Trans-Atlantic Inflation Risks

“There’s also recognition there’s a point beyond which that control could break down if things got really bad.” (Andrew J. Bailey)

Summary:

· The Chancellor of the Exchequer is accelerating towards “Weimar Ungovernable Kingdom” (WUK) status, as rapidly, as the Bank of England is trying to evade it.

· The Chancellor and the Bank of England are playing cat and mouse over the fiscal rule bending about central bank solvency.

· The Bank of England is more likely to use its “bent” accounting solvency to tighten monetary policy and become more insolvent than to buy more Gilts.

· Failed fiscal rule-bending will show the “Weimar Ungovernable Kingdom’s” (WUK’s) economic limits.

· Pensioner blowback will show the “Weimar Ungovernable Kingdom’s” (WUK’s) political limits.

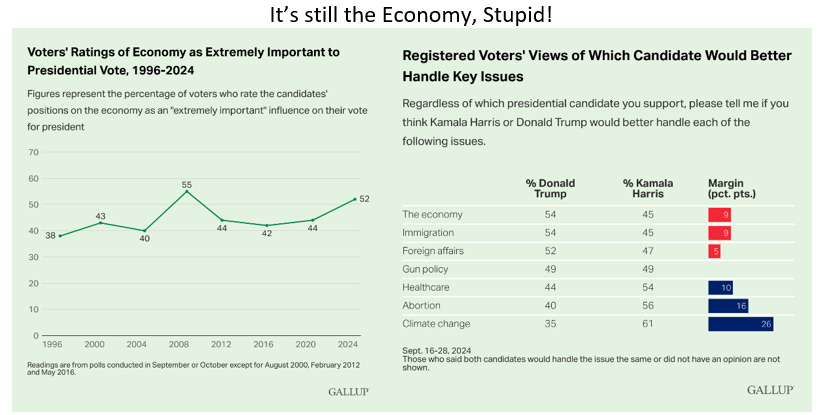

· Despite all global and domestic distractions, the US Presidential Election result is still about the economy.

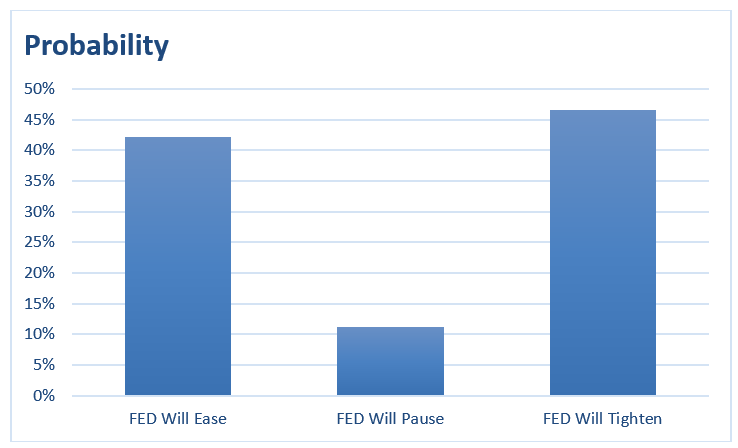

· The early-month Key Signals US indicator indicates that it is more likely that the Fed will have to mitigate the risk, that it has taken with inflation, sooner than intended.

· The early-month Key Signals US indicator confirms that the Fed missed the window of opportunity, for easing, during the June-July inflation-inflection point.

Extracts

· “Grim (Reaper) Labour’s Cheka” confiscates pensioners’ wealth to transfer to public sector foot soldiers.

· “Grim (Reaper) Labour’s Cheka” confiscates pensioners’ wealth to fund public sector capital investment.

· The “Grim Reever” does not understand that you cannot confiscate an actuarial deficit by pretending it is hypothecated national wealth.

· When the “Grim Reever” realizes she cannot confiscate a deficit, she will oblige the Bank of England to monetize it.

· An obliging Bank of England will monetize the Ungovernable Kingdom (UK) into the “Weimar Ungovernable Kingdom” (WUK) rather than the “Woke Kingdom” (WK) status quo.

· The “Weimar Ungovernable Kingdom” (WUK) is the hyperinflationary gateway to “Far Right Reform”.

(Source: the Author, August 17th 2024)

· Having baled on Don Keir “Inner Temple’s” Jibbers, Andrew “The Governor” Bailey should, now, be tightening, against them, according to the September Key Signals monthly UK indicator.

· Chancellor Reeves signals that the UK fiscal rules will be bent.

· Presumably, Andrew “The Governor” Bailey will let Sterling do the tightening; until it crashes the UK economy, at which point, he will, then, let it do the easing.

· The effective loss of control of Sterling will oblige the UK to seek help from the IMF.

· The IMF will opine that the bent fiscal rules are broken.

(Source: the Author, September 28th, 2024)

· Chair Powell confirms, the Key Signal, that the FOMC shoulda-woulda-coulda-didna start easing back in July.

· Because it is behind (the Key Signals Curve), the FOMC is taking an, unnecessarily, “higher” risk, with inflation, that it may have to mitigate “sooner” than intended.

(Source: the Author, September 21st 2024)