The “September Surprise” Half-Life, Of Mr. Market’s Observed Truth, Reveals Core Macklem Doctrine

“This tech future may accelerate truth decay.” (General Angus Campbell)

Summary:

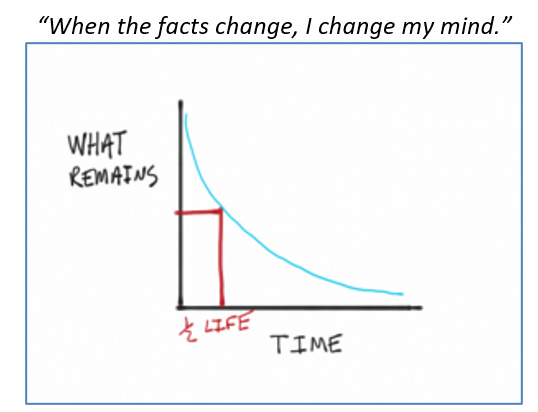

· The “September Surprise” is accelerating the decay of currently held truths and the adoption of new old ones.

· The “September Surprise” generates Alpha for the “Polycrisis Model Portfolio” of the “Masters of the Asset Class Universe”.

· Lagarde’s communication anxiety constrains leaks.

· Apparently, the “Global Blair Inc. Witch Project” is “borrowed”.

· Post “G20 BRecCsit”, Jamie Dimon invites India to apply for G7 membership via his firm’s emerging global bond index.

· India responds to Dimon’s invitation by promising to be Basel III compliant by next year.

· India’s G7 emergence is challenged by its “Sikh and Destroy” human rights track record.

· “Uncle Tom” Cleverly is with Stupid.

· Mr. Market is joining the dots from this year’s missed equity market rally to the recent “September Surprise”.

· The Yuan is being framed as the new Yen, in Carry Trade terms, to frame Japan as Friend-Shore compliantly “Investable” and China as “Uninvestable”.

· Mr. Market has been reminded that “Brimmer’s Law” was canonized at Jackson Hole.

· Classical “Brimmer’s Law” cannon is allegedly a new (post-Covid) supply-side inflation-driven ‘innovation’.

· The “Brimmer’s Law” ‘innovation’ frames supply-side inflation as a monetary policy tightening.

· The Fed’s supply-side innovation adheres to “Macklem Doctrine”.

· The Fed’s supply-side innovation leads to productive capital investment rather than inflationary consumption.

· The captains of industry have confirmed that the “Ungoverned Kingdom” (UK) is “Uninvestable”.

· According to the “Friends-and-Family Shore” son-in-law, it doesn’t matter if your country is “Uninvestable” as long as it is more investable than France.

· The five-year delay, of the Green Agenda, in the “Ungoverned Kingdom” (UK), extends the returns to the bottom line of “Friends-and-Family”.

Extracts

· The “September Surprise” is happening.

· The “September Surprise” is US Dollar “Stronger for Longer”.

(Source: the Author)

· The 60/40 Portfolio died in “Speaker Pelosi’s Bottom”.

· BlackRock’s Alpha Slam Dunk Model Portfolio has replaced the 60/40 Portfolio.

· BlackRock’s Alpha Slam Dunk Model Portfolio is “good enough for Government work”.

· The Alpha Slam Dunk Model Portfolio is consistent with the “IMF Spring” Fragmentation paradigm shift.

· Evidently, BlackRock also “Slam Dunked” in “Speaker Pelosi’s Bottom”.

· BlackRock’s AUMs will replace the Fed’s balance sheet as the main fiscal and monetary policy driver of US economic policy.

(Source: the Author)

· The “Hypergrowth Phase” lexicon is transitioning from its “Masters of the Asset Class Universe” authors to its current and future Industrial Drivers.

· The “Hypergrowth Phase” is certified as En-AI-bled and “Friend-Shore” compliant.

(Source: the Author)

· Rather than redress the egregious inequity, the Fed intends to transfer its dual mandate, along with its balance sheet, and the usurious monopoly lien on the US taxpayer, to the “Masters of the Asset Class Universe”.

· The executive policymaking function is also “collateral” that will be transferred to the “Masters of the Asset Class Universe”, along with the Fed’s balance sheet, without a return of consideration and accountability.

(Source: the Author)

· US Monetary Policymaking, and Fiscal Policymaking, along with the elected executive policymaking function, will be ‘dominated’ by the non-elected “Masters of the Asset Class Universe”.

· Fiscal Domination, by the “Masters of the Asset Class Universe” is visible in the public domain.

(Source: the Author)

· Christine Lagarde is anxious to ensure that central banks are better understood ex-post Jackson Hole.

(Source: the Author)

· The “Friends-and-Family Shoring son-in-law” ridicules, and exposes, Labour’s “Global Blair Inc. Witch Project” policy redundancy by quoting its eponymous author.

(Source:the Author)

· India’s recent “G20 BReCsit” is on the “Global Blair Inc. Witch Project” timeline.

· Cleverly’s “stupid” suggests that Chinese malign influence, on the “Ungoverned Kingdom (UK)”, predates current policy, at least, as far back as the Brexit referendum decision.

· Evidently, if India continues to act in good faith, on its “G20 BReCsit” intentions and capabilities, it will be forgiven for its malign influence on the Brexit referendum decision and any current policies in the “Ungoverned Kingdom (UK)”.

(Source: the Author)

· The “BRIC August Surprise” was surprised by the Managed Trade/FX regime on display at Jackson Hole.

· The US Dollar ascends another BRIC in the Wall of Worry.

· The US Dollar transcends the “Uninvestable” Great Wall of China.

(Source: the Author)

· The “September Surprise” is happening.

· The “September Surprise” is US Dollar “Stronger for Longer”.

· The “September Surprise” triggers capital flight from what is perceived to be “Uninvestable” towards that which is “Shore-Friendly”.

· The surprised “Wave of Liquidity” will be a tailwind for “Hypergrowth”.

· A strong US Dollar mitigates the inflationary tailwind within the “Hypergrowth Phase”.

· The Friend Shoring strategy overlayed on the NAFTA architecture will lead to further Dollarization rather than De-Dollarization.

(Source: the Author)

· Mr. Market will be encouraged to make the “’24 Leap of Faith”, towards a US Soft Landing, under the canon of “Brimmer’s Law” at Jackson Hole.

(Source: the Author)

· The Macklem Doctrine of America’s global imperative may make bigger fools out of the FOMC than the incoming inflation data.

· The Fed may embrace Macklem Doctrine when it sees the unrealized losses on its balance sheet from the recent spike in yields.

(Source: the Author)

· The Ungoverned Kingdom (UK) is now perceived as an “Uninvestable Submerging Market”, ceteris paribus with its pro-Brexit/“Friends-and-Family Shoring” affinities and affiliations.

· The Ungoverned Kingdom (UK) reaches “Submerging Market” status through the plausible excuse of taxpayer-funded “Friends-and-Family Shoring” as the market alternative to taxpayer-funded nationalization.

· The “Submerging Market” of the Ungoverned Kingdom (UK) is nudging the plausible excuse of private pensions to fund “Friends-and-Family Shore” recipients as a market alternative to direct tax transfers.

· “Submerging Market UK” has funding for “Friends-and-Family Shore” members but not for schools.

(Source: the Author)

· The “Friends-and-Family Shoring son-in-law” ridicules, and exposes, Labour’s “Global Blair Inc. Witch Project” policy redundancy by quoting its eponymous author.

(Source: the Author)

· “Friends-and-Family Shoring” is the Ungoverned Kingdom’s (UK) Polycrisis strategy.

· Blue Horseshoe loves INFY, but he’s really got the hots for BP.

· Behind the next great fortune, in the Ungoverned Kingdom (UK), lie the lies about Energy Security.

· The Carbon Footprints in the Ungoverned Kingdom (UK) follow the VIP Lane, by way of a private jet, away from the Green Transition, to great fortune behind which lies the familiar/familial nepotism.

· Conflicted commercial and pecuniary extended family interest has been obscured behind a plausibly deniable cloud of Energy Security.

(Source: the Author)