Stabflation and the Incremental Deathly Hallows of the Free-Loaders

“Why Trick or Treat, when you can do both?” (Unattributed)

Summary:

· There’s a Witch Hunt, somewhere, over the Trans-Atlantic rainbow.

· “Peak Bum Squeak” has arrived.

· The Fed is easing in US Dollars, globally, while tightening in US Dollars domestically.

· The US economy is “Friend Shoring”, the Fed’s current US Dollar global easing as, a US domestic economic tailwind that is a global economic headwind.

· Biden can spare more than a dime, for his “Friend Shore” buddies, but others will have to nickel and dime it.

· The Front-Loaders are off to see the Wizard of Incrementalism.

· The “pivot”, from Front-Loading to Incrementalism, is the gateway, to pause QT, on the way to more QE aka MMMT.

· John Williams starts the debate, leading to a new definition of full employment, that is consistent with the supply-side switch from Front-Loading to Incrementalism.

· The new definition of full employment must explain how and why high inflation makes more than 50% of Americans work multiple jobs for less than inflation wages.

· The Front-Loaders are turning Incrementalist at least five months too late, for those who are the collateral, which enables the next Free-Loading transition to stimulative.

· The Bank of England is the first insolvent central bank to get bailed out by the insolvent government that it was bailing out.

· “Cuckoonomics” replaces “Kwasinomics.

· “Cuckoonomics” will make Britain more ungovernable and, hence, Balkanized.

· Without American-sponsored global trading club memberships “Cuckoonomics” is still “Voodoonomics”.

· Balkanized Britain is a project for the Britain Project.

· Balkanized Britain may be a project for JP Morgan’s International Council.

· At Peak Balkanization, Britain will get “Friend Shored” by America.

· “Friend Shoring” is the next Great Migration, transformational, Slam Dunk for America.

There’s a Halloween Rainbow over the Atlantic ….

· Dimon’s Hurrikraine is also the (Tony) Blair Inc. Witch Project tailwind.

(Source: the Author)

There appears to be a rainbow over the Atlantic. This one’s a bit different, because there are tricks and treats at either end of it.

The tricks involve the old Anglo-Saxon tradition of Witch Hunts.

The treats involve the printing of US Dollars rather than the traditional pots of gold at the rainbow’s end. This is consistent with a global economy that is based on fiat currency, rather than gold bullion.

Trick or Treat: Biden can you spare a dime?

· Peak Bum Squeak may portend some, imminent, volatile global inflection points.

· Stabflation signals that there is a disinflationary, and destabilizing, global shortage of US Dollars.

(Source: the Author)

Peak Bum Squeak has appeared at either end of the rainbow!

That pot of money should be just around the corner.

Apparently, it’s now official that the scarce US Dollar is playing King Hamlet’s Ghost. Apparently, also, the Equity Queen needs to lose some more weight, and Prince Gold has been emasculated by King US Dollar. But some equities are priced in US Dollars, so where better to bet, one’s manhood, on more obesity?

Coming out of the recent IMF Washington meetings, lazy journalism, also known as the global consensus, was led along an editorial line that looks beyond the impending global financial crisis.

The polled sentiment of Mr. Market would seem to agree with the editorial line. It is, allegedly, time to “buy (US Treasury) Bonds (and Stocks) and wear diamonds” again, but, only if you’ve been “Friend Shored”.

Lazy Journalism Inc. also thinks that a global economic crisis is, already, in the process of being averted by the Fed. Data shows that the Fed has eased globally, in US Dollars, by 18% more than last year. Global Central Bank reserves, at the Fed, are being minted at a fast pace. This Global Central Bank asset, at the Fed, then allows the Global Central Banks concerned to create a liability, of their own, within their own jurisdictions, outside the USA.

But here’s the thing, the new domestic currencies, created by the Global Central Banks, are swiftly being converted back into US Dollars, and then, recycled, back to the USA, as quickly as they are created. Thus, the global economy is still devoid of US Dollars. The US economy, and US assets, have a nice tailwind blowing for them though. For want of a better word the global supply of new US Dollars is getting “Friend Shored” back to the USA.

· The Fed’s “Fergie Time” is the global economy’s injury time.

(Source: the Author)

Faced with this indirect tailwind, the Fed may conclude, with a little justification, that it may need to tighten monetary policy, in order, to suppress new bubbles in US financial assets and price inflation of US goods and services. The only good news is that a rising US Dollar, generally, softens commodity prices, thereby mitigating the price inflation boost.

But here’s another thing, if the Fed tightens, the flow of US Dollars from the global economy into the USA will get even stronger. In electronic engineering terms, this positive impedance feedback loop is destabilizing the global financial system as a whole.

· The US “Friend Shoring” valve has tightened from the global singularity to the global economy destructive “Death Star” level.

(Source: the Author)

Furthermore, US economic and foreign policy are sucking in US Dollars, and businesses, via what this author calls the “Friend Shoring” policy valve.

Bernanke’s colleagues just don’t seem to get financial stability policymaking. This is a great pity because it is what central banks do most of the time these days. Powell’s Fed is not independent, it is slow-witted, and inert, possibly the worst two things that a central bank can be in the Twenty-First Century.

Chairman Powell, and his team, are still stuck in the Twentieth Century, pretending to be Paul Volcker, fighting the great inflation challenge of that epoch. Since then, the world has come off the Gold Standard and moved onto the central bank balance sheet funny-fiat-money standard. In this new standard, the US Dollar now acts as the role of Gold in the ancient regime.

The change in the central banking monetary system of exchange, from Gold to US Dollars, is the critical disconnect between the Twentieth and Twenty-First centuries. Gold Reserves and fixings have been replaced by central bank balance sheets and international swap lines. This is the new global financial stability policy standard. Growth and inflation mandates are domestic anachronisms that, oftentimes, get in the way of the global imperative.

(Source: the Author)

The last report discussed how Ben Bernanke and Kansas City Fed president Esther George, appeared to be the only American central bankers who understood the constraints on 21st Century central banking. Their US colleagues are learning, this lesson, the hard way. The lesson will be even more painful for the global economy. Bernanke has recently received a Nobel Prize for his prescience; and deafening silence from his former Fed colleagues. The ostracism of Bernanke is nothing, compared, to the treatment of George.

Esther George has been hunted, into retirement, like a witch, ever since she muttered the spell Constraints at the Jackson Hole cabal of central bankers.

· If the “Front-Loaders” finally listen to, and follow, Esther George’s incremental rate hike proposal, they may still be able to Soft Land the economy and avoid having to aggressively money launder the Fed’s balance sheet losses.

(Source: the Author)

The Witch Finders, and their Witch Finder General Powell, are independent and think themselves to be unaccountable. Time, and the unfolding global financial crisis, may prove otherwise. We will return, to the hunt, later in this report.

“By the dawn’s early light”, this author thought he heard the bugle of the US cavalry, and the jingle of Trillions of newly minted US Dollars, layered on the balance sheet, by the Fed, and disbursed by President Biden as POTUS, “so proudly”, “hailed at the twilight’s last gleaming”.

This was another one of the author’s awful lucid waking dreams.

Unfortunately, deeper analysis, of the slow-motion charge, has revealed that the US cavalry is going to charge over its enemies, and some of its allies, indiscriminately. The cavalry may even stomp some of the “poor huddled masses yearning to be free”, in countries whose migrants were once welcomed, with open arms, by the lady with the lamp.

· The Minerals Security Partnership (MSP) anticipates Biden’s G7 “Friend Shoring” Infrastructure Plan launch by about a week.

· “Speaker Pelosi’s Bottom” is firmly supported by the MSP and the Biden G7 “Slam Dunk” “Friend Shoring” G7 Infrastructure Plan.

· The MSP and the Biden G7 “Slam Dunk” “Friend Shoring” G7 Infrastructure Plan are Vinod Khosla’s “Techno-Economic War”.

(Source: the Author)

President Biden can spare domestic $ Trillions for “Friend Shoring”, and Techno-Economic Wars. Evidently, everyone else, with a few notable strategic exceptions, is going to have to nickel and dime it, on the “Friend Shoreline” periphery!

Here’s to being an exception!

· Stabflation signals that there is a disinflationary, and destabilizing, global shortage of US Dollars.

(Source: the Author)

Times is hard if you need some US Dollars. The global shortage of US Dollars, of which the Fed seems to be in denial, of the magnitude of, was very much a topic of discussion at the recent IMF Washington meetings.

Scarce US Dollars, make it impossible to come up with readies to buy Oil priced in US Dollars. Unless one can bust sanctions, and sneak in some Russian Crude, the only solution is to tighten one’s belt. The current strong US Dollar/Strong Oil dynamic is inherently unstable. The problem is not a strong US Dollar, making oil prices more painful but, rather, a lack of US Dollars to sustain the painfully high price. The asymmetric outcome is a weaker global oil price, with, and without, a stronger global economy.

Mr. Market is also sensing that the strong US Dollar, and weak commodities thesis, is driven by US foreign policy. This policy, allegedly, targets an oil price capped at $60 per/barrel. This capping will get inflation down, without derailing the secular trend towards renewables, and also take Russia (and President Putin) off the table.

Janet Yellen would like IMF SDRs to fill the global void, of scarce US Dollars, but only for developing nations. Developed nations have an inflation problem, so they won’t be getting any liquidity which may make it worse. For once, France actually seems to agree with America about something and supports Yellen’s SDR initiative.

The US Dollar craving developed nations, with the exception of France, and the USA, who won’t be getting any SDR allocations, are reluctant to allocate any of their own liquidity, to back the proposed SDR issue, for their developing brothers and sisters. So, basically, without the paternalistic Franco-American generosity, the developing world would be left to rot by the developed world. That would just throw the developing world into the arms of China.

With no new SDRs, coming from the global custodians of fiat money, the developed nations must endure a diet of US Dollar starvation. This starvation diet will feed into a disinflationary diet for those nations who sell “things” priced in US Dollars.

The custodians of the US Dollar, on the other hand, seem to be having a less than good-natured tiff at the moment. It may get out of hand. It may also be resolved, Incrementally.

Trick: The US Witch Hunt, somewhere, over the “rainbow” ….

The Fed appears to have colorfully regressed, back to infancy, in its behavior and communication. Appearances can be misleading, however. The content is very adult.

For a moment, this author imagined that he was watching Daly’s Wicked Witch, of the West Coast, versus George’s kindly Witch Glinda who’s really someone’s auntie from Kansas. Loretta Mester was Dorothy and Jay Powell was Toto. Charles Evans was the Tin Man. Neel “Ex Culpa” Kashkari was the Cowardly Lion and Jim Bullard was the Scarecrow.

(Source: the Author)

In the last report, this author recounted a dream, of his, in which some FOMC members appeared, to him, as characters from the Wizard of Oz.

On waking, the author was more disturbed by the fact that the reality resembled a nightmare film much worse than the kiddies’ musical in his dream. A fatal policymaking mistake appeared to be unfolding, in real-time.

· With one notable exception, the Fed’s Front-Loaders are all Free-Loaders.

· The exposure of unethical Fed Free-Loaders is the loss of Fed independence.

(Source: the Author)

The waking nightmare was triggered by the observation that, despite their folksy demeanor, most FOMC members, with the exception of Esther George, are Front-Loaders. This affliction is a systemic cognitive illness, that precludes the sufferers from having clarity of vision. This affliction is made even worse, for monetary policy outcomes, by the fact that the same Front-Loaders, with the same exception, are also Free-Loaders.

In closer analysis, the Free-Loading affliction appears to be pathologically related to psychopathy, which manifests itself, in the subjects, as an ambivalence to the economic suffering, of others, and a personal predisposition towards unethical behavior.

The malign subjects, being studied, thus, lack clarity of vision and purity of intent. This is compounded by the fact they have been given independence by Congress. Consequently, they are free to indulge themselves at the expense of the US, and global economies. With great power comes great responsibility. Also comes the great opportunity for grand larceny and other unethical behavior. Some of the Free-Loaders have been filling their boots.

Why people seem to think that the Free-Loaders suspend all their human fallibility, and pecuniary conflicted interest, when they vote on the FOMC, is laughable in this author’s opinion. The evidence, and the cover-up, with platitudes like Transient and Transitory, belie the fact that the Free-Loaders are still getting away with murder. On the subject of murder, these psychopaths are not averse to a little bit of rhetorical homicide when they are caught in flagrante delicto by one of their co-workers.

The author’s nightmare and the reality were represented by the recent dramatic act of the killing of Esther George’s Incremental monetary policy tightening thesis. The psychotic rhetorical killers, apparently, took George’s thesis as an intellectual assault on their own credible commitment. They, initially, offered no quarter towards George and her thesis. Just as in the film, initially, tried to write George out of the Fed’s monetary policymaking history.

But then the facts have changed, and so have the Front-Loaders.

St. Louis Fed president James Bullard was identified as the Scarecrow, in the author’s dream. In reality, he appears to be method-acting the part of the rustic anti-hero with no brain. Bullard remained psychotically committed to Front-Loading until he wasn’t. He also remained psychotically ambivalent, and cognitively blind to the financial stability crisis, that Front-Loading is causing, until he wasn’t. This author can only observe that, where there are no senses, there can be no brain.

Bullard’s brainless Free-Loading tendencies were, also, on full display, at an unethically prima facie pay-to-play gig, with Citi’s chosen few. The Scarecrow has stolen the Fed’s valor, along with its credible commitment, and sold them cheaply for private pecuniary gain, of a selected few, that he didn’t even select himself. If there was any guidance delivered, at the event, it was done in a selective way, that breaks all the rules on transparency, conflicted interest, and even insider dealing. Citi did the selective banjo playing, on behalf of the Fed, and the Scarecrow shucked and jived for his supper.

Later, the Scarecrow condescended, to the great unwashed masses, in the public domain, that they have, correctly, priced in the FOMC’s September Dot-Plot consensus. Now it is time for the FOMC to reward them by delivering the signaled rate hikes to come.

Newbie Fed Governor Lisa Cook is, evidently, a quick learner. She also appears to be a rote learner. Cook recently, verbatim, demonstrated that she has quickly rote-learned the consensus to Front-Load rate hikes and then sit tight. A pity that she couldn’t demonstrate the same knowledge of Incrementalism.

Philadelphia Fed president Patrick T. Harker, who has learned a thing or two, also, likes to show and tell what he has learned. His recent show and tell explained how fiscal policy, monetary policy, and Russia have contributed to the current inflationary environment. Apparently, now that the US economy is weakening, the Fed is obliged to take Front-Loading action that it should have taken, back in March 2021, when the US economy was booming. The lesson would seem to be that Front-Loading is better to have sooner, rather than later, although Harker does not say this. To do so, would be to imply that Incrementalism is best, under the current circumstances.

One simply can’t, and hasn’t, just made this Free-Loading/Front-Loading thesis up. It was rampant and systemic. The Scarecrow should resign, or be fired if he won’t. Toto should also go before more unethical indiscretions, on his watch, as Fed Chair occur. If they survive, the protagonists will do so through their skills in becoming Free-Loading Incrementalists.

· If the “Front-Loaders” finally listen to, and follow, Esther George’s incremental rate hike proposal, they may still be able to Soft Land the economy and avoid having to aggressively money launder the Fed’s balance sheet losses.

(Source: the Author)

The Fed doesn’t know the ethical constraints, on its behavior, so how the hell can it be expected to fully accept the economic constraints on its monetary policymaking behavior?

When it comes to shuckin’, and jive-talkin’, Atlanta Fed president Raphael Bostic is the doyen of psychotic serial Front-Loaders and Free-Loaders. Un-chastened and un-flustered, by his recent exposure as unethical, in behavior, Bostic has insidiously twisted his Front-Loading narrative to make it appear in compliance with his full employment mandate.

According to Bostic, the odd (thousands of) redundancy or two, is nothing, and a price worth paying (not by himself) for achieving the kind of low wages which will sustain full employment for longer. Bostic, cynically, refers to this cost, on the labor force, with the double euphemism of “shuffle and churn”. He could quite easily have made a Freudian slip, in reference to what he did with his portfolio, which recently got him on the wrong side of an ethics investigation.

Having once embraced broad inclusivity, and average inflation target overshooting, for the same reason, Bostic, the psychopathic Front-Loader, is now exclusively embracing inflation fighting. Thus, Fed independence, and self-governance, have begotten unaccountability and verbal creativity. This form of lying, on the job, is professionally known as Extended Forward Guidance.

When it comes to Free-Loading, Front-Loading Minneapolis Fed president Neel “Ex Culpa” Kashkari is the Cowardly Lion from the author’s dream. Cocooned, in his comfort zone, Kashkari has decided to become a passive/unaggressive Front-Loader, to avoid embarrassment in another financial crisis. Thus, rather than the say that he believes in Front-Loading, he now says that he doesn’t believe in pausing monetary policy tightening. What this demonstrates is that Kashkari is not certain about growth and financial stability anymore. Rather than deal with this uncertainty, he prefers to say that he is certain about high, intransient inflation.

· By making the case for larger rate hikes, over a shorter time horizon, Neel “Ex Culpa” Kashkari, and Charles Evans, have actually explained the need for smaller rate hikes over a longer time horizon.

(Source: the Author)

What Kashkari has, of course, noted is that Esther George’s Incrementalism is receiving attention. Rather than trash talk Incrementalism, he prefers to leave himself open to its persuasion, not by stealth but, by guile. In a previous report, this author observed that, by talking up the need to take risks with growth, by Front-Loading, Kashkari had made a more eloquent case for Incrementalism. Evidently, he thinks so too, and is now backstroking his Front-Loader.

In the last report, Chicago Fed president Charles Evans, the Tin Man in the author’s dream, dared to hope that the Soft Landing can be achieved by adhering to the process outlined at the last FOMC meeting. On his latest outing, his guidance remains ever hopeful and adherent.

The release of the latest regional Fed director meeting minutes, of September 8th, has thrown a spotlight on the little spat between the Front-Loaders and Incrementalists.

As it happened, directors of the New York and San Francisco Fed were 50-basis points Incrementalists. No wonder San Francisco Fed president Mary Daly was so bitter towards Esther George. Daly was on thin ice with her own constituency. Neel “Ex Culpa” Kashkari’s regional Fed directors voted for whopping 100-Basis points of Front-Loading. No wonder he’s a Front-Loading scaredy cat. Clearly, Kashkari’s tail is flicking, agitatedly, because his own Manor is a fat tail risk. The other nine regional directors all went for 75-basis points of Front-Loading.

Further context for the Front-Loading groupthink was provided by the Fed Board’s staffers. This invisible, yet powerful, and unaccountable, organ of policymaking provides the numbers and forecasts for FOMC decision-makers at the committee’s meetings. As the eyes, and ears of the committee, this organ is extremely powerful. It is also extremely dangerous. The staffers are the archetypal Free Loaders. These Free Loaders have a self-interest bias in Front-Loading because they have consistently produced data to support it, thus far.

The Fed’s staffers have decided that the economy is actually running even hotter. Sadly, this warmth is not framed, by them, as the Soft-Landing Zone. It is framed as the take-off zone for more aggressive Front-Loading. The staffers see a much smaller potential output gap. The FOMC currently interprets this signal as demand-side overheating and responds with Front-Loading. Hence, more Front-Loading is recommended by the staffers. The staffers, ignore the supply side.

Also missing from the staffers’ analysis is the nuance and context of the supply-side narrative. The fact is that more than 50% of Americans have a second job because they can’t make ends meet with just one job. The allegedly tight labor market is, thus, confronted by the even tighter personal financial circumstances of consumers/workers. Inflation is, in fact, making 50% of Americans work harder for less pay.

· The doyenne of Barbarous Relics, on the FOMC, from the Twentieth Century, broadcasts that the Fed’s cognitive blindness and bias are structural.

(Source: the Author)

Evidently, the corpus of the FOMC, Staffers, and regional Fed directors, are Front-Loaders. The risk of policy error through Front-Loading is high unless this group characteristic changes.

Esther George is in a minority of three. This minority is growing thanks to the Regional Fed Districts. In the latest Beige Book, there was a striking note of softening for both growth and inflation.

We’re off to see the Wizard ….

At the threshold of, yet another, policy mistake, there are, however, hopeful signs that Chairman Powell is growing a pair, of Incrementals, as requested by this author. We may be off, to see the Wizard of Incrementalism, in the Emerald Green City of US Dollars, after all. Getting there will be a struggle, but it will be so financially rewarding, for us all, when we do.

· Free-Loading Chairman Powell needs to grow a pair and use his casting vote magic to turn Front-Loading into Incrementalism.

(Source: the Author)

Wicked Witch Mary Daly has finally, and bitterly, conceded to her staffers and broached the subject of Incremental reconciliation with Good Witch Esther George. This can only mean that Toto (aka Chairman Powell) is growing a pair of Incrementals.

As she reinvents herself, Daly, now, just has to try not to lose face, in the switch from Front-Loading to Incrementalism. Weaker inflation data may ease her journey. Her initial attempt, in the flattering lighting, and dissembling atmosphere of a cozy fireside chat was almost sincere.

Apparently, Daly has been misunderstood, and, is not wicked after all. For the record, she now states that: "I (Daly) hear a lot of concern right now that we are just going to go for broke. But that's actually not how we, I think about policy at all." Apparently, also, she has been misconstrued so that, in reality, she is "thoughtful" and "incredibly data-dependent." Consequently, she can say, with all sincerity, that "We (the Fed) have to make sure we are doing everything in our power not to overtighten, and we can't pull up too fast, and say we are done."

The accused, unethical, Scarecrow James Bullard’s brain also appears to be kicking in incrementally. Now, he is not so sure about the efficacy, or sanity, of tightening further through 2023.

The Yellow Brick Road to Incremental Land has started to become congested with one-way traffic.

Tin Man, Charles Evans is the latest addition to the unidirectional flow. With what may prove to be apocryphal words, he has said that "Front-loading was a good thing, given how far below neutral rates were. But overshooting is costly, too, and there is great uncertainty about how restrictive policy must actually become, so this is going to put a premium on the strategy of getting to a place and a level where policy can plan to rest and evaluate data and developments."

In the glacial, face-saving, behavior, of the Free-Loading Front-Loaders, the journey down the Yellow Brick Road to Incrementalism will probably begin with a well-advertised debate over the efficacy of smaller rate-hikes as the FOMC delivers one more big one at the next meeting. To hang on to any vestiges of credible commitment, the Fed cannot appear to be changing its mind, capriciously, so soon after embracing Free-Loading. There must be a semblance of a process that observers are supposed to trust.

In this author’s opinion, Modern Monetary Monopsony Theory (MMMT) is the theoretical destination, at the end of the economic Yellow Brick Road, on which the Incrementalists are traveling. There will, out of necessity, be a lot of Supply-Side road signs, along the way. In addition, there will be lots of Financial Stability indicators, since, essentially, monetary policy becomes financial stability policy on this road.

One Supply-Side road sign is already in view. It appears to be saying that a, seemingly, tight labor market is, in fact, a supply-side cul-de-sac, in which the Front-Loaders were briefly lost. Incrementalists may drive on, cautiously.

Time to pull back the Supply Side curtain to reveal the balance sheet ….

· The Fed’s pivot from its inflation mandate to its employment mandate will require a new definition of what full employment means in relation to the COVID-19 experience.

(Source: the Author)

This author has long held, the view, that the journey, down the Yellow Brick Road, will begin, with a new definition of full employment, so that the Fed can get away, with easing, even though labor markets are tight. To this end, it would seem that New York Fed president John Williams is broaching the subject.

According to Williams, the “skills gap” is a big issue. Hence, Williams has identified the big supply-side problem. This should get the Fed off the hook, from delivering a demand-side focused monetary policy tightening solution. This is the slippery slope, by which, to then promise to support supply-side solutions, with monetary policy easing and room on the balance sheet. This easing and balance sheet space are the components of Modern Monetary Monopsony Theory (MMMT).

Evidently, Fed Governor Michelle Bowman has also, recently, graduated from the same supply-side school of thought as Williams.

Bowman recently lectured that it is critical to address pandemic-related learning loss. With great certainty, she said that “in order to have the strongest possible labor force in the future, it is critical to understand and act immediately to address the educational losses experienced during the pandemic.”

Mr. Market is already ahead, of the Free-Loaders, on this Incrementalist journey. Developments, at the other end of the rainbow, are helping him on his way. Both developments are behind the Key Signals curve and, hence, have a great deal of catching up to do.

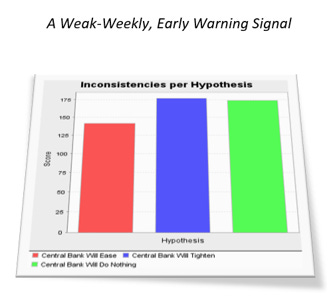

· A Key Signals proprietary indicator signals that the FOMC is, once again, totally off with its timing, this time, on monetary policy tightening.

(Source: the Author)

By this author’s reckoning, the Fed is, already, more than five months behind the Key Signals curve at this point of becoming Incrementalist. By the time that the FOMC becomes stimulative, it will already be too late for many. This many are, sadly, the collateral that the Fed needs to become stimulative.

The global collateral, and political corpses, are piling up, at the other end of the rainbow, in Britain.

Trick: Ding-Dong, the Witch is dead ….

The UK regime change vacuum has hoovered up some more rubbish. One hopes that the next occupant of Number 10 is viewed more favorably by Britain’s creditors. It is doubtful that Britain’s creditors will trust the British electorate to decide on who should lead. The British electorate does not want to tighten their belts and knuckle down to austere lending terms. They want their government to write cheques that they do not have to honor as taxpayers. They need to learn, quickly, that beggars cannot be choosers.

The first lesson has, already, been learned by the Bank of England. This lesson disabuses all central bankers of their belief that they are independent.

Britain is not so much a global pariah, as a mad dog with a lethal bite. Maybe it’s time to put the old “female dog” down, too.

(Source: the Author)

Starting at the end, as it were “Lizzo’s” position was untenable. Her demise was inevitable. The timing was predictable. As Britain has lost control of its currency, and its economy, “Lizzo” lost control of her party.

What happens next is a process of metanoia. Unfortunately, Britain is still in the deconstruction phase of this process. Construction is in the “project” planning phase.

If it all sounds a bit Churchillian, it should do, because the former PM wants it to. Boris Johnson idolizes Churchill, and he will be buggered if the same ignominious ending is going to happen to him that happened to his hero.

(Source: the Author)

In the chaos, of the new Tory leadership battle, as predicted, the malign figure of Boris Johnson has returned.

The malign figure of Johnson is shadowed, closely, by the penumbral Rishi Sunak. Evidently, Sunak’s US Green Card re-application has been put on hold by wifey, the in-laws, and other related Sub-Continental interests.

The former UK Chancellor, it would seem, already, had some impeccable “Butlering” credentials of his own, in the Subcontinent.

Hence, it was business as usual, for him, to indirectly dole out economic assistance to his other homeland. Further assistance is currently being demanded, with menaces, rather than via encrypted chat, by the Tata dynasty. UK taxpayer funding is being demanded, or else the dynasty’s Welsh steel interests will be closed. Unfortunately, the replacement Chancellor’s other homeland is in the Arab World so the funds may not be forthcoming for the Tata dynasty.

(Source: the Author)

These two regressive leadership developments suggest that the Butler Model, and the VIP Lane of crony Kleptocracy, so despised by the EU and America, are attempting to make one last hurrah.

· Kwasinomics becomes Keanononimcs in the form of a Kleptocracy to build a war chest for the guerrilla warfare, in opposition, of the Tories in Balkanised Britain.

(Source: the Author)

These regressive steps signal that the Tories are preparing for exile, in opposition, intending to fill their pockets and leave scorched earth for the Labour Party to inherit. Johnson and Sunak are unelectable in a national election. Their return, to lead the Tories, can, therefore, only be for some ulterior purpose. As always, with these two, one should follow the money.

The Bank of England follows the money and, is already dealing with the scorched earth legacy.

· Central Bank insolvency is aligning with fiscal insolvency at a rapid pace in the global economy.

· The alignment of central bank and fiscal insolvency promotes the exclusive interest in financial stability policy.

(Source: the Author)

The Bank of England has become the first developed economy central bank to admit that it is insolvent.

The Chancellor of the Exchequer will have noted that when both the UK Treasury and the Bank of England face insolvency, they suddenly have aligned interests in financial stability. Perhaps this is what he has been betting on, all along.

The lesson should not be lost on other developed central banks, which are now technically insolvent also. The Bank of Japan certainly understands this lesson.

(Source: the Author)

As this author said, there’s no shame in it, since all are insolvent.

HMG has just recapitalized the Bank of England, thereby, making it clear that independence vanishes at the point of insolvency. Effectively, the Bank of England has been nationalized. Unfortunately, HMG is also insolvent, hence, it’s the insolvent recapitalizing the insolvent. In political terms, one may call this the stupid leading the blind. Sadly, for blind Britons, foreign creditors are neither blind nor stupid.

The nationalization of the Bank of England is interesting and embarrassing. The embarrassment was recently highlighted by the Bank of England’s alleged Regulatory Knight Sir Jon Cunliffe. Sir Jon professed his concern about the lack of separation, of regulatory powers, between the Treasury and the Bank of England. Sir Jon seems to be unaware of who pays his salary, and who owns all the equity in his loss-making money transfer franchise.

· The Bank of England is a cash cow that has gone from being too big to fail to become too juicy not to get slaughtered by the rapacious Conservative Party.

· UK fiscal and monetary policy will remain antipathetic until the war over the Bank of England’s independence is concluded or the recession overwhelms inflation.

(Source: the Author)

The Bank also, recently, bailed out the UK pension system when, apparently, the central bank was already insolvent. One may, thus, conclude that the Bank is now a fiscal agency that throws money at various lost causes and political initiatives set by its owner.

The era of the 21st Century central bank, as envisioned by Ben Bernanke, has broken first in the UK. As interpreted by this author, the modern central bank is nothing better than a domestic conduit for fiscal policy, and a currency board operator, on behalf of the government.

Since UK Gilt yields are out of the control of the Bank of England, the Government has been forced to rely upon the sufferance, and charity of foreign lenders. Britain’s creditors have, officially, demanded fiscal rectitude in order to safeguard their asset.

· Kishidanomics i.e. Abenomics II is the globally acceptable face of UK Kwasinomics.

(Source: the Author)

Unofficially, the foreign creditors want regime change to deliver something that is globally compliant. This kind of global compliance is, currently, being modeled by Japan. Japan’s global compliance is what allows it to run unsustainable fiscal policies.

· “Weimar-on-Thames” style with an English accent UK economic policymaking seeks to nationalize the Bank of England “Kremlin-on-Thames” style with the same English accent.

(Source: the Author)

Britons ever, ever, ever shall be slaves to foreign creditors. They won’t like it. Neither did Weimar Germans, and we all know what happened next there.

Britons must now go through the process of looking for scapegoats, for their condition. As they do so, the fabric of society will be torn apart. In a democracy, which Britain still is, for now, the first scapegoat is the government of the day. It is after that, that the fun starts, as one weak government follows another and anarchy grows out of the frustration of the population with each leader.

Anarchy, oftentimes, leads to tyranny when the polity decides that it needs a firm hand.

· The UK will become an austere economy with an ungovernable polity.

(Source: the Author)

For some time, this author held the view that Britain would become austere and ungovernable.

There is now open talk of “Anarchy in the UK” from what is believed to be the less-hyperbolic, than this author, source of Reuters. This author would say that Reuters is more hyperbolic than his original position. This original position has changed, for the worse. He looks forward to Reuters eclipsing his current Balkanization thesis with trepidation.

Taking austerity first, the new Chancellor’s “Cuckoonomics” prescribes austerity. This comes with the objective of getting Sterling and interest rates under control, or so he thinks so that Britain is not obliged to live on the charity, with conditions, of foreign lenders. He must have read this in a book.

And this is where governability comes in.

· The UK Own Goal is the prelude to a Slam Dunk.

Whilst the elected leadership degenerates, the growing political vacuum is filled with growing resentment and anarchy. Industrial unrest is flaring up, initially, in the case of the postal service, swiftly, then followed by the transport sector. If there was a coal industry, it would already be on strike!

No doubt, the Government’s response, to the industrial unrest, will be privatization of the sectors resisting. This will simply inflame matters and broaden the unrest, within the public sector, among workers who fear being privatized/downsized/rightsized/whatever.

(Source: the Author)

In reality, as foreseen, austerity will lead to ungovernability. Ungovernability will undermine Sterling and UK interest rates. Just because you are borrowing less, does not make you more attractive to lenders, if you are despised by taxpayers, and are aggressively reducing them, in number, by creating an austerity-driven recession.

Margaret Thatcher’s austerity came with the promise to restore law and order, after years of weak governments trying to ingratiate themselves with a violently ungovernable polity.

Britons need to be allowed to misbehave until they, tire of the consequences and, yearn for law and order. Even if they are not allowed to misbehave, they will do so anyway. It would be better if they were given latitude, for political expression, rather than forced to take the latitude with force.

The author now holds the view that Britain will become Balkanised.

· The rekindling of the symbiotic Special Relationship is pending the tall New World Order of the permanent sacking/resignation of the Butler, the conviction of the Oxford Apostles, the UK re-joining the EU, the closure of the VIP Lane, and India leaving the BRICs.

(Source: the Author)

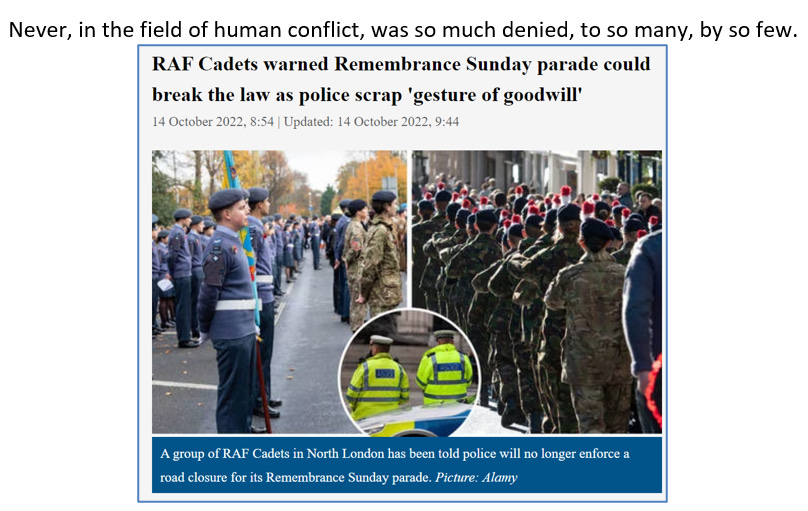

The Balkanization has reached the absurd point at which those, brave young Britons, who would defend the rights, of the abusive Balkanizers, with their own lives, have been told that remembering those who did the same thing, in two great past conflagrations, is illegal.

So fearful has HMG become, of public disorder, that it is now undermining the very foundation upon which public order is defended. It’s not that the principle of Remembrance is illegal, it’s just that the event, itself, will become a warzone for the contesting Balkanizing factions to project their extremist minority views onto the silent majority.

Into this, incendiary powder keg, throw in the alleged, racists and misogynists, who are supposed to keep public order, and you have a recipe for disaster.

Henceforth, in this status quo, citizens and law enforcement officers may quite literally take the law into their hands. Some of them already are doing so.

Throw in the fact, also, that the judiciary has become an extortioner, and is, also, allegedly racist and misogynist, at its highest levels, and the Separation of Powers, which holds together British Constitutional Democracy, is looking defunct.

Britain, literally, can’t afford to serve justice at a time when citizens, and law enforcement officers, are taking the law into their own hands. It is not so much a case of the Separation of Powers as a case of separate powers in conflict.

· The Bank of England is the first adopter of the next round of Modern Monetary Monopsony Theory (MMMT).

(Source: the Author)

The Bank of England (BOE) is now supposed to Monopsonize the funding of what is unsustainable. But the Bank cannot do so, because it is already insolvent. The problem is that lenders do not trust HMG, or the BOE, so Britain is no longer in control of its funding, and hence its destiny.

There are various definitions of what a state is. In theory and practice, the ability of HMG to organize the country for self-defense, in times-of-war, and peace is now questionable. Thus, Britain no longer exists as a functioning unitary state. This may surprise some. If the lights, and gas stoves, go out this winter, the surprise will become self-evident.

If anyone says that Britain is not becoming Balkanised, this author has a London Bridge that he would like to sell to them, assuming that it has not been stolen, or demolished to provide projectiles, already.

Balkanised Britain can, thus, tear itself apart, violently, because the pillars of democracy are crumbling and the mob is angry.

Then, just to finesse it, throw in a growing awareness that those, whom we are supposed to aspire to be, are, allegedly, serially abusing us, and have been doing so for a long time, it’s game over for Constitutional Democracy in its current form.

Charles Rex III was recently heard to say “dear, oh dear” within earshot of “Lizzo”. Perhaps he was referring to events closer to home rather than cheekily addressing his First Minister of State.

Britons must now endure the painful death, from the bottom up, of what is, already, dead, from within, and above. Everything is ethically and financially bankrupt. Jerusalem must be re-builded there. As George Harrison said, it’s going to take a whole lot of time and a whole lot of spending money. The time will be Britain’s and the money will be somebody else’s.

Whereas thieves can, until apprehended, be beggars, borrowers cannot be choosers.

· The UK Own Goal is the prelude to a Slam Dunk.

(Source: the Author)

At the subjective, point of Peak Balkanization, America will financially intervene and Britons will tire of the internal civil unrest. This is the least that America can do, since the unraveling of Britain is the catalyst that will allow President Biden to “Slam Dunk” on the global economy.

Britain will get “Friend Shored” and re-inserted, into America’s global deck, as its Ace card or Joker depending on the global roleplaying requirements. It’s similar to the Reagan and Thatcher bridge pairing. Clinton and Blair, and then “W” and Blair reprised the double act. Blair has provided dodgy dossiers and other services when required.

The new proto-global deck of cards is, currently, being shuffled by the bridge-playing pair of Blair and JP Morgan CEO Jamie Dimon. It’s all very reminiscent of the Milner Roundtable Movement that Woodrow Wilson and James Pierpoint Morgan became so fond of back when America began to nudge Britain out of the Anglo-Saxon global driving seat. It’s also much loved by aspiring young Rhodes Scholars who want to fast-track it, in return for services rendered, to good careers in central banking and the highest elected office. Today, the movement has the fancy name of JP Morgan’s International Council. It still packs a meaningful punch. This punch is unelected and, thereby, plausibly deniable.

As with the riddle of Larry Summers’ eulogy for Shinzo Abe, delivered inside the mystery of Modern Monetary Theory (MMT), Bank of England Governor Andrew Bailey is forecasting that the UK economy will turn Japanese in 2023. The project to build a new middle-of-the-road political consensus must, therefore, by default, be wrapped in the enigma of Abenomics.

(Source: the Author)

It is, hence, no surprise to see Blair, also, playing a similar role, behind the scenes, in Balkanised Britain, to produce the new Aces and Jokers, for America, in the deck of a new middle-of-the-road UK political party, envisioned by this author, to sweep into the UK and global political void.

Then it will be game on for the Britain Project, with its 1990s Tony Blair DNA. This game is already happening in the high street shops that are selling out of 1990s fashion.

(Source: the Author)

At Peak-Balkanization, the author predicts that the Britain Project will have electable MPs ready to go to the country. Tired, of being Balkanized, Britons will vote for the said electable Britain Project MPs.

Britons may welcome the Britain Project, but they should be careful. Leviathan, especially when he is not a native, exerts a cruel influence and demands egregious tribute from those that he governs. The Britain Project may not be a liberator. It may, in fact, be a gateway to tyranny, slavery, and oppression.

· Britons are the useful idiots that US home flippers were, in the GFC, to enable the next global credit expansion.

(Source: the Author)

With the benefit of hindsight, some historians may decide that Britain was, not Balkanized, but was, in fact, Groomed.

The Grooming began many years ago.

Cui bono is probably Quis Culta, but let’s not get into that.

There is a long way to go at the Grooming salon. Currently, the groomed consensus remains in the ungovernable phase.

· As Kwasinomics became Keanonomics he took one for the relegated “Team”.

(Source: the Author)

The last report discussed the failings of Kwasinomics, which then became Keanonomics, but still remained Trussonomics at heart. It may now be called Cuckoonomics, rather than Huntonomics because the eponymous new Chancellor is not in fact a real Chancellor. Jeremy Hunt is a cuckoo, rather than the traditional Tory Stalking Horse, who has been put there by those who wanted to see Truss removed. Were the cuckoo to become the party leader, which is highly likely, the Tories would still lose the next general election because their time, with their snouts in the trough, is up. Hunt is window dressing, to make the party look nearer to the center of British politics. This is still the center of an economic black hole, however.

It is how the British people react to being in a black hole that matters. Currently, the British polity is being ripped apart by the strong economic force of the black hole. The smart money, behind the Britain Project, is betting on bringing everyone back together, in the black hole, and then spitting them out into the future through a political wormhole.

· Keanonomics will fail because Britain has no trading counterparties to go with its cheap currency.

(Source: the Author)

Whatever the economic strategy is called, next, the main failing is that Britain is, currently, excluded from all the major trade blocs that govern global commerce.

Having a cheap currency is no good if you aren’t in anybody’s trading club. Britain has created more countries than America has destroyed, over the years, but, apparently, to no current avail. Unfortunately, this winning stat has not translated into a myriad of trading opportunities, today, because America has created more trading blocs than Britain has destroyed.

Britain is being imperially unfriended, by those whom it created by drawing a few straight, and squiggly lines, through the homes of subjugated autochthonous antecedents, to go with the pink shape-fill. Last week it was the Hindus doing the unfriending. This week it is the Māori’s. Imperial unfriending is hence color blind.

Even the EU, and its colonial legacy, is an American Marshall Plan construct. The EU is, originally, a Dulles Brothers Production, strictly speaking, that Britain has, recently, opted out of with seriously negative consequences for its membership of other American-sponsored global, and regional constructs.

· Kishidanomics i.e. Abenomics II is the globally acceptable face of UK Kwasinomics.

(Source: the Author)

In fact, having a cheap currency policy may harm your chances of membership, in these global trading clubs, unless you’re Japan. If you have a cheap currency, you are a threat to potential trade partners. If you’re Japan, you are the driver of the Yen Carry Trade, which is reflating the global economy, so you are “Quids-In”, so to speak, in nearly every trading club.

A recent example of the failure, of Trussonomics, is the relocation of BMW electric Mini production to China and brand electric vehicles to the USA. Since Britain is not in the EU, BMW has no obligation to support its industrial base, even if it is a cheap production cost location. The less militant Chinese and US workforces, and the market scale attractions, of both, trump Trussonomics. BMW has looked at the political and economic fundamentals in Britain and said no thank you. Britain is just too unstable at this point in time. Furthermore, it is not in any reputable trading club so what’s the point in risking production there?

Electric vehicles (EVs) are expected to be the big growth curve of the Twenty-First Century, possibly, even, the biggest. It is not just about electric motors. A whole ecosystem needs to be developed, similar to what exists today for thermal combustion engines. It’s a global economic game changer. The EV industry has decided to take a detour to avoid the UK. Some companies are taking the straight route, paved with fiscal incentives, and protectionist legislation, directly, toward the USA.

BMW has decided that Britain is not going to participate in this massive growth opportunity. It’s a damning indictment, made even worse by the fact that the Mini was invented in Britain. Worse, than an indictment, it is an industrial epitaph. The project managers, of the Britain Project, should take note and hurry up before it’s too late for other transformational industries to locate there.

Britain needs to get to where Japan is now with America. Japan, like Britain, is weakening its currency. Japan, like Britain, has ugly fiscal fundamentals. Japan, unlike Britain, is in America’s good books, so it gets away with murder. Not only that, America actually cooperates on, and fully shares intellectual property (IP) with Japan. Japan is, thus, given the opportunity to sell products, derived from US IP, on the cheap.

· The failure of Kwasi’s Keanonomics is the enabler of the next leg, of the global reflation, via the Yen Carry Trade.

· The Yen Carry Trade is disinflationary unless you’re Japanese, but the Kishida Put will cover your bills if you are.

· Kishidanomics loves Friend Shoring and Yen Carry Trade global reflation.

· Japan Inc. positions for Friend Shoring and Yen Carry Trade global reflation.

(Source: the Author)

The last report explained how Japan is America’s fighting brand in Asia. Japan can, therefore, undermine China, and the Yuan, as much as it can, with the full support of America. The weak Japanese Yen, hence, strong US Dollar, is also critical to America’s disinflationary global reflation thesis.

The Britain Project, thus, needs to make Britain America’s fighting brand in Europe, and globally, once again.

Trick: No man is an island ….

The Bank of England is making itself, and the UK economy, insolvent by hiking interest rates. Simultaneously, however, the Bank is loading its balance sheet, again, for the imminent Sterling capital market liquifying exercise. For some reason, lazy journalists think that the US economy and Fed are islands that are immune to this contagion. The fact is that they are on the biggest island, which can take the whole global system down with it.

(Source: the Author)

America’s problem is that there is no bi-partisan consensus on the domestic priorities for the nation. National priorities are split across party, and ethnic, lines. Pecuniary agendas of the lawmakers, and their constituencies, govern the fiscal spending pecking order.

The American thirty-year narrative involves the funding and creation of a bipartisan consensus from the perceived Chinese threat via Latin America.

(Source: the Author)

All the domestic partisans can, however, agree that China is an existential external threat, so “Friend Shoring” can achieve a bipartisan consensus lacking on the domestic agendas. The individual States must, then, fight each other to attract the returned “Friend Shoring” industries.

Clever policy wonks, and intelligence agencies, are now eroding the partisan hurdle by linking President Trump directly with Chinese state-sponsored narcotics gangs South of the Border.

Treat: The Next Great American Migration is a Slam Dunk ….

“Friend Shoring” is not only a great economic stimulus, it is also a great migration wave. This is the next wave in the history of the transformation of America from its agrarian roots.

· Blue Horseshoe loves the new Hypergrowth Phase driven by Federal policy, the removal of Chinese competition, and the search for productivity in tight inflated labor markets.

(Source: the Author)

The author has viewed this event as the next “Hypergrowth Phase”. This phase is synonymous with the energy tipping point that has just occurred in the US. The other great thing, not previously listed, above, about America, is its continental scale and a plethora of time zones. Americans are not always generating and consuming electricity, simultaneously, as in smaller countries with one time zone. America has already crossed the tipping point of renewable electricity production. At the current rate, it is expected to produce half of its electricity from renewables within a decade. This is a structural, transformational, and irreversible change.

With its scale and various climates, and time zones, America lends itself to the concept of being a giant integrated renewable energy generator. There are tides, there is sun, and there are winds that just need to be sewn together by a Federal Green New Deal. President Putin has just provided more needles and thread. Russia’s weaponizing, of energy, and its attacks, on global telecommunications, and other key infrastructure, have accelerated the American trend towards hardening its own infrastructure and building in self-reliant redundancy. China has provided further momentum. The momentum comes not from any altruistic wish to save the planet but from the strategic objective of continuing to dominate it.

Evidence of this strategy of will to power can be seen all over the place.

Treat: Let’s be all that we can be ….

Coincidentally, or not, depending on how naïve one is, the Pentagon’s own supply chain is, currently, being “Friend Shored” and hardened. For example, Army Materials Command (AMEC), the mission-critical function, of managing and operating the service’s organic industrial base, is “setting conditions”, this fiscal year, to implement its own “Friend Shoring” process, to support the “Techno-Economic War” of the present, and future, across the United States starting in fiscal 2024. Inflation obviously is a major strategic threat. This cannot be overcome with tight monetary policy alone. Supply-side stimulus and reform are required. A strong US Dollar, with corollary weak commodity prices doesn’t do any strategic harm either. The other services are all facing the same challenges and transformational requirements.

· The Federal Reserve Board mission creeps towards a Third (National Security) Mandate in the form of Patriotic Monetary Policymaking.

(Source: the Author)

Evidently, there are national security considerations being made in economic policy decisions. Not only will the Fed have to get out of the way of the national security decision-makers, but it will also have to facilitate and enable them. Fed independence is a pipe dream. As noted, by this author, the Fed is mission creeping “towards a Third (National Security) Mandate in the form of Patriotic Monetary Policymaking”.

Obviously, the basket case US States and localities, like Britain, with toxic multi-ethnic dynamics, will not be the first places on the “Friend Shorers’” destination list, unless the Federal Government and the Federal Reserve make them look attractive. Even Silicon Valley is struggling to look attractive to the great “Friend Shoring” migration.

With a Democrat in the White House, this form of intervention is well underway. POTUS will be acutely aware of many of the problems, already, festering away, in his Home State, awaiting Federal intervention. These problems scale across the North American land mass.

The two new episodes are also a Slam Dunk for President Biden’s Mid Term-and-beyond-show ratings.

(Source: the Author)

The last report discussed President Biden’s improving political fortune.

Evidently, wifey thinks so too.

The Last Dancer has a few more “Slam Dunks” left in him.