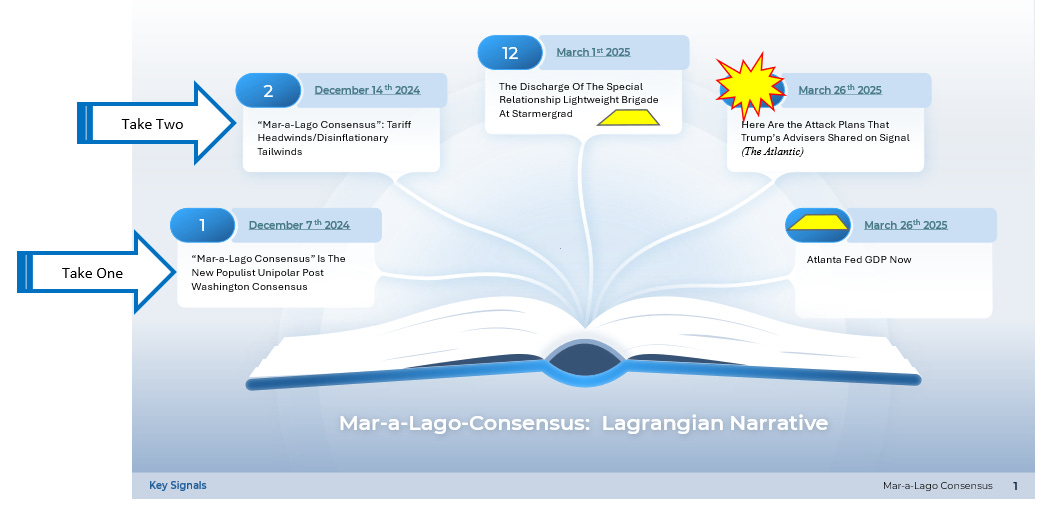

The Fist, Flag, Fire “Signal” Confirms The “Mar-a-Lago Consensus” Key Signal

“If the US successfully restores freedom of navigation at great cost there needs to be some further economic gain extracted in return.” (SM)

Summary:

· Mr. Market is price discovering that “DOGE is the equivalent of Paul Volcker for the incoming secular economic expansion and bull market”.

· An anonymous ECB cadre subscribes to the Key Signals thesis that the Fed is being re-aligned with DOGE to weaponize monetary policy.

· The Fist, Flag, Fire Signal confirms the “Mar-a-Lago Consensus” extortionate privilege Key Signal.

· The “Disinflated in China” part of the “Mar-a-Lago Consensus” thesis appears in the editorial.

· The re-basing of the Atlanta Fed GDPNow data, basis Gold, confirms that global central bank accounting practice, for the creation of new Global Reserves, in proportion to Gold Reserves, is at an advanced stage.

· The US Minsky Moment reveals that DOGE is the equivalent of Paul Volcker for the incoming secular economic expansion and bull market.

(Source: the Author, March 15th, 2025)

· “Mar-a-Lago Consensus” just had its US Minsky Moment reveal.

· The US Minsky Moment is the loss of the Fed's credible commitment.

· The loss of Fed credible commitment is a result of the insolvency that DOGE will exploit.

· The Fed’s credible commitment, and, hence, monetary policymaking is being realigned with DOGE.

(Source: the Author, March 15th 2025)

· “Mar-a-Lago Consensus” has transitioned, “Onshore”, via “Mar-a-Lago Accord”.

· The halo effect, of the recent US Minsky Moment, highlights that the Fed is now two FOMC meetings out of re-alignment with the “Onshore Mar-a-Lago Accord” policy curve.

· The Fed’s misalignment raises the requirement for a less gradual re-alignment than Chair Powell’s “Transitory” rhetoric signals.

· President Trump has “Executively Nudged” the Fed off its employment mandate dataset onto his DOGE “Onshore” dataset.

(Source: the Author, March 22nd 2025)

· Biden’s “Friend Shoring” Washington Consensus has been hardened into Trump’s “Mar-a-Lago Consensus”.

· “Mar-a-Lago Consensus” is Unipolar.

· “Mar-a-Lago Consensus” is the fundamental global macro theme of the “Trump Trade” thesis.

· “Mar-a-Lago Consensus” prescribes sanctions first, followed by regime change second, to all those evil-doers who challenge the US Dollar’s Unipolar Global Reserve Currency status.

· “Mar-a-Lago Consensus” will transfer the global supply chain security cost from the US taxpayer to the global taxpayer/customer.

· “Mar-a-Lago Consensus” will boost the US economy and mitigate the cost of global supply chain security for nations that trade with the USA.

· The unipolar “Mar-a-Lago Consensus” reinforces the global energy security imperative, and aligns, with US Swing Producer status, to deliver a disinflationary global economic stimulus, exclusively, to America’s trade partners.

· “Mar-a-Lago Consensus” and US Swing Producer status combine to reinforce the unipolar “US Exorbitant Privilege”.

· “Trump’s Technocracy” is proselytizing “Mar-a-Lago Consensus” into disinflationary, fiscal deficit shrinking, productivity gains.

(Source: the Author, December 7th 2024)

· In a managed trade and managed FX regime, the central banks’ role will encompass currency board operation.

· The Dallas Fed believes that managed trade and managed FX rates, in an era of expanded Global Reserves, will be best facilitated through the creation of short-duration Central Bank reserve liabilities and consummate duration sovereign debt balance sheet assets.

· Based on the recent inventory “check”, by POTUS, at the Kentucky Federal Bank of Barbarous Relic, the next sovereign creation of Global Reserves will be in proportion to the level of national Gold Reserves.

· Assuming that the new creation of Global Reserves is proportionate, to Gold Reserves, the “Mar-a-Lago World Order” is G1+8-UK.

(Source: the Author, March 1st 2025)