Orthodox 11/30 Advent: Dial 911, For The 11/30 Global Response Team

“But there are also unknown unknowns- there are things we do not know we don’t know.” (Donald Rumsfeld)

Summary:

· 11/30 was the Gregorian Eurozone advent of the Orthodox Ukraine genocide war crimes trials calendar that will end at the UN in New York.

· Dial 911 for the 11/30 global response to Madrid in the Rumsfeld Quadrant.

· FTX-gate and Biden-Kennedy Spin historically resonate with “Tweet Throat”.

· Chaos and anarchy reign, over the ECB Governing Council, and there is nothing that Christine Lagarde can do about it.

· The potential EU-USA trade war should be viewed in the context of China’s Belt, Road, and Skin in the Ukraine/Russia proxy Taiwan wargame.

· Extend and pretend (that it won’t happen) is the current default positioning for Stagflation that has become Stabflation.

· There’s “trouble at’Bank” in the Eurozone.

· The Fed’s incremental walking stick has not totally corrected its “Transientopia”.

· The incremental Fed intends to outlive the ephemeral mortal politicians.

· The Fed’s incremental domestic settings appease everyone, in the short term, and help no one in the long term.

· Fed Vice Chair Brainard admits that central bankers have no idea how the global economy now operates.

· The poor business response rate to the Employment Situation Report survey threatens the credibility of the data and its policymaking efficacy.

· A new Fed definition of full employment should include the observation that tight labor markets constrain economic growth, at least, as much as they boost inflation.

· Mr. Market’s 11/30 Market Close called Chairman Powell’s Bluff.

· Inflated idolatry and inflated apostasy are hyper-inflating “Gamblinflationary Britain” (GB).

· Britain, on aggregate, has lost hope, and faith, in its salvation from the current form of governance.

In case you missed it ….

11/30 was a normal day for those whose lives will be changed by those whom 11/30 was not a normal day for. It was anything but a normal day for the barometer of global change known as Mr. Market.

11/30 marked the advent of a set of global changes that are intended to be the Ukraine endgame. The changes rely on the same old story, that Americans understand, in which genocides only happen in Europe. What befell Native Americans and African Americans is, briefly, erased from view so that Americans can feel (and act) righteous. For righteously, read bi-partisanly.

As explicitly predicted (in parentheses) by the author, 11/30 was as much about the Eurozone, and global instability, as it was about the contemporaneous NY Times DealBook Summit in New York. The Times certainly had this editorial view. The editorial line projected the Ukraine endgame and the implied endgame for President Putin.

President Zelensky was given his 15 minutes, of fame, ostensibly, to defame Elon Musk and his appeasement Tweets. Things have not been going too well for Elon’s Twitter invasion of late. He may now have to become more compliant with the Western Alliance’s plans for Ukraine if he wants to boost his stock price. Zelensky also told Bibi to get Israel off the fence and come down on the correct side of history. DealBook Panel speaker and Treasury Secretary, Janet Yellen also reminded Elon that the long arm of the DOJ will extend further, towards him, if he does not become more of a Team America player. After the stick, Elon was then shown the carrot, by the FCC, with approval of his proposed 7,500 satellite network.

Clearly, it’s a learning process for both Elon and the Democrats.

Elon, however, is no pushover, as the Democrats soon found out.

There was a terror incident at the Ukrainian Embassy, in Madrid, thereby, effectively extending the warzone, from Ukraine, into the Eurozone hinterland. This incident was part of numerous others, including the US Embassy, in Madrid. The warzone has, thus, been extended from Europe to the USA, since the US Embassy is sovereign US territory by law.

Legally speaking, the Western Alliance and Ukraine have been attacked. In light of this attack, by assailants, as yet, unknown, the global national security protocols, commissioned to deal with Unknown Unknowns have been triggered. The Western Alliance is at war, with somebody. That somebody may be somebody already known.

German lawmakers, who should know a thing, or two, about genocide, voted to recognize a historic Ukrainian genocide, perpetrated by Putin’s putative role model Stalin. The German precedent for war crimes trial involvement was thus set. With this precedent, a little nudge was given to Bibi, and Israel, to get back on the right side of historiography. At the higher European level, European Commission President Ursula Von der Leyen was calling for an official war crimes trial to be held at the UN, in New York, thereby closing the circle from Ukraine, to the Eurozone, and back to New York.

Meanwhile, back in New York, via disgraced Elon’s satellite link, President Zelensky opined that 6 million people are without electricity in his country. With the onset of winter, this clearly does not end well. It may well legally qualify as intentional genocide.

America, currently, seems to be more interested in the imminent genocide from the use of Russian bioweapons. US intel, such as the prediction that Russia would invade Ukraine, has an unerring lethal accuracy.

The ducks are hatching and aligning for a UN declaration of a 6 million-person genocide with war crimes trials to follow. If it walks and quacks, like a genocide, it must be a genocide, may it please the jury?

There is, however, a way for the uniquely unfortunate President-Colonel/Brigadier-General in Chief to avoid the Hague, if he is deemed to be too ill to stand trial. Incarceration, and ostracism, in a sanatorium, would be the sentence; thereby leaving the exonerated chain of command upwards to negotiate peace with honor. Strangely enough, this sentencing is already taking place in the criminal court of the public domain.

(Source: the Author)

According to the editorial host, of the New York Times Summit, 11/30 was the advent of the Ukraine genocide war crimes trials that will be held in New York. This advent calendar is Orthodox, not Gregorian. This author has previously discussed the War Crimes trial and sanatorium exit routes for President Putin. President Putin’s direct control of military operations, in Ukraine, and the atrocities committed, were viewed as making him indictable in a war crimes trial.

Seemingly, the War Crimes Trial exit route is being revisited as the EU and the USA also attempt to settle their differences over US “Friend-Shoring” and protectionism. One senses a grand bargain under negotiation, by great powers, the way these things were done back in the Twentieth Century.

All in all, then, 11/30 was not a bad day’s work for the policymakers and journalists.

Interestingly, the Leader of the Free World is also, potentially, facing indictment but not for war crimes. The lesser, potential, crimes are malfeasance and election interference.

Interestingly, the New York Times had its own, unique, 11/30 take on the Leader of the Free World’s, potential, guilt.

“Tweet Throat”: FTX-gate? Fuh-gate about it! ….

· Beware the ides of 11/30/2022.

(Source: the Author)

The “ides of 11/30” may augur for a winter of partisan discontent.

· FTX-gate is starting to resemble Watergate.

(Source: the Author)

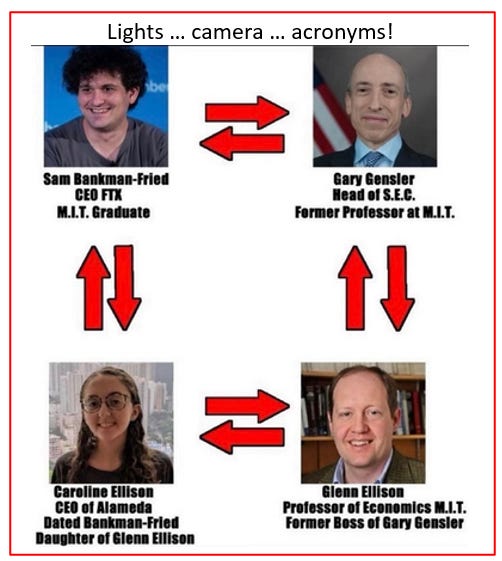

As the 11/30 singularity event approached more ducklings and plots, hatched. The similarity between FTX-gate and Watergate is manifesting, in the current year-end festivities, leading toward New Year resolution.

The significance of electoral campaigns, and their shady funding, has begun to resonate in the hatching narrative plot. Democrat campaign funding is, currently, synonymous with the FTX Scandal.

Campaign funding, and its criminal linkages, are subjects not unfamiliar to Democrats. With this in mind, it is worrying how President Biden is framing his potential re-election campaign. Perhaps he has chosen to confound his enemies by hiding in plain sight.

Reaching, for that Kennedy frame of reference, President Biden “retreated” to Nantucket, in order, to strategize and for campaign inspiration. President Kennedy relied upon shady operators, from a sunny location, known as the Rat Pack, to finance his campaigns. President Biden may have relied upon a polycule, of shady operators, in a sunny location, to perform a similar function to the original Rat Pack.

The Kennedy frame, of political reference, is not so gilded. In many respects, it is controversial and also cursed. It is, certainly, a conspiracy. Perhaps, therefore, it is the perfect frame of reference, in an unintended sort of way.

Today’s political conspiracy began with the revelation of how President Obama weaponized Facebook, with a little help from Mark Zuckerberg, to win an election and re-election. President Trump was initially as successful in his application, of the dark social media arts, but then failed to capitalize during the Capitol insurgency. President Putin, allegedly, almost swung both elections for Trump, on Facebook and Twitter. President Biden has watched all this from his unique position as Vice President. Who would bet against his having made a few notes along the way?

US legislators and the judiciary have certainly been making notes. Their response is pending.

Today’s conspiracy also has all of the prerequisites.

It has social media. It has money. It has politicians. It has sex. It has spies. It has military interventions, and covert operations, in far-off lands. It has Russians. It even has its own three-letter acronyms.

Seemingly, the only thing that is missing is Jimmy Hoffa; and even this feature is as it should be according to legend.

And it has got Crypto, thereby, making it the greatest conspiracy of all time.

All of these prerequisites were represented in the milieux, of the 11/30 event, hosted by the New York Times.

The New York Times 11/30 editorial frame of reference, of “FTX-gate”, was that there was nothing to see, and, thereby, nothing to indict POTUS with. SBF confessed to making a mistake rather than acting with wilful fraudulent intent. A confession of wilful fraudulence would, then, have put campaign financing into the criminal frame of investigation. Better, for all concerned, therefore, for it to be put down to the youthful indiscretion of a bunch of horny MIT graduates.

As noted previously, however, Elon is no pushover. Nor does he see things, necessarily, the same way that the New York Times does. After taking his medicine, at the 11/30 event, he dished out some of his own. Unsurprisingly, Elon’s medicine has a subtle aftertaste of Watergate about it. Pre-Elon, Twitter, allegedly, restricted the access of its members to articles, critical of Hunter Biden, during the 2020 election campaign.

Ironically, reader access was denied to critical articles published in the New York Times. This is the same New York Times that was the 11/30 venue for the ostracism of Elon amongst other perception-framing initiatives. Go figure!

The inference of interference in the election process by the Democrats is becoming palpable.

The journalistic “Tweet Throat” source has warned of “weird times” ahead.

With a Presidential election, not too far away, Elon’s Twitter investment is finding some serious context. The latest S&P downgrade of Twitter suggests that “weird” is going to get dirty. In theory, the Federal Government’s ability to remain solvent is greater than Elon’s, so he should know when to fold. Folding, however, may not be enough for the Federal Government. With the election just around the corner, Elon may also think that time is on his side.

Blockbuster billing, and hence, framing context, should also be awarded to the growing trade tensions between the USA and the EU.

Trade War? Possibly, with Chinese Belt, Road, and Skin in the Russian Game.

· China may also be blowing an indirect global economic headwind via alleged US trade partners.

· A trade war between America and Europe is highly likely.

(Source: the Author)

The last report discussed rising US-EU trade tensions over US “Friend-Shoring” and the Inflation Reduction Act’s, potentially, protectionist trade policies.

France and President Macron were noted as key players, in the rising trade tensions, by the nature of French initiatives to promote an alternative relationship, outside the US aegis, with China. As a consequence of this initiative, President Macron had fallen foul of the US Department of Justice.

This trade war is being fanned by China’s overt, and covert, support for diverse European economic and political initiatives that conflict with American global strategy.

As the Europeans prepared to go down the genocide/war crimes route, through Ukraine, to the UN, the Chinese shuffled to contact. Evidently, China doesn’t want the genocide line of inquiry to run its course. China thus seeks to temper criticism of its own humanitarian oppression, of its ethnic minorities, and those demonstrating against COVID-Zero policy, by compromising with the EU, over Ukraine, and applying pressure on President Putin.

China also has skin in the game in Russia. Moscow is now the fourth largest offshore trading hub for the Chinese currency. Along with the arc of the Belt and Road, along the ancient Silk Road, Chinese economic interest, in Russia, has exponentially increased since the Ukraine War broke out.

East finally got to meet West, in person, at G20, but the priorities appear to have changed since COVID and the Ukraine War diversions appeared on the scene. This scrambling of priorities may conceal a strategic realigning of priorities. This concealment may, in fact, hide a global realignment. It most certainly indicates a few detours and diversions on China’s Belt and Road. Perhaps there have been a few over-takings and crashes along the way, too.

(Source: the Author)

Evidently, China wishes to have a Ukraine solution, involving the EU, at the expense of and the exclusion of America. China wishes to make it a Eurasian thing.

· The Ukraine war is a wargame for the Taiwan war.

(Source: the Author)

This author views Ukraine as an American wargame for Taiwan. With this view in mind, therefore, it is important to follow how American intentions and capabilities, towards China, progress in relation to Ukraine and Russia.

The French had prepared for an upcoming meeting, for President Macron, with President Biden, in a seemingly, confrontational manner. Acknowledging the American investigation, of Macron’s campaign finances, Finance Minister Le Maire has downplayed the current role of advisers which has led to the American investigations. In addition, Le Maire has signaled that French intentions and capabilities, to push back against American protectionism, are consistent with the EU policy.

President Macron’s recent meeting with President Biden was an opportunity for him to close his personal gap, with POTUS, and narrow the trade war gap between the US and the EU. No gaps were narrowed, on this occasion, although both sides have now agreed to talk constructively about what is causing these gaps.

Prior to the resolution, of EU-US differences, the former may find itself in the midst of a financial crisis that the latter can leverage over.

Start extending, stop pretending (II): Show and tell time ….

· Europe is now the greatest headline inflation, financial instability, and growth threat to the global economy.

(Source: the Author)

Chaos and anarchy, rather than Christine Lagarde, preside, over the ECB Governing Council. On the contrary, Lagarde is making the situation worse. It would seem that she has lost control. To hide this leadership failure she opines meeting-by-meeting data dependence.

Yesterday’s man, ECB Chief Economist Philip Lane is, currently, in an urbane conflict with fellow Executive Board member Isabel Schnabel. Schnabel has become increasingly Hawkish as Lane has become increasingly inept at forecasting inflation developments.

· RIP Philip Lane, long live the Tweet-Show replacement.

(Source: the Author)

Lane procrastinates about all the difficulties involved, in inflation forecasting, whilst stating, resolutely, that medium-term inflation expectations still remain well-anchored. This is completely disingenuous because the same challenges to forecasting are actually what are de-anchoring inflation expectations. Lane has no idea how long these challenges will persist.

Once famous for its intellectual sharpness, Lane’s lilting brogue mumbles unscientific concepts, such as “quite a bit”, to qualitatively quantify what he sees as ECB monetary policy settings that are already tight. Gone is the intellectual rigor, and, gone is the credibility.

Schnabel sees through the challenges that Lane procrastinates about. Her own viewpoint clearly sees de-anchored medium-term inflation expectations.

The Lane-Schnabel conflict is the least of Lagarde’s worries. Elsewhere, in the Governing Council, insults and ridicule are being traded on a daily basis. Klaas Knot says that Fabio Panetta’s worries about over-tightening are a “joke”.

Lagarde herself has come down, on the side of the Hawks, which has opened a division with her Vice President Luis De Guindos who has called peak inflation.

· Far from avoiding a Eurozone financial crisis, callable/extendable bank debt will trigger one.

(Source: the Author)

The last report discussed the process by which the extend and pretend approach, of Eurozone commercial banks, to their liabilities, would weaken the stability of the banking sector and the Eurozone economy.

Evidently, the ECB is getting worried, about the financial sector, and is now coercing the systemically important Eurozone financial institutions, to make capital provisions, for weakening asset quality on their balance sheets.

Evidently, also, there is blood in the water, of liquidity, in which the Eurozone banks are swimming. The sharks, in Strategic Consultancy, are circling, which, probably, means that the sharks, in the hedge fund community, have already started nibbling away.

A very clever shark, from McKinsey, semiotically depicts the global financial crisis developing in the general South East of the global economy. Translating this. into the Eurozone, one can see that Northern Europe is, allegedly, under siege from its partners to the South and the East.

According to McKinsey, the Eurozone banks’ ability to dodge, being consolidated, has eroded their capital bases’ abilities to withstand a recession.

This author observes, that said eroded capital bases are predicated on the assumption that the national sovereign debt, that these banks hold, exclusively, of their own sovereigns, will still be viewed as the highest form of capital available, to mankind, in the event of a financial crisis. The scale of the fiscal deficits, of the sovereigns, and the opinions of the EU, and the ECB, about their size, all suggest otherwise.

· The tactics adopted in trying to remain solvent, whilst following its inflation mandate, mean that the ECB is triggering a banking crisis that will lead to a recession and then more QE.

· If the ECB and the EU intend to trigger deeper banking sector and economic integration, with QT, Grexit proves otherwise.

· The EU is choosing deeper economic union to avoid fragmentation and ECB insolvency.

(Source: the Author)

This author believes that recession, and consolidation, are being forced onto the Eurozone banks, by the collective actions of the EU and the ECB. A financial crisis would be the catalyst. The author is not sure that consolidation will occur, however, based on crises-past performance. He is more certain that more QE and ECB balance sheet expansion will occur, as the consolidation attempt spectacularly backfires on the ECB.

In their bunkers, awaiting financial crisis, the Eurozone banks are loading up on what they believe is safe sovereign debt. This hunkering down is amplifying the risk to the banks’ capital positions through the practice of extending the duration of their assets and their capital bases.

The Eurozone banks have increased the duration, and hence price, risk on their balance sheets. This is mirrored by the increased price, and liquidity, risk in the extended duration of their capital bases. At the same time as this duration and liquidity risk is compounding, on either side of banks’ balance sheets, the ECB is withdrawing short-term funding liquidity from the capital markets. So, bank asset and liability risks are compounding at the same time that funding liquidity is being withdrawn. Oh, dear.

In the event of a crisis, the banks will face illiquid capital markets, which will reprice their capital bases, and their balance sheet assets, at deep discounts to fair market value. Presumably, at this point, the ECB hopes to consolidate rather than have to bail out the banks. History would say otherwise.

· The ECB’s latest financial stability report is a synopsis of an impending financial crisis.

(Source: the Author)

On the eve of a potential crisis, the ECB exonerated itself by warning the commercial banks of their folly, and the regulatory response that will ensue. The banks have been told that their capital bases are inadequate to deal with capital losses from, interest rate hikes and, the resulting economic slowdown. As the author previously noted, with the ECB’s recent financial stability review, a crisis libretto has been provided, in advance, for the Eurozone banks to sing along to.

History shows, however, that when the Eurozone banks sing the ECB dances the bailout tune.

Also on potential crisis eve, a rating outlook cut, on France, by S&P, hinted at the mischief ahead. It also revealed the epiphany that not all sovereign debt should have a zero-risk capital weighting.

As the Eurozone incrementally edged nearer to a crisis, the Fed incrementally edged nearer to a global solution.

Can an Incremental Walking Stick cure the Fed’s “Transientopia”?

The European strategy, of extending and pretending, clearly, seems to be a malady that is also plaguing the Fed and the US economy. The American strain, of the affliction, appears to be conjoined with the traditional “Transient” cognitive blindness of the Fed, which this author diagnoses as “Transientopia”.

The Fed just isn’t capable of binocularly seeing, what its two mandates are doing, simultaneously, until, it’s too late to do something, about one of them, which means it’s more important to focus on the other. The Fed procrastinates that the “Transient” nature of what is seen, eludes true understanding.

This time around, the Fed’s “Transient” blindness is in relation to rising unemployment. Previously, it was in relation to inflation.

Allegedly, the US labor markets are seen to be tight by the Fed. An FOMC member with a hammer can, therefore, only see tightening nails. The result of the application, of the tightening policy hammer, to these nails, goes largely unnoticed by the average FOMC member. Unfortunately, all of the FOMC members, with the exception of Esther George, are below average. With the majority consensus, visually impaired, the chances of the Fed stumbling into unforeseen dangers are good.

This author is resigned to his fate at the hands of a Bot. He only wishes that this fate will befall central bankers as well.

To be fair to the Fed its “Transientopic” cognitive defect has been remedied, to some degree, by the adoption of Incrementalism. Watching the incremental Fed is like watching a blind man use a walking stick. The incrementalist stick has corrected the visual impairment to some extent.

But will the incremental stick be enough to stop the Fed from killing the economy and itself?

The Fed has signaled that it is in full-on Incremental Walking Stick mode as opposed to “Front-Loaded” seppuku. This behavior has been prompted by financial instability, and growth threats, more than it has been enabled by any radical improvement in the inflation picture.

Richmond Fed president Thomas Barkin recently warned that incrementalism is not a move closer to easing, in his opinion. On the contrary, incrementalism means that interest rates are going higher but more slowly. Incrementalism, thus implies that yield curves can invert forever if inflation and inflation expectations remain structurally elevated. Given that the Fed is incrementally tightening, the chances of said structurally elevated inflation dynamics becoming the status quo are quite compelling.

St Louis Fed president James Bullard, like Barkin, envisages an incrementally higher target rate, within the 5% to 7% range. Currently, he is nearer to 5% than 7%.

The subject matter, of inflation, has brought tears to New York Fed president John Williams’s eyes. Like with an onion, as he peels back each layer to understand its nature, the experience brings tears to his eyes. Through these tears, of sorrow, the lachrymal Williams sees the need, to tighten further, because there is a skills shortage that is making the labor market appear tight. His tears suggest cognitive blindness to the structural supply-side problems of the labor market.

· The Fed does not know what lagged economic outcome from an initial belated, historical, monetary policy overreaction it has recently overreacted to.

(Source: the Author)

Whilst it may appear tempting, there is absolutely no reason to take any of these Fed speakers at face value. One should not shed any tears for, or with, Williams.

These are all the same Fed voices that opined “Transient” inflation until it wasn’t anymore. Although history is no guide, human nature is, a good guide, therefore, one should expect the Fed to get it wrong again. Since the Fed is now behaving incrementally, in theory, the margin of failure should be smaller. Progress indeed!

The latest guidance, from Fed Vice Chair Lael Brainard, was a warning for the Fed watcher not to become beguiled by the speaker. Without implicitly conceding that the Fed failed, on “Transient” inflation, Brainard admitted that there is a great lack of understanding, by central bankers, in general, of how the global economy and global polity now interface. What she seems certain of is that the old way of looking at the global economy is no longer applicable. Acting incrementally, whilst there is a lack of understanding is, therefore, understandable. It should not, however, inspire any confidence that any greater level of understanding will be attained by the central bankers.

This author had little trouble understanding what the latest alarming Challenger Job Cuts number signifies. He is certain that Brainard et al will not struggle to understand it either. Those lagged impacts, of previous rate hikes, seem to have shown up just in time for Christmas. The next Fed speaker who says that the labor market is tight is a duck-egg.

The prima facie strong latest Employment Situation report was, in fact, ambiguous. The response rate, by businesses surveyed, was poor. Thus, the credibility, of the report, from a monetary policymaking perspective was poor. The Fed can no longer trust this data, hence, the central bank has become more blind to the real employment situation.

· The Fed’s pivot from its inflation mandate to its employment mandate will require a new definition of what full employment means in relation to the COVID-19 experience.

(Source: the Author)

Given the paucity of the latest Employment Situation report, perhaps the Fed may now be persuaded to seriously look at a new definition of full employment. A shortage of labor is as much a constraint on growth as it is an inflation booster. Evidently, Richmond Fed president Thomas Barkin is starting to think this way. If this line of reasoning becomes widespread, the rationality of tightening economic conditions, without any mitigating supply-side labor market stimulus, will fall into question.

This author also had little trouble understanding the statistic which signals that US commercial bank begging/borrowing, at the Fed’s discount window, is back to where it was at the liquidity nadir of the COVID pandemic. He hopes that those Fed members on the other side of the discount window have also understood.

Newbie Fed Governor and top banking supervisor, Michael Barr is clearly aware of the liquidity problems, in the banking sector, and how they are related to bank solvency and financial instability. In his first speech, he mapped out how the Fed will take a “holistic” view, of all this interconnectedness, as it sets out its standards, and frameworks, for bank capital adequacy. This author views this interconnectedness as having reached a tipping point at which Stagflation has become a financial stability policy phenomenon. Tipping his cards, a little, thereby, revealing his elevated concern, Barr said that it is “smart” to slow the pace of rate hikes, going forward, to avoid triggering unnecessary financial instability.

Chairman Powell had a little more clarity on offer than Brainard, but not much. He offered certainty that the size of future rate hikes will be smaller, going forward, but could not say when they will end. He also said that they may have to go on for longer, thereby, sending the target rate higher. Powell’s view was endorsed by Fed Governor Lisa Cook.

Fed Governor Michele Bowman proposes a damage assessment period, of pause, during which the Fed can see the lagged impacts, of previous rate hikes, on the economy. She hastens, to add, however, that this pause is not a prelude to monetary policy easing, but, rather, to appropriately calibrated further hikes.

What this author enjoyed most, about hearing Powell, was the market reaction to his guidance. The market did not take any of his Hawkish rhetoric seriously.

On the contrary, Mr. Market looked at events in the US, the Eurozone, Ukraine, and China, and then called Powell’s bluff.

More worrying, for the Fed, is the fact that it is beginning to lose any vestiges of credibility with US business leaders. The “Transient” inflation debacle is rapidly deteriorating into a strong economy blind spot.

More worrying for Cleveland Fed President, and Hawk, Loretta Mester is the fact that her own staffers now see monetary policy settings as too restrictive in Q4 of this year.

This author has noted that it is imperative for its survival, and independence, that the Fed finds a policy mix that is consistent with the underlying economic and political environment. Incrementalism would seem to be the acme of skill in this respect. As it has always done, the Fed has adjusted with the objective of outliving the ephemeral politicians and their agendas.

· The Fed Listens, and responds, to Key Signals in order to Constitutionally Comply with the 13th Amendment.

· Being Constitutionally Compliant does not mean that the Fed is employment mandate compliant, anymore, as the mass layoffs in the technology sector grow.

(Source: the Author)

The Fed is, thus, pretending to be complying with both its domestic mandates and the overarching Constitutional framework, without really doing anything. Incrementally complying, therefore, appears to appease everyone, in the short-term, but helps no one in the long term. This exclusively domestic positioning also leaves the Fed wide open to an incoming global economic shock.

You’ve been Gamed: Lose the faith, lose the Nation …. but win the World Cup ....

Europeans are struggling to understand if Modern Art imitates modern life or vice versa.

The outpouring of national sentiment, and soul searching, which normally accompany a World Cup have had some interesting artistic developments.

The Germans are re-living hyperinflation, through contemporary inflation, by revisiting their World War II past with inflated works of art from that period of history.

Consistent with history, and Brexit, Britain is off on one of its artistic tangents.

· The UK will become an austere economy with an ungovernable polity.

(Source: the Author)

Whilst most Britons are glued to the Telly, watching the Footy, the debate over whether Modern Art imitates Mughal Life or vice versa has taken a carefully-curated, turn, for the worst, in God’s Own Countrystan aka North Yorkshire.

Art critics are struggling to understand and coherently explain, the, seemingly, conflicting appearance of inflated idolatry alongside the inflating apostasy in Britain’s, hitherto, green and pleasant disinflationary land.

A less urbane political debate over whether this semiotic rift accurately depicts the rift in the rich multicultural tapestry, in the wider subcontinent of Britain, is developing alongside the artistic one.

There is, clearly, a correlation, between all these rifts, but the critics just can’t see what the real cause is just yet. The average Briton, who has not had the fortune of studying art criticism, and/or Iconoclastics, at Oxford University, may violently disabuse the intellectuals, and the idolators, of their fondly-imagined semiotic memes.

The latest indicator of the decline and fall, of once Great Britain, into apostasy, is faithfully representative of an underlying trend. Whilst the headlines opined the demise of Christianity, and the ascendance of Islam, and Hinduism, the reality is that more than half of Britons, on aggregate, have lost faith and hope in their salvation. King Charles III, is now the defender of minority faiths, assuming that he is still the defender of the faith.

The demise of Christianity may, in fact, be the demise of the old White Anglo-Saxon Protestant work ethic that was so industrious in making Britain the global factory of the Industrial Revolution. This sad demise, of the ailing WASP, is not just religious, or ethno-specific, since it appears to be a Long-COVID symptom and long-term symptom of a secular decline in standards of health and diet.

· The UK has turned Japanese in 2022 instead of 2023 as originally predicted by the Bank of England.

(Source: the Author)

This demise is a ticking bomb, since falling potential economic growth is now well below the trajectory of the fiscal deficit. Britons will neither live, nor work, long enough to pay off their own and the national debt. As noted previously, Britain has turned Japanese. Like Japan, immigration is currently frowned upon. Unlike the Japanese, Britons are more aggressive in their dissatisfaction; so it won’t end well.

It would appear that British apostates now worship at online gambling dens of iniquity. The decline in the country’s religious and economic fortunes has a clear correlation with the quest for salvation through speculation. There is, apparently, no route to salvation through hard work and prayer anymore. In fact, there isn’t much work, to be had, and prayers seem to go unanswered by both God and Mammon.

Various nut-jobs, of all faiths, and persuasions, will, doubtless, subjectively, frame perceptions of the religious and gaming statistics to their assumed religious advantage. Presumably, their religious persuasions will deliver the required hope and salvation. Should the faithless trendline indicator continue, the proselytizers will, doubtless, feel vindicated, enough, to press on rather than be dissuaded. The decline and fall, of once Great Britain, will, thus, advance to the cadence of religious incantations and rustling betting slips.

In medieval times past, cynical, religious, and political leaders, militated, for Crusades, to arrest the domestic anarchy. Brexit was an echo, of that Crusading spirit, but it was a strategic retreat rather than a call to arms to take it, away from home, to the infidel. The fire and brimstone pantomime rhetoric, double act, of Farage and Johnson, has gone very quiet of late.

Crusading has, also, become a pantomime that is not welcome at major global sporting venues. The Crusading spirit remains, however, awaiting release. The current lack of global projection means that domestic scapegoating, and witch-hunting, are, currently, the only, inevitable, games in town. These games usually get violently played out, in town centers, when the pubs and clubs are closed. The recent census statistics on faith will, no doubt, be formed into a catalyst and a spark for the Crusading incendiary outcomes. Maybe that’s what’s coming home.