Famous Last Words: Discount Me, I’m A Central Banker!

Markets are getting carried away with policymakers’ famous last words. The consequences could be disastrous for economic growth.

Summary:

· FOMC speakers, ex-Barkin, continue to ignore China at their peril.

· Esther George’s Purge is, unintentionally, stock-picking winners and losers.

· Thomas Barkin would like to be back at neutral asap.

· The conflicting US employment data are accurate.

· Mr. Market has gone beyond Barkin’s FOMC-neutral to George’s Purge-tight.

Markets are getting carried away with policymakers’ famous last words. The consequences could be disastrous for economic growth.

Returning to pre-COVID neutral monetary policy settings will feel like and look like a recession, for many, against a backdrop of high inflation. For the chosen few, these conditions will represent an unchallenged opportunity to consolidate their pricing power.

Famous last words: Chinese Whispers ….

· China’s global significance and prescient economic calls are gaining attention and traction.

(Source: the Author)

China has emerged, recently, as a key player in the Ukraine standoff. The flow of Russian hydrocarbons, away from the West, towards China, has received a major structural boost from the crisis. The Chinese economy, and its supply chains, have, thus, been strengthened at the cost of the Eurozone economy.

The Chinese tractor beam, gripping global economic events, has continued to strengthen to a level that, recently, has attracted comment from George Soros.

Soros has recounted Chinese Whispers, exclusively audible to him, predicting an internal challenge to President Xi Jinping developing over the course of this year. Combining this new political threat, with the growing internal economic growth headwind, and external Fed tightening will conspire to give China even more importance in global economic events going forward.

Chairman Powell and Vice Chairman-elect Brainard have re-confirmed that China is the most important actor for the US economy this year.

(Source: the Author)

“Pro-Tempore” Fed Chairman Powell and Vice-Chair nominee Brainard have already made it publicly known that they have the intention and capability to U-Turn, swiftly when slowing China comes knocking at their door. That time may be coming, or at least George Soros wishes us to believe so.

Unfortunately, the news from the Chinese supply chain has not got, as far down the Silk Road, to the Yellow Brick Road in Kansas yet. If and when it does, it may be too late for Main Street.

Famous last words: Follow Esther George’s careless whisper down the Yellow Brick Road to a recession on Main Street ….

The last report detailed how the American consumer, as surveyed by Gallup, does not believe that the current inflation situation is anywhere near that of the Volcker-era. This evidence is, seemingly, lost, along with news from China, on Kansas City Fed president Esther George.

It is George’s view that “with inflation running at close to a 40-year high, considerable momentum in demand growth, and abundant signs and reports of labor market tightness, the current very accommodative stance of monetary policy is out of sync with the economic outlook.” The 40-year high allusion clearly evokes an illusion of the Volcker-era.

George wishes the FOMC to respond, “by smoothing out demand growth to allow supply time to catch up, monetary policy can support the strong and steady expansion of economic activity.” In essence, she wishes to slow the US economy down to meet the current slow pace of the easing-up of supply chain constraints. Shrink the demand-side, to match the supply side.

The study also highlights that a tipping point has been reached, at which confidence in economic growth and employment has fallen to an unstable dynamic equilibrium between the positives and negatives, whilst inflation expectations have risen, universally, over the next six months. This is, perhaps, what Stagflation looks like in 2022. Inflation is a headwind, that consumers expect to be made worse by rising interest rates. Those whom the Fed tried to broadly include, with its new overshooting monetary policy framework, are currently being broadly excluded, by inflation, and just about to be further excluded by rising interest rates.

(Source: the Author)

Why George does not think that the US economy and market forces can do this downsizing, and adjusting, without the help of the FOMC is surprising. When the Fed failed to acknowledge the growing inflation problem, back in Q1/2021, this adjustment process began by default. As noted in the last report, the US consumer has adjusted spending patterns, since then, and is not aggressively seeking higher wages.

George takes the primary, subjective, view that the Fed’s balance sheet is too big and then works back from there. There is no consideration, that the current supply chain, as inadequate as it is, requires the current high levels of liquidity to remain open and to improve.

George seems to think that, somehow, the aggregate removal of monetary policy accommodation will only come from the consumer demand side of the economy. The parlous state of credit rationing, along the supply chain, clearly, questions this assumption. The removal of this lifeline may, in fact, hurt the supply chain even more than the final consumer demand. If this were to occur, then, by following George’s prescription, more money would, then, have to be removed from the US economy to shrink demand lower towards the new even lower supply. In this second prescribed shrinkage, the supply-side would once again be shrunk further, thereby, calling for even more aggregate demand shrinkage. A negative feedback loop would, thus, have been established by George.

The only spot of good news, from George, is that she believes, if balance sheet cutting is aggressive, she won’t need to increase the pain with aggressive interest rate hikes. This good news means a slower death, but a nonetheless painful one, for the condemned US economy.

Do readers see where blindly following George takes the US economy?

Goldman Sachs does.

On the contrary, applying the Goldman scenario, assets with upwards-adjustable cash flows may have the potential to be hedges against inflation. Goldman thinks that the Beta halo-effect, from the sell-off in the assets with no/fixed cash flows, is creating Alpha in these potential inflation hedges. The potential inflation hedges should at least trade at a premium to the no/fixed cash flow assets.

(Source: the Author)

Big companies, with big balance sheets, will be the only ones that survive George’s prescriptive actions. The potential for them to exert even stronger inflationary price hikes will, thus, be reinforced by her actions. These companies will pass-on deflation to their suppliers and inflation to their consumers. Since there is, effectively, no competition for the mega-cap survivors, of George’s Purge, they will be free to widen their margins and enrich their shareholders, in the process. Inflation does not really fall, it just gets baked into a few larger hands.

The recent earnings reports from Alphabet (GOOGL), and Amazon (AMZN), will attest to this George’s Purge outcome thesis. Equity markets are now in the process of sorting out those who prosper from the current economic situation and those who fail. This noisy price discovery is more significant than the rotation news story that is being peddled to explain it.

The minted billionaire oligopolists, of today, are now on their way, to becoming trillionaires, thanks to Esther George’s Purge. This lack of understanding of microeconomic outcomes, with real macroeconomic implications, by a Fed president, is a shocker. Perhaps President Biden should nominate more Fed Governors from small-to-medium-cap US industry, now, before these sectors, and the jobs that they create, become extinct.

Famous last words: All roads lead to, and from, Richmond if you’re going to San Francisco….

· The loss of US economic momentum is reaching a tipping point.

· The FOMC wishes to be seen and heard as a tough inflation fighter.

· The FOMC may be felt as a tough inflation fighter only in March.

(Source: the Author)

Unlike Kansas, all possible roads, for economic drivers, lead to and from the Richmond Fed. In this position, Richmond Fed President Thomas Barkin is, thus, quite happy to start his baseline from the March interest rate hike position. Beyond that point, however, he remains flexible and primarily data-dependent.

Barkin’s baseline, and road network, are contiguous with that of San Francisco Fed president Mary Daly.

Daly, “absolutely”, agrees with a rate hike in March. Beyond March, however, she will make no commitment at this point in time. She is, also, emphatic to the thesis that this is not like the 1970s, so one may infer that she is less in agreement with those calling for multiple successive rate hikes this year.

Famous last words: “at least sitting here today”, and gone tomorrow ….

· Jay Powell may be in the Chair, but James Bullard is at the wheel and will take ownership of the results of the aggressive taper when it is perceived to have failed.

(Source: the Author)

St. Louis Fed president James Bullard has, effectively, taken the steering wheel for the FOMC taper this year. As can be seen above from the famous last words, from two of his colleagues, recently, his grip is being loosened.

Consequently, Bullard was recently compelled to re-assert his tight grip and Mr. Market’s attention. “At least sitting here today,” with all the known unknowns in his mind, Bullard has ruled out the 50 basis point hike, and perhaps done, thesis being peddled by the combined guidance of Atlanta Fed president Raphael Bostic and Minneapolis Fed president Neel Kashkari.

Bullard prefers a sustained, incrementally, rising path, of up to five rate hikes, this year, combined with balance sheet reduction to take over at a later date. Bullard may be sympathetic to Bostic and Kashkari’s intentions to prepare for an FOMC enforced slowdown. He is, however, aware that Mr. Market will be off to the races, discounting this slowdown, way before it arrives, thereby, creating the conditions that sustain the current rise of inflation. Bullard wishes to slay the inflation dragon, convincingly, before bringing the dead-collateral US economy back to life.

Bullard may be emboldened, to overestimate his powers of resuscitation, based on his experience of the ease with which the US economy was switched off and then on when COVID first appeared. Bullard is, thus, leaning against the current forces conspiring to flatten/invert the yield curve. He hopes to preserve some semblance of a normal yield curve to stave off recession, and the resultant blame falling upon him for causing it.

Somewhat counterproductively, for the FOMC’s credibility, and his own, Bullard is dividing the consensus on tapering. This division will become more of a problem, for the FOMC, and Bullard, if and when economic growth becomes more of a concern to Mr. Market and Mr. and Mrs. US Consumer.

Philadelphia Fed president Patrick T. Harker is, like Bullard, not in favor of a 50-basis point March move. Instead, he is sticking with his four rate hikes baseline. Harker would, however, agree with a 50-basis point emergency response in the case of an inflation “spike”. Evidently, what he is seeing now is not a “spike”, so, perhaps, he can be forgiven for allowing it to fester for so long before dealing with it.

Famous last words: You need three points to start a trendline or a reversal pattern ….

Goldman’s market positioning pivot was noted by this author in early December 2021. Everything that unfolds, from the firm, should, thus, be viewed in the context of this pivot.

(Source: the Author)

Goldman’s original chart-plotting, and positioning, was noted as forming a market bottoming reversal pattern in the last report. This pattern formation was, recently, confirmed further by the firm slashing its US GDP forecast for this year, from 3.8% to 3.2%. The slashing of the Q1/2022 forecast, from 2% to 0.5%, is massive and implies an economic contraction this quarter. This, scary, new forecast now questions the validity of the multiple consecutive rate hike thesis and the sanity of those who hold it. Goldman also sees the Quantitative Tightening of the Fed’s balance sheet creating market illiquidity that becomes an economic headwind. Not to be left out in recession signaling melee, Standard Chartered is, now, calling for a possible yield curve inversion.

Famous last words: “It ain’t me, it ain’t me, I ain’t the fortunate one ….”

With President Biden’s popularity waning, and the US economy showing visible signs of slowing, it was unsurprising to see the White House swiftly giving ownership of the current economic situation to the Fed. This was a classic one-two combination.

First, Chairman Powell, and the Fed, were given complete latitude to do the right thing about inflation by President Biden.

Second, the White House warned that the next unemployment rate number would not be good.

Over to you, “Pro-Tempore” Chairman Powell.

Famous last words: Supply-Side deficits don’t matter ….

· “Supply-Side Keynesian” Yellen wishes to Build Back Better America’s disinflationary supply chain with a larger fiscal deficit.

(Source: the Author)

Thirdly, in response to the trap being set for the FOMC, by the White House, this author expects “Supply-Side Janet Yellen” to start promoting her own pre-flagged solution, which is a fiscal stimulus aimed at unblocking supply chains. In addition, President Biden’s controversial Fed nominees will be framed as key supply-siders.

Perhaps, sensing the warm fiscal gravy being loaded onto the train, and headed his way, stimulus obstacle, Senator Manchin has suddenly opined how “extremely qualified” the President’s nominees are.

All the President’s Men and Women nominees have, then, dutifully, sworn an oath to tackle inflation before their committees. By the look of it, one of those Washington fait accompli deals that adds several noughts to the fiscal deficit is being cooked.

First, however, those bad jobs numbers need to print. So far, they have been equivocal.

This author has noticed the key signal that the Chicago Fed, the epicenter of the Freshwater Supply-Side School milieu, has just embraced the new economic supply-side Zeitgeist. Henceforth, going forward, the Chicago Fed’s Economic Mobility Project will be a thought leader on the supply chain conundrum. Leading thought by following Treasury Secretary Yellen, unfortunately, questions the independence of said thought. Watch this space, for independent analysis of said, alleged, independent supply-side thought leadership.

This author suspects that those Chicago Fed staffers, previously of the “transitory” inflation and “broadly inclusive” employment persuasions will now be prevalent, prominent, and gainfully employed in the new mobility project. Now that is an example of economic mobility if ever there was one!

The supply-side Zeitgeist has been embraced by the Richmond Fed also. Staff researchers have recently asked the question “Does Infrastructure Spending Boost the Economy?” Their answer is yes, but with a time lag. Richmond Fed president, and famous essayist, Thomas Barkin should be expected to start discussing this thesis in due course.

Bridgewater, and a few other good firms, were noted, in the last report, as taking the bearish stand against Goldman. This Clash of the Titans is getting more divisive. Bridgewater has, recently, turned up the invective on its inflation and FOMC rate hike call. Credit Suisse believes that the flattening yield curve is a false indicator, of an impending recession, and underestimates the probability of larger interest rate hikes for a longer period of time.

Famous last words: I told you so ….

Perhaps, in view of the unfolding White House set-up, Atlanta Fed president Raphael Bostic began clawing back some of his initial 50-basis point rate-hike bombshell. As swiftly as he called for the outsized hike, Bostic qualified that it will only be needed if inflation expectations trigger second-round wage inflation effects. How this is expected to happen, meaningfully, in a month before the expected start of the rate hike process is pure conjecture. Bostic was, thus, just putting 50-basis points out there, but, remains data-dependent. Bostic’s erratic behavior and guidance is a much larger, potential, problem.

Bostic’s clawback was part of a much larger I told you so, but you didn’t listen, act of guidance procrastination. Advertising that he, allegedly observes and adapts, Bostic reminded anyone who was listening that he and his team were worried about inflation long before the FOMC, officially became worried, in December 2021. This doesn’t really explain why Bostic was also in the “transitory” inflation camp for much of the time that he was allegedly alarmed. Neither does it explain how he dropped the inflation concern when he was being “broadly inclusive” during his “transitory” sojourn.

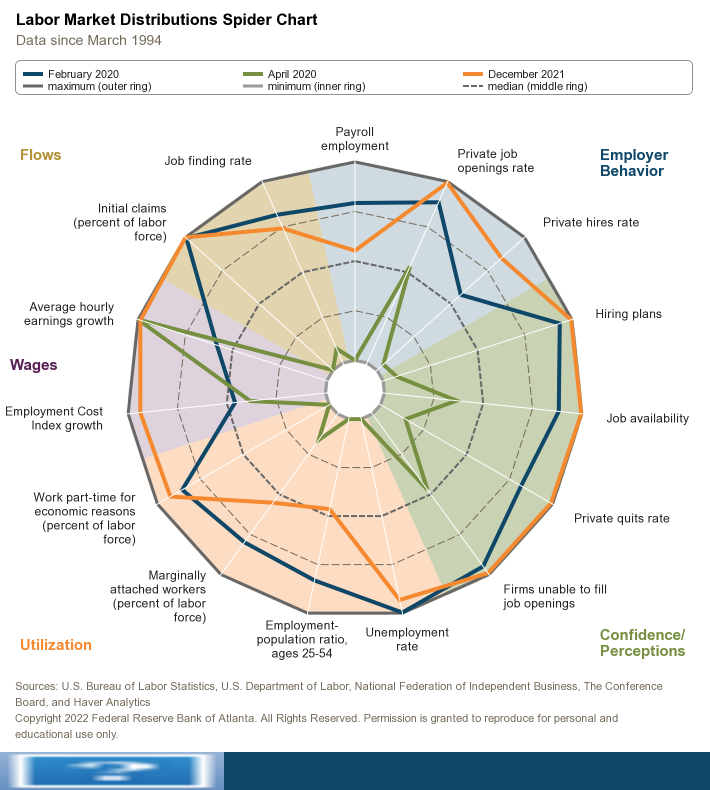

Bostic’s team also updated and published a spider chart, of an employers’ surveyed view of the labor market, since the inception of the COVID-19 pandemic. Whilst some of the metrics have arrived at the full employment boundary, some still have not. Observing and adapting to this chart means that Bostic doesn’t need to go the full fifty in March.

Sadly, Bostic’s team does not have an employees’ surveyed view of the labor market spider chart, to compare and contrast with that of the employers. Such comparing and contrasting would be telling and more accurate. After all, Bostic also serves the employees as much as he serves the employers, or at least he used to back when he was “broadly inclusive”.

Just to pile on the irony, and agony, for Bostic, his research team’s latest GDP Now tracker currently estimates that growth will plummet in Q1 this year. No doubt, Omicron will be blamed if this slowdown materializes. But will Omicron, also, be blamed if inflation rises further during the quarter?

Perhaps, more importantly, will Bostic adapt to this incoming growth and inflation that he observes, and how will he adapt? It is easy to say one is observing and adapting, but very difficult to do so when one’s observations conflict with each other.

Famous last words: “If you can keep your head, and say Holy Cow, when all of those around you are losing theirs, and shouting Katie bar the door, you should be the Fed Chairman my son!”

This author has noted, and discussed, how the perspicacity and common sense, of the great essayist and Richmond Fed president Thomas Barkin, has been a breath of fresh air throughout the observable hysteria on the FOMC.

· The FOMC ex- Barkin race to exit monetary policy stimulus misunderstands the labour force participation conundrum.

(Source: the Author)

Barkin has set himself apart, from his colleagues, by being objective. He has, thus, been able to disentangle himself, from the “transitory” and “broadly inclusive” milieu that has suddenly, and belatedly, become Hawkish.

Candidly, Barkin admits that he does not yet, fully, understand the forces at play in the economy. Like Bostic, he is observing. Barkin is not yet prepared to, fully, address what he does not, fully, understand, however.

Practically, Barkin wishes to get monetary policy settings to a position where they have the best chance of acting optimally, if and when he fully understands what is happening, without totally prejudicing any optimal things that may be happening, currently, by way of natural adjustment. He is not saying if it ain’t broke don’t fix it. He is saying get to a position to find out what is broke, without doing any harm along the way, and then fix what is broke.

Continuing with this objectivity, Barkin recently (indirectly) chastised his subjective colleagues, for being trigger happy, by exclaiming “Holy Cow” at their zeal. Whilst he accepts that there is a basis for swiftly returning the term structure of interest rates, back to pre-pandemic levels, he only views this as a dynamic equilibrium point from which to then pivot either way, depending on the data and circumstances. Essentially, for Barkin, where the Fed was at, immediately pre-arrival of COVID-19, was neutral in conventional monetary policy setting terms. Neutral in conventional terms is where he wants to be, as quickly as is practically feasible, to observe the US economy from. It sounds like a plan.

Sadly, Barkin could not shed greater detail on what neutral is in unconventional monetary policy i.e., in balance sheet terms. Obviously, the Fed’s balance sheet should be smaller but there is no guide on what size it should be from Barkin, yet.

What this author found most interesting, about Barkin’s latest guidance, was his specific observation of the importance, of supply chain conditions in China, as a critical input for FOMC monetary policy decision making. Here is a Fed president who gets it.

Famous last words: “It was the best of times, it was the worst of times ….”

The incoming employment data is a tale of two economies. Data from the ADP Research Institute shows a weakening picture, whilst the Labour Department data shows strength. It may not be a case that one is right and one is wrong. Both may be correct, in a sign that the economy is behaving in fits and starts, based on the supply chain dislocations and COVID constraints upon it.

Unfortunately, as the US economy, endogenously, tries to deal with its issues the FOMC, exogenously, intends to throw in some bigger issues; namely interest rate hikes and balance sheet reduction. The endogenous system, of allocating resources, will thus have further hurdles to allocation, erected by the FOMC, going forward.

As it transpired, the latest Employment Situation report was framed as the starting gun for Chairman Powell’s sprint to tighten monetary policy. Strong job creation, rising wages, and upward revisions in the previous numbers all suggest that the FOMC should get cracking asap. The White House attempts, to get a fiscal stimulus through, by emphasizing the weaker unemployment rate looks dead on arrival.

The tale of two economies is a conundrum that intrigues the objective Mr. Thomas Barkin, and one that will get ignored by his subjective FOMC colleagues. Combined with the rising participation rate data, the “subjectives” will assume that the labor market has fully recovered. There’s enough there for Barkin’s call to get back to neutral, and then some more for the “subjectives”.

The market is pricing in tightening, beyond neutral, and creating the financial conditions that are an economic headwind. Barkin’s Neutral may, thus, feel, and manifest, more like a George’s Purge in practice. This painful manifestation would, then, be the right time for the White House to talk about another fiscal stimulus. This next stimulus will not, however, be a supply-side one; it will be a traditional demand-side Keynesian one.