It’s The Global Economy, Not The Global Regime Change, Stupid!

“It is an honour to be appointed Chair of the GHOS”. (The Guv’nor of The Guv’nors)

Summary:

· The recently released Global Regime Change virus is highly contagious and wildly indiscriminate.

· The war in Ukraine is the catalyst for irreversible structural changes in the global economy.

· Some G7 central banks are self-isolating, from the regime change virus, to save themselves by fighting inflation.

· The Fed is diverging from the White House and may even, officially, blame the Federal Government, for the current inflation spike, under oath.

· Macklem Doctrine (GHOS Protocol) will roll out in global venues soon and run for three years if successful.

It’s (still) the (Global) Economy, Stupid. (sic)

Regime change by Cancel Culture could be on the G7 agenda

(Source: the Author)

G7 has unleashed the Global Regime Change virus. Once unleashed, just like COVID-19, this virus is indiscriminate, and spreads rapidly, through the vectors of inflation and economic weakness. In their haste to be seen as blameless, for the current inflation spike, some G7 central banks will sacrifice economic growth and their commanders in chief. There is, however, a network of the central banking fraternity, that sits within their browser, which has the intentions and capabilities to prevent the situation from deteriorating beyond the threat level needed for the next global economic stimulus.

G7 leaders, especially President Biden, should be careful of what they wish for. The vast regime change virus which they have released, into the global economy, comes with a curse.

It’s the (Global) Economy, Stupid (sic) ….

Sadly, multi-polar indigestion, for all involved in the digestion of Ukraine, will come from a global recession, rather than unilaterally for Russia through sanctions per se. Justice will then be served on the political grandstanders, as they are turfed out of office because of the recession. Justice may never be served on President Putin if he retains his grip on power during the recession and beyond it.

Amusingly, the central bankers will survive, as they always do during and after global crises. Indeed, they may be greeted as saviors when they start the massive monetary policy stimulus, again, to counter the recession that they had a hand in creating. Politicians come and go, but central bankers live eternally, or at least their expanded balance sheets do.

(Source: the Author)

In Biden’s case, the Federal Reserve is swiftly self-isolating, thereby, allegedly, saving itself, and its credible commitment, at the expense of US economic growth and the Biden administration’s popularity. President George Herbert Walker Bush knew this feeling well. Having liberated Kuwait, a recession, and an indifferent Alan Greenspan, forced him from office.

President Biden’s recently promised New World Order may, thus, ultimately, not include him nor some of the other G7 leaders who have recently signed up for it. As this specter of global failure grows, for the early days of the order, enthusiasm for the project may also begin to wane; until a full-blown global recession gives it wings. By then, however, the original political architects of the project may no longer be employed, even though their central bankers still are.

Following the 1990s New World Order strategic playbook President Biden has declared, and then not-retracted, that victory for G7 and NATO, in Ukraine, will be defined by regime change in Russia. Regime change is not geo-specifically related to Russia. Rather, it is defined as the sphere of influence of Russia. But eviction of Russian influence in Ukraine, and beyond, is not enough anymore. The broader strategic objective will require more time and effort.

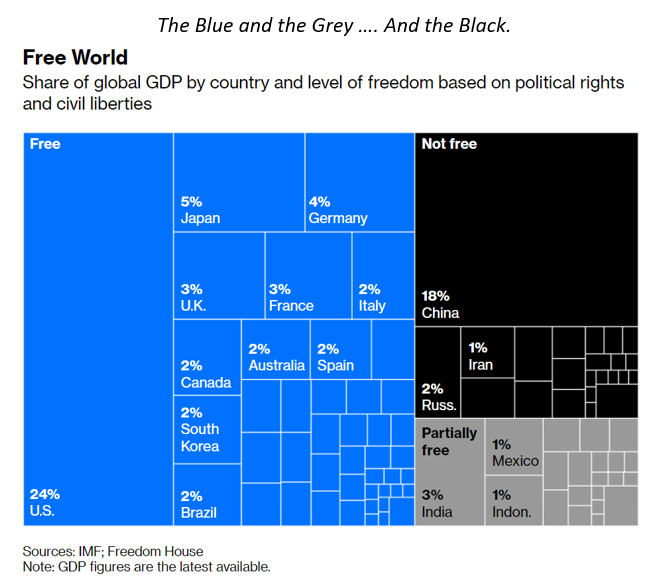

The narrative of global regime change is part of a broader thesis on the attribution of economic growth between the Free World and the rest. Hitherto, in the public domain, the thesis has opined on the drift of global GDP, away from the Free World, as globalization has been hijacked by dictators and kleptocrats. This thesis was recently updated by the Peterson Institute’s latest analysis on the trend in ownership from private to state in China’s top 100 companies. German Finance Minister Nicholas Lindner has also, xenophobically, embellished the narrative, with inflammatory invective, by identifying China as a great “systemic threat” to the German economy and its polity.

This hijacking, of globalization, was recently illustrated by the way that Russia and China, effectively, diverted the agenda of G20 Indonesia 2022. G7 has responded by trying to engineer a G20 regime change.

The broader issue of global regime change is, therefore, aimed at redressing the current style drift of GDP, and global governance, away from the Free World. China’s foreign minister Wang Yi has warned G7 that it will not undermine G20, thereby, confirming that the bloc is China’s preferred bloc for its own global strategy.

The broader G7 strategic objective will escalate the conflict beyond Russia and Ukraine, to other regions of Russian influence. For example, in Eastern Europe’s former Warsaw Pact countries, Poland is now in conflict with Hungary. The Balkanization of the EU’s Eastern frontiers is now a logical expectation.

Since President Putin remains supported by China, G7 is now engaged in conflict with China by default. Eurozone nations must now pay for their Russian gas with Roubles, whereas Chinese customers can pay with Yuan. The economics of the Russian energy complex, thereby directly challenge the existing reserve currency mechanism that underpins the global economy. Should OPEC nations follow suit, then a full-blown regime change in world currency reserves would occur.

The US Dollar would not be the biggest victim, of such regime change, however, since America has abundant hydrocarbons. Hydrocarbon-poor Europe and the Euro would be some of the biggest losers. These potential losses are, doubtless, nudging the Eurozone to quickly transform its energy base to become less hydrocarbon intensive.

If it looks bad for the Eurozone, then, it must look even worse for the United Kingdom sans North Sea Oil. The UK Prime Minister has led the charge against Russia but has not secured the energy defenses of the realm in Sterling terms. The UK economy, and Sterling, are thus question marks. The answers, to these questions, may reveal surprising emerging markets like answers for the, hitherto, assumed to be developing market status of the UK economy. A fundamental revaluation of Sterling and Sterling assets is an elevated, and elevating, possibility, currently trending towards higher probability outcomes. No doubt, Fracking is back on the table.

The Ukrainian conflict is now, well and truly, global in dimension. This conflict is the catalyst for the irreversible changes in the global economy that lies ahead. Consequently, the global economy is now hostage to the vicissitudes of this global conflict. Currently, there are no clear winners.

There are, however, emerging players.

The Free World loses economic momentum ….

Germany, and its economy, represent accurate barometers by which to calibrate and follow the vicissitudes of the economic impact of the global conflict. The early signs are not encouraging. Germany Inc. has quietly signaled that it will take a large direct hit from the Ukraine conflict. Moreover, this hit will be prolonged, initially, as the country disconnects its economy, from Russian industrial inputs, and reconnects to alternatives.

Walking a tightrope, between decoupling from Russia, and signaling a general war mobilization, Germany is carefully going through the gears of raising the national emergency protocols. Combined with Finance Minister Lindner’s thesis, on the evolving dialectic with China, Germany is clearly preparing for a long global economic war of attrition.

Just as Germany seeks new industrial inputs, somewhat, counter-productively, the European Central Bank is choking off their supply chains.

The Energy Supply Chain loses liquidity ….

With the global energy supply chain already under extreme pressure, the recent action of the ECB seems perverse, until one understands the underlying method in the apparent madness.

The ECB will not provide emergency liquidity facilities to beleaguered commodity trading firms and exchanges, thereby, exacerbating the current volatility and illiquidity in the underlying physical markets.

Greedy, thinly capitalized, and over-leveraged, middlemen and speculators are, presumably, the ECB’s targets; but there will, by default, be knock-on effects, and casualties, for the real economy.

One may look at this process as the removal of the speculative barriers, to the free flow of commodities, as supply chains are unblocked. This process will not, however, be a smooth one. There will be friction and blockages along the way, as the barriers are removed by the application of ECB financial muscle.

· Disinflation price discovery by Cancel Culture is on the global commodity and capital markets agenda.

(Source: the Author)

In a previous report, this author detailed how commodity markets are being manipulated, by policymakers, and their central bankers, in the global war on inflation terror. The ECB’s recent actions, on commodity traders, should be viewed within this context.

This author hopes that the ECB, and other central banks, will, however, step in if and when commodity supply becomes so egregiously constrained, by their actions, that a recession is triggered. Engineering a soft landing for commodities, in essence, is also the engineering of a soft landing for the real global economy.

A soft or hard landing, will, however, be the catalyst for the big, remedial, fiscal stimulus which ensues. The harder the landing, the more likely it is that the Fed will be on hand to monetize the associated fiscal deficit.

Fiscal Smoke and Mirrors ….

It is not certain if President Biden’s original “Build Back Better” initiative also envisaged a global dimension. What is certain is that events in Ukraine have conflated the President’s domestic and global agendas. If the Fed is going to tighten monetary policy, in line with the 1994 thesis currently gaining favor, then the US and global economy will be in need of some building back better therapy, in the near future.

(Source: the Author)

The last report detailed how American fiscal and monetary policy stimulus were being delayed, from joining the global economic stimulus initiative, by partisanship and a Federal Reserve that is fighting inflation.

President Biden has made inroads, into the partisan political obstacle, by conflating his domestic Build Back Better agenda with the wider global mission to defeat Russia and China. Still, however, the domestic political obstacle remains. In response, the President has now taken the tactical route of presenting a budget that is Build Back Better in all but name and potentially unlimited in nature.

This proposed budget will neither itemize, the detailed purpose, nor the specific cost of any fiscal initiative within it. In addition, there will be a vague commitment, to build up a counter-cyclical fiscal reserve, through the process of a commitment to a neutral fiscal position over the long term. The proposed budget is, hence, vaguely fiscal neutral in theory. This vagueness means that it will, probably, be massively deficit negative in magnitude and practice.

The proposed budget promises everything and nothing. It represents a blank sheet of paper, upon which both sides, of the partisan divide, can write their spending fantasies. One can live the dream, but not the fantasy. Consequently, the Federal Reserve and its balance sheet will be required to monetize these fantasies in due course. One hopes that inflation has been curbed before the Fed restarts monetary inflation again. One’s hope, in this regard, seems more like a fantasy. The budget is writing cheques that the US economy cannot honor. Consequently, the Federal Reserve will need to warehouse the debts that the Federal Government welches on by rolling them into perpetuity.

Politically speaking, President Biden’s tactic has, already, been successful. The major obstacle, within his own party, of Senator Manchin, has been enthused, and thereby removed, by the blank cheques that President Biden has proffered to all and sundry. Responding with alacrity, Manchin has agreed to accept the blank cheques proffered to the Climate Change movement in return for their acceptance of his anti-Climate Change blank cheques. The new bipartisan cheque printing exercise was, then, kicked off by the Senate passing of a technology stimulus, aimed at combating China, with a 68-28 margin.

Unfortunately, for the Biden administration, the Fed is signaling that it will not be on hand to take the blame for the inflationary consequences of the next fiscal expansion. This development is a weak early warning signal that global regime change may not overlook the American President.

It’s (Regime Change) coming home: When inflation is everywhere a fiscal policy phenomenon ….

According to Gallup, inflation is the highest concern of US consumers. Furthermore, this concern has taken a quantum leap higher of late.

It has, also, been estimated that the average American household will spend an extra $ 5,200 on “inflation tax” this year. This kind of taxation will find representation at the voting booths.

Despite his recent bipartisan budget triumph, President Biden is still struggling with his leadership image. The good news is that his attempt to conflate the situation in Ukraine with his domestic political agenda is nudging to the fore. Sadly, however, he can take no credit for this since his leadership is, by far and away, the biggest non-political concern for US consumers. Americans want to fight Russia and China but, seemingly, don’t want Biden to lead this fight.

Unfortunately for Biden, he can’t rely on the Fed to support his fiscal expansion; since the central bank will be responding to the heightened consumer inflation concern. In fact, as the reader will soon find, the Fed may be engaged in pinning the blame for the inflation, that concerns the US consumer so much, on President Biden and his COVID-19 fiscal response.

The Fed’s, widely advertised, concern about inflation has manifested itself in consumers’ concerns. Having raised the concern, the Fed must now be seen to address it swiftly and convincingly.

Let the self-isolation and acrimony begin ….

This author has long held the view that the Fed’s capture, by the US Treasury, back in Q1/2021, was the point at which the inflation battle was lost. The FOMC’s failure to begin scaling back its massive monetary policy stimulus, at that point in time, has contributed to the inflation spike of today. At the time of this systemic failure, the Fed had just embraced and enshrined the discipline of flexible average inflation targeting (FAIT) into a new monetary policy framework. Now the Fed would like to pretend that this mistake never happened. It would also like to pretend that the mistake has not contributed to the massive inflation target overshooting that is now evident.

Sensing that another fiscal stimulus, and ensuing inflation spike is on the way the Fed is digging in its heels on its inflation mandate. Ironically, this inertia will simply lead to the kind of economic slowdown that will lead to the next inflation-boosting combined fiscal and monetary policy expansion.

· Aggressive monetary policy tightening may be a vanity project, in pursuit of lost credible commitment, that will undermine the Macklem Doctrine Solution for the New World Order.

(Source: the Author)

In the meantime, however, the Fed is off on what this author has dubbed the “vanity project” of trying to rebuild its credible commitment as an inflation fighter. This vanity project puts the economy, and the US President, at risk in the name of the Fed’s inflation mandate.

The latest exercise, in the vanity project, from the San Francisco Fed was the release of, effectively, calumny, which blames 3 percent of the current inflation spike on the fiscal authorities’ reaction to the COVID-19 pandemic. First blood, in the blame game, has been drawn by Mary Daly’s, of all people’s, team. A re-evaluation of the, seemingly, innocuous and loyal Daly should be undertaken by the White House and, probably, Pro-Tempore Chairman Powell also.

Philadelphia Fed president Patrick T. Harker has an interesting euphemism, for the vicarious shenanigans, involving the Fed’s self-isolation and finger-pointing at the White House. He calls it “Interesting Times”. In these times, despite all the external threats, however, the US economy remains robust.

Harker is happy to give the Federal Government the credit for the robust economy, and also the blame for the inflation that has come with it. Federal fiscal excess even gets blamed for the sacrilege of, “whopping” golf club fees, clearly, an inflation indicator close to Harker’s heart. Nowhere in his thesis is monetary policy to blame. In fact, monetary policy is framed, by Harker, as the savior that will now be tightened to engineer a soft economic landing and golfing disinflation Nirvana. The attack on his right to cheap golfing, now, has Harker swinging his 50 basis point rate-hike sand-wedge, with lethal intent, from the safety of the FOMC’s sand-trap. Heaven forbid, that inflated golf club fee expectations should become entrenched in America.

The disingenuousness employed by staffers, at the Dallas Fed, could win prizes for creative writing. The staffers warn that there is a housing bubble similar in magnitude to the one that preceded the GFC. The recent spike in mortgage rates has doubtless triggered a crisis, but the researchers omit this counterfactual from their analysis. Consequently, the case is laid out for the US housing market, and the wider economy, to follow the course predicted by the currently inverted yield curve. The FOMC will then fulfill this prophecy, by its course of action, some of which is to address the housing bubble.

· James Bullard no longer has credibility.

(Source: the Author)

St Louis Fed president James Bullard’s self-isolation is not just from the fiscal policy executive. Bullard has extended this self-isolation to his FOMC colleagues who are not as highly motivated as he is to too aggressively tighten monetary policy.

· James Bullard wants the Fed to risk economic growth in order to restore the central bank’s credible commitment.

(Source: the Author)

Bullard seeks to frame the inflation threat as if it didn’t exist, at all, prior to his inflation spike call, in October 2021, and the ensuing November FOMC meeting which adopted his aggressive prescriptive policy action. Missing from his guidance is any reference to the FOMC’s time in US Treasury captivity, playing at being broadly inclusive. Gone also, is any mention of the explicit commitment, to inflation target overshooting, fulsomely embraced by all FOMC members as the core of the Fed’s new monetary policy framework.

Recently, Bullard began his self-isolation through dissent at the last FOMC meeting. This dissent was then explained by him in writing. His latest written guidance explains why the FOMC must act aggressively. Reading between the lines, of Bullard’s written explanations, it is as if he is preparing a legal deposition for the day that the Fed is put on the stand for its inflation mandate failure.

Affirmation, Absolution, Capitulation, and a Big Long moment ….

Judge Powell's Monetary Policy Is The Law, But Is It Legal?

(Source: the Author)

This author has noted previously that Chairman Powell has been preparing for the day of reckoning, which Bullard is now anticipating, for some time. Bullard’s behavior supports the thesis that time is running out for the Fed and that the finger-pointing has begun.

To her credit, Kansas City Fed president Esther George has remained independent of mind and self-isolated from her insidious colleagues. When her colleagues were getting busy, inflation target overshooting, and embracing broad inclusion, George remained aloof and cautious. Similarly, today, when those around her are getting remedially overly aggressive, George is, once again, warning of the need to proceed with cautious, incremental, deliberation; but, on this occasion, for the opposite reason of concern for growth. The inverted yield curve is a warning signal for George, that a potential recession lurks out there, as an elevated probability, that she does not want to elevate further.

The inverted yield curve also warns George that balance sheet reduction should be viewed, and debated, within its context. For her, the inverted curve is primarily a financial stability risk indicator which may then, secondarily, translate into the real economy as a recession risk. Consequently, by comparison with her colleagues, George’s record may stand up to the kind of deeper legal scrutiny that Powell and Bullard seem to be preparing for.

· Thomas Barkin gets a credibility downgrade.

(Source: the Author)

Richmond Fed president Thomas Barkin’s credibility has slipped, in this author’s opinion, because his alleged interest in racing back to the neutral rate is inconsistent with his FOMC voting position which drags its heels. That being said, Barkin remains watchful of the US economy and transparent with his observations through his essays.

Barkin’s view of the fallout, to date, from the Ukraine war, is that it has boosted US inflation without cannibalizing aggregate demand. Hence, in theory, he should be in a harry to get back to neutral but is not. Barkin’s credibility must, hence, be marked down a further notch for his inconsistency.

· The Macklem Doctrine of America’s global imperative may make bigger fools out of the FOMC than the incoming inflation data.

(Source: the Author)

From this author’s perspective, Barkin is opining on the fate of the eponymous strategy, which he calls the Macklem Doctrine, at the grassroots level in America. This doctrine, named for its author Bank of Canada Governor Tiff Macklem, opines on the imperative of fiscal stimulus to unblock supply chain bottlenecks. Hence, the supply-side fiscal stimulus, envisaged by Macklem Doctrine, is failing in practice in small American towns. The hallmark of this failure will be the persistence of Stagflationary conditions, on aggregate, across these small towns.

Chicago Fed president Charles Evans is seeking solace, and anonymity, through self-isolation in numbers. He has recently been found, playing it safe, by hiding in the median consensus, of professional forecasts, for six further 25 basis points rate hikes this year. Despite this, desired, inconspicuous, safety in numbers, he seems distinctly perturbed about the threat to economic growth from both the situation in Ukraine and the developed central banks’ withdrawal of monetary policy stimulus.

Dial “M” for Macklem Doctrine: Mission Impossible (GHOS Protocol) ….

The central bank of central banks, also known as the Bank for International Settlements (BIS) has just gone through a bloodless regime change of its own. One would be forgiven for overlooking this “GHOStly” regime change on All Fools’ Day.

The BIS does not eat its own, it reallocates them within the brotherhood. Effective immediately, in the vernacular of another financial brotherhood, Bank of Canada Governor Tiff Macklem was just made.

The newly made Canadian central banking wise guy has just been upped to become the Chair of the oversight body of the Basel Committee on Banking Supervision. This cadre of central bank “Guv’nors” from across the global financial Manor, under their aegis, is called the Group of Governors and Heads of Supervision (GHOS).

Macklem’s acceptance speech was deceptively ambiguous with gravitas. He stated that “It is an honor to be appointed Chair of the GHOS”, and pledged that “I (Macklem) look forward to continuing its important work of providing strategic direction to the Basel Committee, as it works to promote full Basel III implementation, address new challenges facing banks and supervisors, and enhance global financial stability.”

This pledge read like an indirect declaration of intentions and capabilities to deal with an imminent global financial crisis, whilst supporting the fiscal stimulus in response to it, and broadly advancing the G7 global governance architecture that will frame the process.

Guv’nor Macklem’s GHOS term is three years. Macklem Doctrine is, hence, by default, not a quick-fix panacea. He has medium-to-long-term inflation expectations, and an inverted US yield curve, already on his side, though.

Vladimir Putin’s house needs painting too Tiff, capisce?