufacturers’ dependency on China. Should India bite, the country will be on the trusted “Friend Shoring” list, along with the likes of South Korea.

It is, hence, no surprise that America, allegedly, drew a line under its involvement in Afghanistan, recently, thereby, putting the Sino-Indian relationship into subjective context. America is, therefore, not truly disengaged. It is remotely engaged but not embedded.

(Source: the Author)

The last report also confirmed the American policy of “remote engagement”, in Afghanistan, within the strategic context of Sino-Indian relations.

America has since confirmed this “remote engagement” in its new policy to remotely control the Afghan economy through an internationally recognized Swiss-based development trust.

The recent remote-controlled elimination, of Al Qaeda’s number two, in Afghanistan, is, hence, not just a drone sales demo for India but is, also, a justification for America to remain “remotely engaged”.

· Speaker Pelosi is a “Triad”-operative.

(Source: the Author)

Clearly, Afghanistan is still a designated terrorist haven so drones are the ultimate remote engagement symbol and policy tool. America intends to remotely control the airspace, and the economy, of Afghanistan without costly boots on the ground. This policy is a unique illustration of the new “Triad” Doctrine recently imbued into American military strategy.

· America and China are currently engaged in a “Techno-Economic War” to, allegedly, obviate the need for a real war in 2026.

(Source: the Author)

This policy, of remote-controlled drones and finance, is also the perfect illustration of what Sino-American “Techno-Economic Warfare” looks like on the global battlefield. India is being offered the choice of being either a player or a battlefield.

“Gotcha!” The Thin Lady, with the Killer Fringe, sang ….

· It’s over for the UK economy but the Fat Lady hasn’t sung …. Yet.

(Source: the Author)

In anticipation, of the recent sacred feminine, this author had predicted that the Fat Lady would soon sing for the UK Government.

As it happened, the lady who sang was not fat.

· The rekindling of the symbiotic Special Relationship is pending the tall New World Order of the permanent sacking/resignation of the Butler, the conviction of the Oxford Apostles, the UK re-joining the EU, the closure of the VIP Lane, and India leaving the BRICs.

(Source: the Author)

It is, perhaps, fitting that the dramatic backdrop of the Edinburgh TV Festival was the altar for the performance of the comedic last rights of the Conservative Party.

In the spirit of the sacred feminine theme, in this report, what happened next is also fitting.

In the spirit of hairdressing, and the sacred feminine, it’s all about the Fringe.

When the Maitlis Fringe is seen, in public, celebrity corpses are soon to follow; as Prince Andrew can attest.

Speaking at the festival, the lethally-befringed journalist Emily Maitlis revealed what many have suspected, that the freedom of the UK press has been suborned since Tory Spin became the traditional British media grist for the mill.

According to Maitlis, the BBC is a vertically integrated media conspiracy to deflect scrutiny away from the true intentions and capabilities, of government ministers, to subvert the United Kingdom to their various familial and personal business agendas.

It may be inferred, from Maitlis’ discourse, that Auntie Beeb is a family member of a much larger vertically integrated conspiracy within the UK Government. The big brother of Auntie Beeb is a kind of Big Brother, give 'em all a name- the Oxford Apostles. Maitlis alleges that the appropriately named, Tory appointee, Sir Robbie Gibb is the Jive Talking Chief Apostle for the BBC-Gees.

This problem can be defined as poor governance, possibly even the total lack of governance. Under Boris Johnson, there was a systematic attack on all the institutions of governance in the UK, including the Bank of England. What was intended to replace them were special teams populated by the PM’s friends and close associates. All those who currently wish to replace the PM prospered during this period of Sleasez Faire. Why would anything change with them in Number 10?

Governments should legislate and govern. Businessmen should do business, within the governance framework, and in compliance with the laws of the land. It’s simple in theory, but hard in practice. Perhaps this is why some former cabinet ministers took a shortcut and conflated the two discretely defined, and legally separated, mandates. Perhaps it was just pure greed, rather than laziness, however, which prompted the conflation.

(Source: the Author)

The can of worms, that Maitlis has opened, will lead to a public reappraisal of Brexit and various other Conservative misdemeanors. Trial by reappraisal will lead to a guilty verdict and conviction at the polls.

Synchronously and, hence, uncoincidentally, with the Maitlis Fringe event, Rishi Sunak went into meltdown.

The two, seemingly, yet sequential, isolated events may be connected.

On the face of it, it would appear that Sunak was attempting to open the can of worms, on the Government’s pandemic response, thereby, exonerating himself.

The sacred Conservative feminine view is that Sunak shot himself, and the Conservative Party, fatally, in the foot.

· All the current favorites to replace the UK PM are unfit for purpose, they just haven’t been caught in flagrante delicto …. Yet.

(Source: the Author)

It would seem that, as suspected, all the wounded are just about to be caught in flagrante delicto.

Then it will be game on for the Britain Project, with its 1990s Tony Blair DNA. This game is already happening in the high street shops that are selling out of 1990s fashion.

(Source: the Author)

The end is near, so it will soon be time for the Britain Project to begin the laborious process of picking up the pieces.

· The rekindling of the symbiotic Special Relationship is also pending the syncretic bicameral Anglo-Saxon political cleansing simultaneously occurring on either side of the Atlantic.

(Source: the Author)

When the dust settles, historians may revisit the prescience of Maitlis, and her flawless timing, with a more dispassionate view. They may then find evidence of a conspiracy, beyond the Fringe.

Attractive section of content. I just stumbled upon your site and in accession capital to assert that I get actually enjoyed account your blog posts. Anyway I’ll be subscribing to your feeds and even I achievement you access consistently and rapidly. There is this site named godofsmallthinghttps: (https://godofsmallthing.com/inspirational-cricket-quotes/)/they have some attractive content that you would not like to miss. .

Is there any way to measure the effect of "deferred assets" on the money supply or other indicators?