Summary:

· History is rhyming with great financial crises of recent times.

· China’s global significance and prescient economic calls are gaining attention and traction.

· The loss of US economic momentum is reaching a tipping point.

· The FOMC wishes to be seen and heard as a tough inflation fighter.

· The FOMC may be felt as a tough inflation fighter only in March.

Rewind, Repeat, or Rhyme?

The behavior of certain characters and prices, of late, has become reminiscent of the chain that led to the GFC and its aftermath. Some of this is by accident. But some of it is by design. The same initial mistakes, and then overreaction, by the FOMC are at the core of the plot. The same positioning, by market participants, to capitalize on these mistakes is, noisily, in process. Whilst these games and strategies are being played out, in the United States, the baton of global economic leadership is being unwittingly passed to China in the process. Vae victis.

The Global Dog that barked ….

Traditionally, when the Fed is into a tightening cycle, and inflation is rising, one might reasonably expect to observe capital flight away from China, especially when there is evidence that the Chinese economy is slowing. So far, this year, however, this traditional capital flow pattern is not happening. On the contrary, capital is flying towards China, even as the Omicron outbreak proliferates there. Observers, who rationalize these capital flows, are concluding that there is a global perception that China is a safer bet to come through the current combination of economic threats than America.

Faced with this changing of the global economic guard, the FOMC is becoming a price-taker in terms of its own monetary policy drivers. China is increasingly replacing the Fed’s two domestic economic mandates. Indeed, these two mandates are, increasingly, being driven by what China is doing. Until the FOMC sets policy in anticipation of what the PBOC is doing, the Fed and the American economy will, thus, always remain behind the global economic curve going forward. Perhaps, one day, the realization of this handicap in the form of a change in its mandate will allow the Fed, and the American economy, to compete globally on a level playing field.

The Inflation Dog that barked and bit a chunk out of economic growth ….

Whilst most of his other FOMC colleagues assume that wage inflation pass-through is causally reinforcing higher inflation, noted essayist and Richmond Fed president Thomas Barkin, and his team, are looking for the causality. Thus far, in the manufacturing sector, they find no evidence of labor pricing power gaining the strength that will lead to wage pass-through inflation.

On the contrary, the Richmond Fed team finds that the US employers’ whip hand is getting stronger, more corpulent, and more rapacious. The inference is that manufacturers will mitigate their rising material input costs at the expense of their enfeebled employees. Alarmingly, the researchers also find that this pricing power, in the hands of manufacturing employers, is a relatively new phenomenon that has been, exponentially, strengthening since the turn of the millennium. This is, therefore, not the return to the 1970’s inflationary environment, that the alarmist press and Larry Summers are so fond of opining.

Sadly, Barkin and his team are unable to say exactly what the current is, with any certainty, thereby, rendering any appropriate monetary policy response pending upon further analysis. In the meantime, some of Barkin’s FOMC colleagues are going to lean further on the employers with tighter credit conditions. Presumably, said leaned-on employers will then lean, even harder, on their employees in order to preserve their companies’ profitability. Said employers are also being leaned on, simultaneously, by rising inflation, and, hence, leaning on their employees in due course. Pity the employees. And pity the US economy.

The Growth Dog that barked and was ignored until it bit ….

The last report observed China’s calls, to developed nations, to rethink their, inflation-driven, hasty exit from monetary policy falling on deaf FOMC ears and the attentive ear of Christine Lagarde.

Undeterred, by the first rebuff, the Chinese Ministry of Commerce turned up the invective, a notch, by warning of “unprecedented difficulties” this year, which could be worsened by an aggressive withdrawal of monetary and fiscal stimulus in China’s trading partners.

At least, the IMF is taking China and the global economic situation seriously. The institution has recently cut its growth forecast, for this year, citing the Chinese and US economies as the main reasons.

America: “Subsisting” or “Gorging” on inflation, discuss ….

· On aggregate, the overextended US Consumer is most likely to be subsisting on inflation, rather than gorging on it, but the Fed is assuming the latter.

(Source: the Author)

In a previous article, it was asserted that the US consumer is most likely to be subsisting, rather than gorging, on inflation. The latest Survey of Consumer Expectations (SCE) on household spending provided further context to the assertion. According to the survey, the US consumer is expecting to do more essential spending and less non-essential spending going forwards. Furthermore, he/she is more likely to save, rather than spend, any income windfall. In the event of a fall in income, the propensity to finance the shortfall, by incurring more debt, is also rising. The US consumer is, thus, seemingly, overextended and in subsistence mode according to the data. Inflation expectations may be baked into the consumers’ psyche, but the effect is being felt like an economic headwind, rather than a driver of inflationary wage demands.

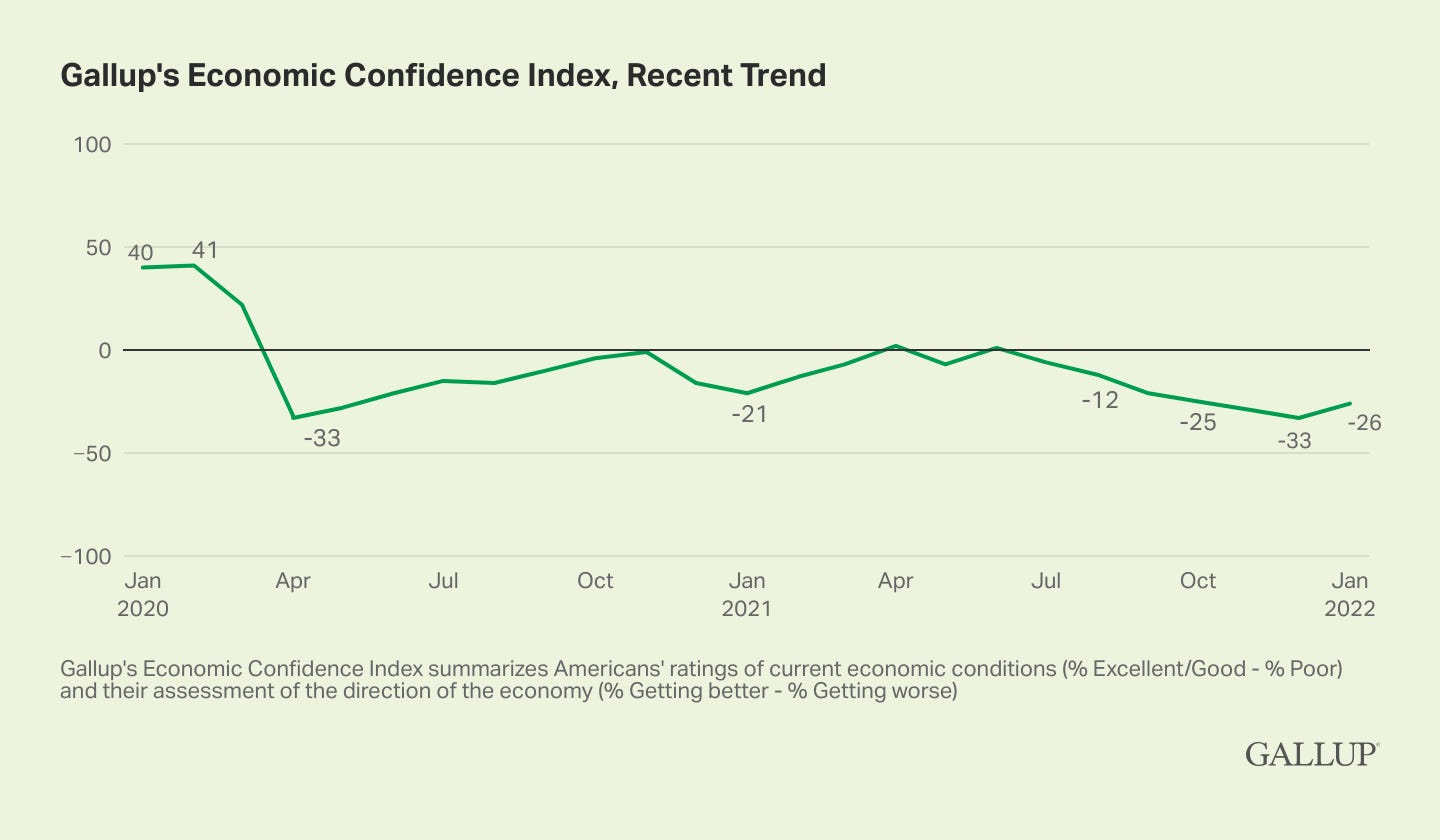

Greater context, on who is gorging and who is subsisting, was provided by the latest Gallup economic confidence survey. Economic confidence is off the pandemic lows but remains weak.

Drilling down through the data, one can see who is the most concerned about inflation and why. Inflation concern has a long way to go before it reaches the Volcker crisis peak, suggesting that the Fed should not be overzealous with monetary policy tightening. Inflation is felt like an economic headwind, which hurts those who can least afford it the hardest.

The study also highlights that a tipping point has been reached, at which confidence in economic growth and employment has fallen to an unstable dynamic equilibrium between the positives and negatives, whilst inflation expectations have risen, universally, over the next six months. This is, perhaps, what Stagflation looks like in 2022. Inflation is a headwind, that consumers expect to be made worse by rising interest rates. Those whom the Fed tried to broadly include, with its new overshooting monetary policy framework, are currently being broadly excluded, by inflation, and just about to be further excluded by rising interest rates.

The Gallup inflation concern data also, clearly, shows that the FOMC has, historically, been overzealous when inflation fears led to what has been called the Dot.com Bubble and Pre-GFC Bubble.

Interestingly, the FOMC was not overzealous back in Q1/2021 when the initial inflation concerns rose. On the contrary, the FOMC followed its overshooting new monetary policy framework, overzealously, thereby, contributing to today’s inflation problem. This time around, inflation is already acting as monetary policy tightening for the Middle Class. The real economy is, thus, already adjusting to inflation. The FOMC, however, feels obliged to make it adjust faster and, thus, risks repeating its mistakes of the past.

In its defense, the FOMC will argue, with a risk manager’s persuasive conviction, that it is taking the precaution of making sure that inflation concern does not run back to the 1970s and 1980s levels. This is plausible, but not acceptable, since the FOMC did nothing, back in early 2021, when the inflation concern spike first appeared. During this period the FOMC went “Transitory”, on inflation, with the resulting spike of today. Now, the FOMC is reacting just as the global economy is imposing its own inflation solution of slowing economic growth.

The FOMC, seen and heard, for what it’s worth ….

The FOMC is of a mind to be seen and heard to be taking the inflation threat seriously. Consequently, the admonishing figure of Chairman Powell has played to the gallery and threatened to hike at every subsequent meeting after starting the process in March. The unfolding drama risked becoming comedic when the Chairman also intimated that he believes that the labor market is at maximum capacity. Since the employment situation has not yet recovered to pre-pandemic levels, Chairman Powell is, effectively, saying that the US economy has shrunk and is shrinking. Furthermore, he now intends to shrink aggregate demand down into line, with this lower level of supply capacity, by forcing an economic contraction.

If the FOMC goes too far, there will be no work to be done, and no surplus workers interested in doing any work, at any wage level. Inflation concerns are, then, absurd under such circumstances. Starving people of credit, to buy goods that they cannot afford and that, in any case, will be unavailable would seem to be churlish. Chairman Powell seems to think that this is the only game in town, however, or at least the only game that will, currently, get him re-elected.

How America is going to pay its massive debts, which are growing, if its economy is being shrunk, is anybody’s guess. This author would guess that the Fed’s balance sheet will be the place where these unrepayable debts find a home, eventually, when the economy shrinks to a level that raises the Chairman’s growth concern above his current fascination with inflation. Perhaps, with this endgame in mind, the FOMC has signaled that it will be tapering by letting assets mature rather than by outright asset sales.

Affirmation, Absolution, Capitulation, and a Big Long moment ….

Judge Powell's Monetary Policy Is The Law, But Is It Legal?

(Source: the Author)

This author has noted, over the years, that Chairman Powell is always careful to represent that he and his team are assiduously, and legally, following their Congressional mandates. The Chairman’s legal duty of care, on his latest speaking occasion, has assumed greater significance given the potential fallout from the FOMC’s intended actions.

At the latest FOMC meeting, the committee went through the motions of affirming its Statement on Longer-Run Goals and Monetary Policy Strategy that it established back in January 2012. This affirmation is not just symbolic or procedural. It serves as the legal disclaimer, and get out of jail clause, for monetary policy mistakes, however, well-intentioned.

The wording of the affirming document is vague enough to give the FOMC the latitude, and independence, to call the shots, and to decide which one of its mandates takes priority when both are in conflict. On this occasion, it allows the FOMC to aggressively target inflation when it is still behind on its employment mandate. Chairman Powell’s assertion, that the labour market has hit full capacity, has thus been legally disclaimed by the affirmation document.

The FOMC also issued a document detailing Principles for Reducing the Size of the Federal Reserve's Balance Sheet. In the context of the affirmation, the principles undertook to reduce the Fed’s balance sheet to a level that is consummate with the FOMC’s specific course of action in relation to its given mandate priorities. The outcome will be a balance sheet of some undetermined size that is exclusively comprised of US Treasuries. This undetermined size will, allegedly, be consistent with both mandate goals.

As noted, by this author, and noted above by Gallup, the Fed failed to act in March 2021 when inflation was getting out of control. The recent affirmation document, thus, covers the FOMC’s mistake and also covers the potential, upcoming mistake of shrinking the level of aggregate demand in the US economy to fit the, imputed, permanent supply constraint set by the labor market. In essence, the document grants the FOMC impunity and absolution from the consequences of its mistakes.

The FOMC is not going to get off the hook, so easily, however, with this bunch of legal disclaimers. The jury is out on Wall Street and also in Congress.

This author noted at the time of the FOMC’s failure to begin tapering, when inflation was getting out of control, in Q1/2021, that the committee seemed to have been captured by Secretary Yellen. In this alleged captivity, the FOMC rote-chanted the “broadly inclusive” and “transitory” mantras which have helped to stoke the inflation spike of today. Evidently, Goldman’s number two now feels the same unease as the author.

Now that the Fed is officially catching up, the risk currency bombing out phase is already approaching its end; even as it garners some ugly headlines and collateral victims. With the Fed perennially arriving late, it is always better to travel than to arrive. It is also better to get off early and buy a ticket in the opposite direction if/when one disembarks early. With these thoughts in mind, Goldman’s swift revision lower for US GDP is apposite rather than prescient.

(Source: the Author)

Goldman’s market positioning pivot was noted by this author in early December 2021. Everything that unfolds, from the firm, should, thus, be viewed in the context of this pivot.

In a recent speaking engagement, Goldman President John Waldron opined that “the independence of the Fed has been damaged in recent years and that it has lost credibility in markets”. The inference is, that the loss of independence is through capture by the political executive. In fairness, Goldman had no issues with this political capture when Wall Street was being bailed out during the GFC. This may, therefore, be a case of the pot calling the kettle black. Nonetheless, the clear nexus of US Treasury and FOMC control has been exposed.

The dots have not, yet, been fully connected to the FOMC’s mistakes, of Q1/2021, which have contributed to the current crisis. This author would also note that President Waldron was nowhere to be seen, or heard, back in Q1/2021, when the Fed was allegedly being captured, so his credibility is not all that it should be.

Evidently, the FOMC has become a threat to Goldman’s business model, and worldview, that it intends to turn into an opportunity. Perhaps there is a new “Big Long” movie in production, and Goldman is editing its trading books on the right side of the historical price-action again. Goldman is swiftly backstroking out of the whole Crypto/Stablecoin meme, so one can see an inherent Big Short position implied by this behavior and the current price action in this market sector. This short position would appear to be paying off handsomely for those who have replicated it by shorting the Ark.

Never interrupt your opponent when he is making a mistake (sic) ….

Goldman is not the only one talking and positioning. Goldman is, however, positioning itself against the bearish crowd. This is a corollary Big Long move being undertaken by Goldman.

In the bearish crowd, the likes of Bridgewater and Morgan Stanley are getting increasingly pessimistic about the future. Similarly, like Goldman, neither firm was seen or heard, back in Q1/2021, when today’s events were being seeded by the “broadly inclusive” and “transitory” FOMC.

On the other side of the trade, Goldman is making clear distinctions between the current sell-off and historic financial crises past. These distinctions are based on the view that (i) current valuations, of assets with cash flows, are reasonable, and (ii) the US real economy is not overheating. It would, therefore, be a mistake to confuse assets that do have cash flows with assets, like Crypto, that don’t under the Goldman view of current economic circumstances.

On the contrary, applying the Goldman scenario, assets with upwards-adjustable cash flows may have the potential to be hedges against inflation. Goldman thinks that the Beta halo-effect, from the sell-off in the assets with no/fixed cash flows, is creating Alpha in these potential inflation hedges. The potential inflation hedges should at least trade at a premium to the no/fixed cash flow assets. Goldman should also say that the FOMC’s current, noisy, attempts to devalue the assets with no/fixed cash flows is the catalyst to this Alpha creation.

Don’t bite the hand that feeds you, just smack it gently but firmly ….

Aligned with Goldman, is Blackrock. This author has previously discussed how Blackrock is the ultimate QE operator meme stock, by nature of the way that central banks have subcontracted out this unconventional monetary policy tool to the asset manager. Evidently, Blackrock wants the show to play on. Consequently, Blackrock’s chief fixed-income strategist is warning the FOMC about the mistake that it may make by aggressively shrinking its balance sheet. The alleged mistake is juvenile.

“Supply-Side Keynesian” Yellen wishes to Build Back Better America’s disinflationary supply chain with a larger fiscal deficit.

(Source: the Author)

The FOMC is, apparently, mistaking purely supply-side driven inflation for overheating demand-side driven inflation. Following this train of thought, as Secretary Yellen has already done, US policymakers should be stimulating the supply-side of the US economy to ease bottlenecks. Should policymakers follow Yellen’s thesis, then, Blackrock will have an expanded mandate and more deficit financing bonds to buy. This author believes that this endgame point will effectively be the acceptance of Modern Monetary Theory (MMT) as commonplace US economic policy. Chairman Powell, however, seems to be convinced that the supply-side has reached its full capacity limits.

Minnesota Fed president Neel Kashkari, a former Master of the Asset Class Universe and PIMCO alumnus, is clearly still empathetic, towards his old colleagues, and sympathetic towards their views. This disposition appears to have prompted his recent forward guidance intervention into the sliding equity markets.

Kashkari, recently, opined that one rate hike is conceivable in March, but in itself will not represent a signal of a series of subsequent intended hikes to come. His views reprise the “balance of risks” baseline that he established on January 4th to maneuver from this year. Inflation is the most visible risk, currently, however, opposing risks may materialize swiftly going forward.

Kashkari’s equivocation provided the context for what would, otherwise, have been a market-destroying salvo of words from Atlanta Fed president Raphael Bostic. Bostic dropped the bomb that the FOMC may need to hike fifty basis points in March. Through Kashkari’s frame of reference, this is more like fifty and done. The four or more rate hike projections, looming over the markets, thus, swiftly, became compressed into one, potential, seminal moment of cathartic market capitulation.

Suddenly, based on Kashkari and Bostic, buying the fifty basis point dip moves up from a remote possibility to a growing probability. Some shorts cannot live with this level of estimated probability, hence, they cover. Price action then encourages the dip buyers to join the price action. The rest is history, as they say when it happens.

A floor has been established under the current price action, that it will take significantly worse inflation data to break. Weakening economic growth data will strengthen this floor.