From Front Loading To Incremental Systemic Inertial Policy Error

“We get to spend a lot of time with data... But I personally would say I need to hear narratives, I need to hear stories, about what’s really going on out there ...." (sic) (Jerome Powell)

Summary:

· The Fed is not committed, it is as inert as ever.

· The Fed does not know what lagged economic outcome from an initial belated, historical, monetary policy overreaction it has recently overreacted to.

· Based on its lack of policymaking situational awareness the Fed is well-advised to move from “Front-Loading” to Incrementalism.

· The Fed Listens initiative does not make the Fed compliant with the 13th Amendment.

· Global central banks have been insolvent for, a lot, longer than people think.

· Japan’s insolvency and contracting monetary base militate strongly in favor of the Yen Carry Trade solution to domestic and global growth risks.

· Global central banks will have to start easing a lot sooner than they and people think.

· The attempted Soft Landing by the insolvent RBA is the financial stability policy canary in the developed economy coal mine.

· Central bank emergency swap lines are accelerating the “Friend Shored” global shortage of US Dollars.

· Behind Rishi’s great fortune lie Suella’s and Priti’s humanitarian crimes.

· Behind the great Poundland Casino lies the Britain Project.

Plus ca Change (sic-ness)….

The symptom of Long-COVID manifested in central bankers, is an extenuation of their prior illness. This means that the central banks have, just, become worse at what they weren’t very good at in the first place. Having eased for too long, at the height of the pandemic they are now about to tighten for too long. Imprisoned, in this debilitating condition, they now find themselves insolvent. This insolvency is brushed away with bravado, but it doesn’t appear to be going away in balance sheet P&L terms. Only an infusion of government fiat currency, and the securities which collateralize it, will cure the sick central banks.

Despite this highly visible, and highly contagious, underlying insolvency symptom, clinical observers believe that they can discern an improvement in the patients’ cognitive and behavioral responses.

The Fed may appear to have abandoned “Front Loading”, in favor of Incrementalism. Unfortunately, the US central bank has not abandoned the inertial lethargy that leads to policymaking mistakes. The inertial thinking which led to the slow response to inflation is now leading to the slow response to a recession. Chairman Powell likes to think of and present this inertia as a commitment to fight inflation. Last time around it was a commitment to fight the COVID recession.

For commitment, read inert. For inert, read always behind the curve. Analysis, dating back to 2011 found that the Fed was inert. This inertia was found to date back as far as the Greenspan Chairmanship. Observation, from 2011 to date, shows that there has been no lessening of the inertia.

This inertia has a second-round effect, which is an overreaction. This overreaction then becomes inert, itself, thereby, leading to a further belated overreaction in the opposite direction. And so on and so forth.

Given the lagged nature of monetary policy action, it is highly unlikely that the Fed knows which, historic, overreaction it is, currently, overreacting to. This observation should prompt a rational actor to act cautiously, and incrementally. Evidently, the Fed is not a rational actor since it remains inertially prone to overreaction, in the first instance, when it finally changes its previous position.

Furthermore, governments face insolvency because the slowdown in economic growth is not reflected in lower interest rates. At this point of national insolvency, the GDP growth rate falls dangerously below the combined level of the inflation rate and the rate of interest on government borrowing. The outcome of this combination, of factors, is financial instability that then becomes an additional economic headwind.

The Fed is under the impression that its own insolvency and the increasing financial instability are unrelated. This is not a luxury that other central banks can fantasize about. Neither is it a luxury that elected policymakers can fantasize about.

Insolvent and Lovin’ it: Nine months of pain for a lifetime of more pain ….

Victory has many fathers, but defeat is an orphan, according to JFK. Central banks and their governments seem to be having a lot of orphans these days.

Governments and their central banks are insolvent. GDP is below combined inflation and borrowing costs. This insolvency may be temporary, but its duration will feel destructively permanent for those living through it.

Policymakers have understood the financial stability implications of collective insolvency. They have tasked their wonks, and advisers, to come up with strategies, and noble lies, to sell further economic stimulus that may be inflationary.

Treasury Secretary Yellen has had the novel hyperinflationary idea of injecting liquidity, into the US capital markets, by funding the buying long term US Treasury Bonds with the issuance of shorter-term US Treasury Notes.

Other, out there, global novelties are equally as heretical.

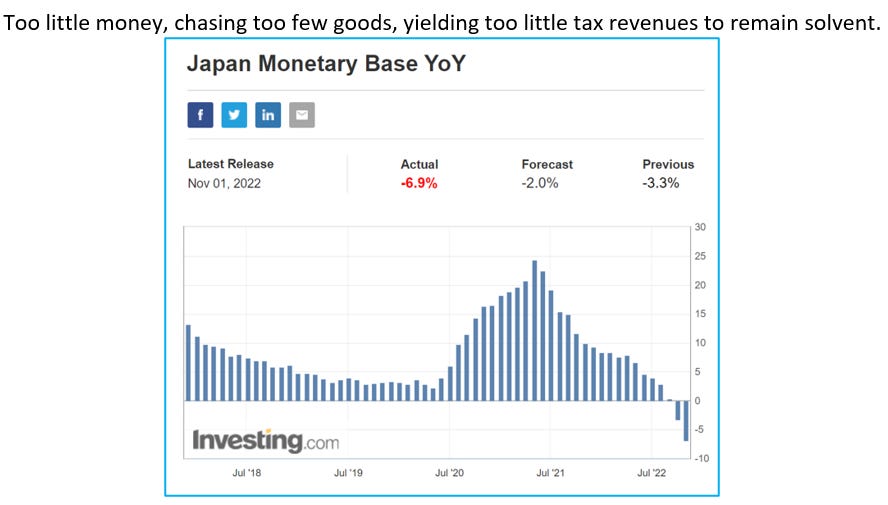

The Bank of Japan (BOJ) is considering swapping its ETF holdings for government perpetual debt that will never be repaid. The monetary base in Japan has turned negative on an annual basis. Money is literally vanishing, relative to domestic goods and services, as the monetary base contracts. The monetary base didn’t even contract, during the height of COVID, when the Japanese economy was officially closed down. Now things are worse, even though the economy is open and allegedly growing.

More worryingly, for the government, and the BOJ, from a solvency perspective, the monetary base is contracting as the fiscal deficit expands. Credit and debt creation are diverging. Debt has become unsustainable, hence, the government and the BOJ think it must be inflated away.

· The Yen Carry Trade is disinflationary unless you’re Japanese, but the Kishida Put will cover your bills if you are.

(Source: the Author)

Monetary policy conditions in Japan are tight, perhaps, even, the tightest ever. There is now a risk that there will be no money to pay Japan’s massive fiscal burden. Consequently, the BOJ and elected policymakers must try to print their way out of debt. To ease the burden, on the Japanese economy, and to simultaneously reflate the global economy, the developed nations have decided that the Yen Carry Trade is the best global solution. The swap of ETFs for perpetual debt, that is never repaid, is, hence just a feature of this carry trade.

The Japanese Government, and the BOJ, are putting money into Japanese consumers’ hands so that it can be clawed back, in taxes, to balance the national accounts and make the central bank appear solvent on paper. Japanese consumers have tumbled this little ruse and responded by not spending or depositing their money.

Cash is King. There is, however, not enough King to pay Japan’s debts. Faced with this problem, the King has decreed that all his debts are perpetual and will never be repaid. Foreign holders of these Japanese debts should get rid of them, and the Yen, as fast as possible.

Better still, more Yen debts, that will never get repaid, should be created, by everyone. And, that is what the Yen Carry Trade is all about.

· Kishidanomics i.e. Abenomics II is the globally acceptable face of UK Kwasinomics.

(Source: the Author)

Japan is getting away with fiscal heresy and deliberate currency manipulation because its actions fit the global agenda of the developed economies.

· Central Bank insolvency is aligning with fiscal insolvency at a rapid pace in the global economy.

(Source: the Author)

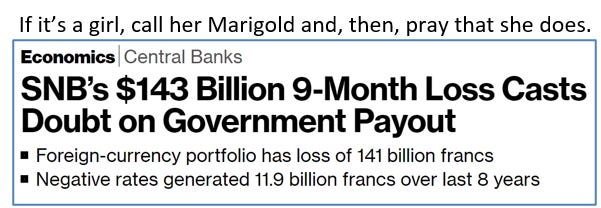

The Swiss National Bank’s (SNB) credible commitment and democratic transparency put those of the Fed, ECB, and BOJ into the shade. This transparency also sheds light on the predicaments of developed central banks. This predicament is that they have made themselves insolvent.

The insolvency problem-child, of the SNB, has, apparently, been gestating for nine months. This is considerably longer than expected by the markets. The recent birth, of the problem- child, in the public domain, thus, hints that monetary policy tightening will have to end much sooner than anticipated by the SNB and the markets.

The SNB’s insolvent child is not an orphan. It has many step-siblings throughout the global central banking family.

The ECB’s insolvent orphan has some hotly disputed parentage. It also has a twin.

The Northern European parents are in denial. They wish to make the child even more insolvent, by hiking interest rates, because their archaic dogma, dating back to gold-backed currencies, obliges them to tighten monetary policy, unquestioningly, whenever inflation rises.

The Southern European parents are worried about the orphan twin, named depression, which is the unwanted progeny of Northern European dogmatic reproduction.

ECB Vice President Luis de Guindos admits that the inflation orphan will have a long unproductive life. This long life is being prolonged by the misguided attempts, of elected policymakers, to make the high price of energy palatable, to consumers, rather than allowing true price discovery to drive an energy diet. This is an implicit admission, by de Guindos, that the ECB will be insolvent for a similarly extended period, by default of the dogmatic commitment to monetary policy tightening when inflation is rising. The risk is, therefore, that the semi-permanent period of insolvency completely zombifies the ECB, and leaves a huge hole, in the Eurozone economy, where a functional central bank should be located.

It is reasonable to assume that the gestation periods for the various insolvent global central banking progeny are roughly the same, by nature of the fact that they were all conceived at the same COVID global orgy of monetary policy easing.

One can, thus, say that the developed global central banking family, with the exception of the Mont Pelerinaires, is much closer, to ending monetary policy tightening, than is widely assumed today.

· A Key Signals proprietary indicator signals that the FOMC is, once again, totally off with its timing, this time, on monetary policy tightening.

(Source: the Author)

This author has reported that, in fact, the Fed should have started easing back in the first week of May. This author-anticipated tightening post-partum date was six months ago. With hindsight, he is, therefore, three months behind the SNB’s proxy Fed curve. In his defense, he says that the SNB did not say that it was three months insolvent when the author was saying that the Fed’s tightening was already stillborn back in May.

· The RBA confirms the commodity disinflation thesis, of the strong US Dollar trend, but now says that this is a Soft-Landing scenario tailwind Down Under.

(Source: the Author)

The Reserve Bank of Australia (RBA) is already getting ahead, of its peers’ problem-child gestation curves, and, thereby, converging on the proxy Fed curve. The subtle financial stability policy-driven shift had already been flagged, well in advance, by Deputy Governor (Financial Markets) Christopher Kent. The latest incremental 25-Basis points rate hike was complemented by the RBA’s view that medium-term inflation expectations are stable. Stable medium-term inflation expectations, impute disinflationary short-term financial instability expectations. The RBA is, hence, saving its balance sheet to attempt to save the economy from a financial crisis. This will be tricky since the RBA is nine months insolvent.

The Fed is, nine months behind the curve and still heading in the opposite direction.

· Free-Loading Chairman Powell’s position is untenable, ideally, he should be replaced, by Esther George, but this probably won’t happen.

· If the “Front-Loaders” finally listen to, and follow, Esther George’s incremental rate hike proposal, they may still be able to Soft Land the economy and avoid having to aggressively money launder the Fed’s balance sheet losses.

· Free-Loading Chairman Powell needs to grow a pair and use his casting vote magic to turn Front-Loading into Incrementalism.

(Source: the Author)

Chairman Powell, and the Fed, are the orphans that everyone is starting to hate. The US central bank is on course to be blamed for the great inflation and the great depression that ensued.

The latest FOMC decision is an incremental commitment to tighten monetary policy further, for longer. This is not a concession to Esther George’s request for consideration of, and reflection upon, the constraints on monetary policy.

A visibly animated, and taciturn Powell, in his press conference, belligerently threatened to tighten monetary policy even further even if he has to do this incrementally going forward. Clearly, flexibility of mind and hand is not in his nature. He doesn’t like to be second-guessed and never admits that he is wrong.

According to the Fed Chairman, there is no evidence that the US economy is slowing. In fact, he believes that the economy has picked up steam. Evidently, he must, therefore, believe that the latest quarterly collapse, in unit labor costs, is an economic tailwind rather than a consumer headwind. Or, perhaps, he is just so angry, about being second-guessed that he can’t see straight.

Working consumers are falling behind inflation. They are also falling behind rising interest rates. As the reader will find, later, rising interest rates are now viewed, by some consumers, as a bigger problem than inflation. Cognitive blindness to this fact is like sleepwalking into a policy mistake.

Chairman Powell is acting as if he is unconstrained. It is a cynical and petulant demonstration of a stubborn nature. Chairman Powell thinks he’s right and intends to prove it, by tightening even further than previously anticipated. To show that he has listened, to Esther George, he will do this slowly. To show that he has not understood her he will tighten further than previously suggested. Don’t fight the Fed and don’t question the Chairman.

Chairman Powell should be made to officially take ownership of the Fed’s balance sheet losses, to remind him of the constraints on and his accountability for the Fed’s actions.

There is some logic in Powell’s method. Powell has surrendered to the bond market because the Fed is insolvent. Consequently, when making monetary policy decisions he will always ask what the bond market will make of his decision, first. Bond markets love recessions, thus, in order, to revalue the Fed’s balance sheet higher Powell must deliver a recession. The US economy must, therefore, continue to pay the price for Powell’s mistakes. It has paid the price for inflation and must now pay the price for recession.

Powell still gets paid, either way, which is something that this author finds incredibly perplexing. The Fed must be the only place, in the heart of capitalism, that is incentivized and rewarded for failure. In actual fact, the Fed is allowed to reward itself for failing.

The Fed is demonstrating its inertial bias towards policy error. Back in March 2021, when the central bank should have been tightening, it didn’t. Now that it should be looking for a place to start easing it has inertially extended the tightening. The Fed’s monetary policymaking process is seriously flawed.

Less petulant, than Powell, but still as inertially misguided, Chicago Fed president Charles Evans could only confirm that “Front-Loading” is over. He does not, yet, see the balance of risks showing parity between inflation, and growth, however.

Richmond Fed president Thomas Barkin disingenuously explains the Fed’s structural inertia as a natural part of its policymaking process. Thus, the structural flaw is “not a plan”, but rather, “an output of our (the Fed’s) efforts to try to keep inflation under control.” Hence, even if the central bank is broken, as evinced by its failure to deal with inflation, back in March 2021, don’t fix it.

This structural flaw was clearly demonstrated by two conflicting processes.

In one ear, and, out the other ….

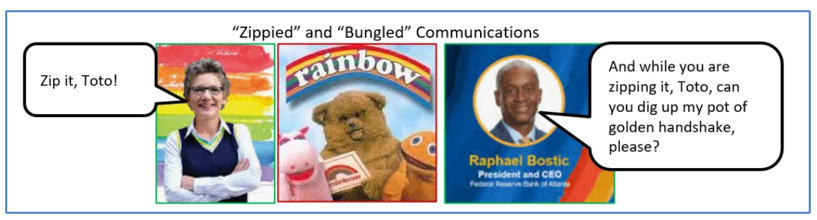

As the FOMC was delivering more economic hardship, on top of the inflation, that Chairman Powell now openly admits that the central bank can’t control, another vestigial organ, of the inertial Fed, was going through the meaningless motions.

When it came out, the Fed Listens initiative was broadly expected to get the Fed’s finger on the pulse and then react accordingly. Chairman Powell, himself, is on record for saying that he prefers real stories, about the economy, from real folks, rather than prosaic data lacking in the human context. It would seem that only Kansas City Fed president Esther George listens, sincerely, in addition to acting professionally, with alacrity, as a Fed Listener. Chairman Powell contradicts himself from either side of his mouth.

So, when Powell was angrily promising, to deliver a recession, in his recent post-FOMC meeting presser, his colleague Raphael Bostic was listening to the contextual verdict, from real folks, on the Chairman’s threats and actions.

Bostic was, somewhere, over the rainbow, in the broadly excluded Black Belt. Inhabitants of this forgotten land are so poor that they need credit to subsist. They live loan-to-loan, rather than paycheck-to-paycheck. The usurious cost of credit, for them, is, relatively, even higher than the prices that they are forced to pay for goods that they consume. What they buy depends on how much it costs them to borrow to pay for it. Since they are a poor credit, and also not white, they pay an egregious interest rate premium. The Fed is now raising the benchmark, rate of interest, on which the usurious premium is spread over. With such a usurious credit premium, it does not take much, of a move, in the benchmark interest rate to yield desolation for this community. Chairman Powell seems to think that a large move in the benchmark interest rate doesn’t really matter because these folks are already dead.

It is highly unlikely that the Fed will listen to the economic plight of ethnic minorities. The central bank is only really interested, in grandstanding affirmative action, to promote colored folks, who have already escaped, from grinding poverty, and, therefore, don’t need help.

As an example, of this author’s observation, Bostic classified the comments, of his ethnic minority Fed Listens audience, as their ignorance of what is really important in life. Apparently, they just don’t get it and, therefore, are not worth listening to, let alone, actually, making policy for. Such ambivalence may reduce the number of colored folks who are competing for jobs with Bostic and the other ethnic escapees, from poverty, within the Fed’s ivory tower.

Boston Fed president Susan M. Collins shares Bostic’s broadly inclusive ambivalence towards those that she has escaped from becoming. Her ambivalence is doctrinaire, which demonstrates that she has been fully indoctrinated by the host ethno-economic community to which she has escaped.

Collins Doctrine, point two, is unrepentant about the fact that the Fed’s hand in the creation of inflation, and its hand in the cure, will fall hardest on those who have no economic franchise. This sounds so Un-American. Additionally, according to Collins, the Fed’s dual mandate is, seemingly, a breach of the 13th Amendment.

The Fed may listen to minorities, but their economic insignificance is not a factor in monetary policymaking decisions. They just don’t move the economic needle, so they won’t get any support to try to move it. In fact, they are the economic needle, in the form of property, which the Fed can move around, with impunity, whilst, seemingly, in breach of the 13th Amendment. The Fed Listens program is, hence, dissonantly politically correct.

· Biden can spare more than a dime, for his “Friend Shore” buddies, but others will have to nickel and dime it.

(Source: the Author)

On the other hand, President Biden listens, attentively, to ethnic minorities. This is why he was elected. Hence, as the Fed raises the cost of student debt POTUS cancels it. POTUS will have heard, what the Fed has, recently, ignored, and will mobilize pressure on the Fed, to listen-up, as he approaches the re-election treadmill.

The Fed may only listen, to Biden, however, when the ethnic majority confirms that interest rates are too high.

As the Fed counts down, to a higher Fed Funds target, in the opposite direction, the global economy is blowing up first.

Friend Shoring contagion ….

· The US economy is “Friend Shoring,” the Fed’s current US Dollar global easing as, a US domestic economic tailwind that is a global economic headwind.

(Source: the Author)

The Fed has been easing globally, through the agency central bank emergency swap lines, with its global peers. Unfortunately, this global easing is getting “Friend Shored”, straight back to the US, as swiftly as the global central bank swap lines can deliver US Dollars to cash-starved global recipients.

Not only are there more risk-adjusted attractive investment opportunities, in the USA, but the energy which the world consumes is priced in US Dollars. Energy consumers must, therefore, get rid of their own currency if they want to consume energy.

Evidently, more global central bank swapping is needed in volume terms. The global shortage of US Dollars, and economic growth opportunities, are leading to a rolling global financial crisis.

The most recent infectious outbreak, of this financial contagion, is to be found at the retail level in Asia. South Korean private speculators have had margin calls on their leveraged-long Hang Seng positions. Simply banning short-selling, won’t make the Hang Seng go up. Liquidity is needed to float the boat. The losses in this current mini-financial crisis appear small, at circa $1.9 billion. It is not the size of the losses, but their location that matters. Korean retail speculators are consumers who can little afford the losses. Consumption and consumer animal spirits have, thus, taken a significant hit. A financial stability problem has, therefore, just spilled over into the real economy.

This latest mini-crisis is another little fire. An outbreak of further little fires will lead to a global conflagration, that will require more than just central bank swap lines to put out. The volume of US Dollar liquidity, at source, will have to be expanded. Currently, fear of inflation is holding back this torrent, thereby making the fires worse. Consequently, the ultimate torrent, of US Dollar liquidity, will have to be, potentially, even more hyperinflationary, in volume, than that which flowed during COVID.

The ultimate torrent of US Dollar global liquidity, as anticipated by this author, will, however, come with a to-do list from President Biden.

Will trade US Dollars for hegemony ….

· Biden can spare more than a dime, for his “Friend Shore” buddies, but others will have to nickel and dime it.

(Source: the Author)

A previous report suggested that Pax Americana and the continued exorbitant privilege, where the conditions precedent on the provision of US Dollar liquidity to the global economy. The chosen few nations to man the “Friend Shoring” ramparts, of America’s global China-exclusion zone, of influence, were viewed as deserving of the liquidity infusion.

· The US Gang of Two now faces the Chinese and Russian Gangs of One.

(Source: the Author)

The last report suggested that by default, of the recently redrafted National Security Strategy, the gang of two, of POTUS and Veep, had abrogated economic and martial power for themselves. This skilled Bridge pair has just played another ace.

It has, recently, been suggested that it would serve the cause of humanity, better, if the EU manned the ramparts of the “Friend Shoring” China-exclusive zone, as an Empire of the East to America’s Empire of the West. This broadly inclusive strategy excludes China, by obliging the EU to sign up for US-proposed trade tariffs and sanctions. This hasn’t happened yet, but it’s out there being negotiated.

· The UK is aggressively 1980s rebooting, Submerging Markets style, whilst its European trade partners reboot in a more peaceful fashion, and America tries to reboot 1990s style.

(Source: the Author)

Britain is noticeably absent from the negotiations because it recused itself some time ago. Britain is out there with no friends, or, trading partners for that matter.

Behind great fortune lies a (humanitarian) crime: What the Dickens has happened to Britain?

· Dickensian Britain is following the scripts of Hard Times, Great Expectations, and The Old Curiosity Shop.

(Source: the Author)

The last report discussed the Dickensian slide in the prospects for civilization as we know it in Britain. Events, continue to plumb the depths.

· The UK will become an austere economy with an ungovernable polity.

(Source: the Author)

This author has been observing the signals of the decline and fall, of Britain, into a state of austere ungovernability. The latest indicator is the most worrying since it points to the most fundamentally important members of the UK polity.

Mothers have suffered asymmetrical economic hardships, throughout history, because of gender-specific norms and conventions. With great democratic integrity and respect for law and order, UK mothers have announced that enough is enough. UK mothers have not become ungovernable, yet, but the writing is on the wall. Should they become ungovernable it will be game over for civilized British society.

Tory scriptwriters have not been idle since the last episode of this depressing soap opera. The latest episode offers the viewers glamour, and excitement, to go with their sleaze and controversy. Instead of asking who shot JR, current series viewers are excitedly speculating about who shot BJ.

Sue Ellen’s eponymous contemporary anti-heroine Suella is a prime suspect in the shooting of BJ (Boris Johnson).

Like her fictional trope, Suella has got baggage.

The latest controversy is the tip of a sleazier iceberg. To sugar-coat its, alleged, humanitarian crimes, against refugees, the government has deployed female gauleiters. Apparently, the gender, and ethnicity, of these potential war criminals, softens the blow and diverts attention, away from, the sufferers. Thus diverted, the chances of investigation and prosecution are, allegedly, diluted.

Once upon a time, it was Gruppenfuhrer Priti Patel who was sending them back. Now it is Suella Braverman’s turn to wear the death’s head badge of honor. Gruppenfurhrer Suella appears to savour the occasion, and the uniform, even more than Gruppenfuhrer Priti. Gruppenfuhrer Suella, unfortunately, like Gruppenfuhrer Priti, does not savor operational security (OPSEC) and the concealment of, potential, crimes against humanity with the same doctrinaire zeal.

Consequently, the British public has been made fully aware, and, thereby, made silently complicit in the said, alleged, crimes against humanity. It’s another stain on the nation’s, less than impeccable, historiographical, track record in dealing with poor folks from the developing world.

The most recent humanitarian crime involves the incarceration, of asylum seekers, in concentration camps that are unfit for human beings. Apparently, this hostile environment is by design rather than accident. This new hostile environment, is, however, only a brief interlude, and introduction, to even worse humanitarian conditions in Rwandan concentration camps.

The Tory Final Solution, like that of the Nazis, is a political riddle, inside an economic mystery, wrapped in an ideological enigma. To engineer Brexit, the Immigration Final Solution was sold to the inhabitants of the traditionally Labour-Voting Red Wall. This selling first needed careful propaganda window dressing. The window dressing was also an opportunity to reward Conservative Party allies in business.

· The symbiotic process of “Dishevelling Up” should do-for both of the major UK political parties.

(Source: the Author)

The window dressing involved the privatization of the Immigration Final Solution. In private hands, it could also be plausibly denied in the event of humanitarian crimes trials. Asylum seekers were shipped off to Red Wall destinations, where the crumbling infrastructure and non-existent housing supply could not cope. Consequently, it was thought, by the local inhabitants, that the immigrants were taking all the houses and resources. The fact that venal and corrupt local Labour Councils, in search of funding, partook in the trough, only served the ulterior political motives of the Conservative Party. Labour was blamed for the immigration problem, for which the Conservatives had the Final Solution. This author has referred to this shameful period, in British History, as “Dishevelling Up.”

As Goebbels taught, telling a big lie, often, usually gets you elected. Consequently, Brexit was misrepresented as the Final Solution to the asylum problem. The conflation of the two, discrete policy issues, was Johnsonian propaganda (at its best) that was, eagerly, consumed by the voting majority. Behavioral economists, and propagandists, understand that if framed well, an issue can be nudged as the incorrect answer to a different question. Britons took back their borders and then set about ejecting the uninvited, whatever, the legal merit of, their reason for being there.

The Conservatives promised to “Level Up” the regions which had been overrun by asylum seekers. This promise could be, and was, viewed as a reward for electing the Conservatives. The promise was hollow. Instead, the asylum seekers and the whole “Dishevelling Up” strategy were scheduled for erasure, and expatriation, from the history books, after the Brexit vote was successfully achieved.

The two female Gruppenfuhrers, tasked with overseeing the erasure/expatriation were a little too overzealous. Incessant, Tory infighting may have even convinced them that they could become Fuhrer. Consequently, they advertised, and demonstrated, their anti-immigrant bona fides, with brio, thereby, drawing attention to the humanitarian crimes that were being committed on their watch.

The new UK PM, therefore, has a humanitarian crime scene, on his doorstep and, in his corner shop on Downing Street. His cynical calculation is that voters will vote with their wallets and not their consciences. Fewer asylum seekers mean more money for the native inhabitants and fewer taxes on them.

The PM may also think that he can avoid prosecution. The Aussies, who know a penal colony, when they are living in one, seem to have got away with it, so why shouldn’t the Old Country?

· UK underdog status risks becoming global pariah status in the developed world under the current regime.

(Source: the Author)

Since Britain is outside of the EU, the European Court of Justice cannot, in theory, prosecute. The Conservatives have also been very quick to legislate their own bill of rights into existence to justify any potential domestic humanitarian crimes committed. Britain is, thus, a global pariah in moral, and ethical terms, in addition to economic terms. This status does not sit well with the civilizing New World Order that President Biden is trying to get the developed nations to sign up for.

Hiding the crimes behind ministers, from ethnic minority backgrounds, does not in fact hide them. Rather, it highlights the crimes by nature of the cynical hypocrisy displayed by the perps. Narrowly including ethnic minorities, to preclude broad ethnic inclusion is politically acceptable but must still be executed legally. This author notes that the Tories are now encroaching on the separate powers of the legislative branch of UK governance. Perhaps the legal execution of politically acceptable policies won’t be needed, in the future, after all.

The House always wins, until it loses ….

With the specter of economic depression looming, speculators, in the UK Poundland Casino, have decided to try their luck at the Q-Table. When “Lizzo” briefly ran the casino, the punters didn’t fancy their chances so much. On the contrary, they betted against the House, and its perceived fiscal profligacy, and won. This bet drove up interest rates and drove “Lizzo” out of the casino business.

The new casino operators are, allegedly, running a tighter ship than “Lizzo”. Consequently, it is assumed that there will be a smaller fiscal deficit. Lazy journalism, and credulous punters, interpret this as a smaller supply of Gilts.

The Bank of England used to be the House until it became insolvent. Now it is every man and woman for him/herself in the Poundland Casino. Since, the Bank is, currently, brassic i.e. insolvent, it has to play its QT chips carefully. With the new casino operator playing a little hand of austerity, this makes the Bank’s QT chips appear to be more valuable to some credulous punters. Consequently, the Bank has been able to drip-feed its QT Gilt sales into greedy little hands at higher prices. The Bank of England’s insolvency is, therefore, not as big as it was when “Lizzo” was running the fiscal scams. It is, however, still insolvent and so is the casino operator. This insolvency will come back to haunt the operator and the players. It will do so when the UK economy is smaller in size, and, thereby, incapable of paying any debt, however small.

· The UK “Off-Licence” is net present valuing UK GDP, and intellectual property, cheaply, at high rates of interest, and then giving them away, in weak Pounds Sterling, whilst boosting unemployment.

(Source: the Author)

What the punters have not understood is that the UK economy is shrinking. Consequently, tax revenues will fall, thereby, weakening the collateral-credit value of UK Gilts. The casino operators will then increase austerity, with the stated aim of reducing the debt outstanding even further. With less fiscal stimulus, the economy will contract and the tax revenues will shrink further. Ultimately, punters will ask to be compensated for the higher risks, of a shrinking UK economy, with higher interest rates. At this point, another spike in yields, reminiscent of the one that ejected “Lizzo” will occur.

At the next point, of casino operator ejection, punters will embrace all things Keynes and reject all things Hayek. These are, presumed to be, the only two real games in town. As noted in the last report, the Tories are Hayek devotees so they will be out.

· Judas, the first Cuckoo of the UK Winter (of Discontent), has made a space for the Head Butler to return, to the family Corner Shop, via the VIP Lane, and for the ensuing asset stripping, and bargain hunting, by friends and extended family, to be blamed on the IMF.

(Source: the Author)

The point of the current game, of Hayek, is, however, not ideological or doctrinaire. The Tories are playing the game, of austerity, to reward their friends and family with privatizations. Thus rewarded, and remunerated, the players can retire, into opposition, and play the guerrilla warfare edition of Call of Duty. What is now in process is a transfer of wealth to said friends and family.

· Keanononimcs, in the form of a Kleptocracy, to build a war chest, for the guerrilla warfare, in opposition, of the Tories in Balkanised Britain will try to use the IMF as a cover.

(Source: the Author)

In effect, the Call of Duty is to transfer any fiscal surplus, and its public sector sources, into the private hands of related friends and family. Said friends and family are not just ideological. Oftentimes, they have been, and, therefore, will be, familial.

If the new casino operators have played their cards right, there will be no UK economy to yield anything, in tax revenues, for the ensuing Labour Government. Consequently, this next Labour government will face the ejection scenario of high-interest rates, and a weak Pound, which will oblige it to fall on the charity (with conditions) of the IMF. At this stage, the Tories in exile will cry foul and call for another general election.

Then it will be game on for the Britain Project, with its 1990s Tony Blair DNA. This game is already happening in the high street shops that are selling out of 1990s fashion.

(Source: the Author)

The Tory strategy game is clever but ignores one major factor. The Britain Project, which is intended to transcend the demise of the Tories, and Labour is gaining traction. It will gain more traction as the economy unravels. Britons will tire of the incessant political churn. They may also come to understand how they are being manipulated by the friends and family of politicians. At this point, the voters will demand something a little more middle-of-the-road.

Hence, the ultimate name over the door, of the Poundland Casino, will be the Britain Project.

The Tory faithful are now realizing that they may have been a little too hasty to get rid of “Lizzo”. Perhaps she should have been constrained rather than ejected. The faithful have also tumbled the new strategy to prepare for a period in opposition. They have yet to realize cui bono from the fire sales and privatizations. The period in opposition could be a long one if a new middle-of-the-road party is born.