Davos’23: It is the Worst of Times It is the Best of Times For POTUS (and The Free World)

“There’s gonna be a New World Order out there.” (POTUS)

Summary:

· “Red October 2022” was the Analysistariat’s global crisis trust inflection point.

· There is a Trust Negative Feedback Loop between global policymakers and their target audiences.

· The conditions for victory, in the Polycrisis, are higher relative trust in the crisis risk management system.

· It is the worst of times it is the best of times for the Free World and POTUS.

· The best of times for the Free World and POTUS is based on G7’s Not Free Managed Trade and Managed FX regimes.

· The ECB’s new inflation paradigm is the catalyst for restrictive monetary policy that delivers a consolidation environment.

· Faced with stronger headwinds, the FOMC affirms its 25-Basis points tightening settings.

· Fed balance sheet reduction is managed by Mr. Market, not the FOMC.

· FOMC members from the Fed Governors Board are becoming more voluble about the soft-landing scenario, although, with Bullard’s circumspection.

· The sub-contracting of foreign and monetary policymaking, to the Masters of the Asset Class Universe, is becoming a Trillion Dollar Marshall Plan Mandate.

· President Putin is retracing the path that led to the breakup of the Soviet Union.

· The Ungovernable Kingdom (UK) is, apparently, open for business and membership of the “Hellfire and Brimstone Club”.

· “Oxford Blue Horseshoe” loves “Techno-Economic War” sector valuations.

It is the worst of times it is the best of times ….

There’s a lot of optimism, in lieu of snow, at Davos, this year. Inevitably, the Analysistariat is reaching for the charts, and explanations, of where this optimism suddenly appeared from. Red October 2022 has been cited, by some, as the optimistic datum.

This author would say that the Analysistariat is there or thereabouts. From this author’s viewpoint, at the time, rather than with hindsight, it all started when Stagflation suddenly became a Financial Stability Phenomenon. At this inflection point, the risk to central bank balance sheets became more important, to the global economy, than inflation. Financial stability risk is disinflationary, so disinflation was inevitable, but the central banks would have us believe that the currently improving inflation situation is their doing.

With hope, apparently, so comes trust. With trust comes credible commitment.

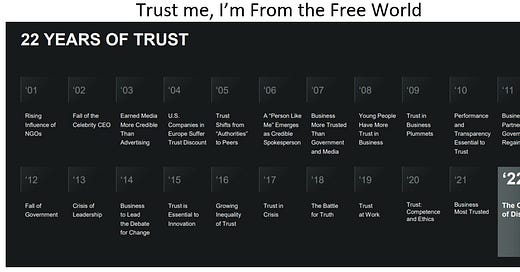

As the great and the good met, at Davos, to dissemble and frame, the state of the World, for the not-so-great and good, to digest, and comply with, a warning was delivered. The not-so-great and good don’t listen to the great and the good anymore. In fact, the not-so-great and good haven’t been listening for the last twenty years, or so.

Furthermore, the not-so-great and good have become increasingly deaf and decreasingly compliant over time. It would seem that the only way to make them listen, and comply, is through the blunt trauma of existential threats, which require collective mobilization. It is perhaps, therefore, no coincidence that the frequency and magnitude, of these, said existential threats, appear to be higher and larger, respectively, than they were twenty years ago. Or perhaps this author’s mind is becoming addled.

Sadly, for the great and good, the not-so-great and good are nobody’s fools, anymore, either, and have come to doubt the basis of these said existential threats based on their incoming higher frequency and increased amplitude.

Thus, the thesis, of the alleged new Polycrisis Operating System (P-OS), was falling on suspiciously deaf ears just as the great and the good, of the Davos Operating System (Dav-OS), met to frame perceptions of and responses to it.

With the warning came a political suicide, to underline the message. Rather than face homicide, at the hands of the not-so-great and good, the youngest leader of the Free World recently fell on her sword. Evidently, she is not up for the Polycrisis, or perhaps her electorate does not think that she is. “Them’s the breaks”, as the putative Comeback Kid says.

This observation, of a policy negative feedback loop, is not the author’s addled thought. It is an empirical fact.

According to the Edelman Trust Barometer, it is the worst of times unless you are in business.

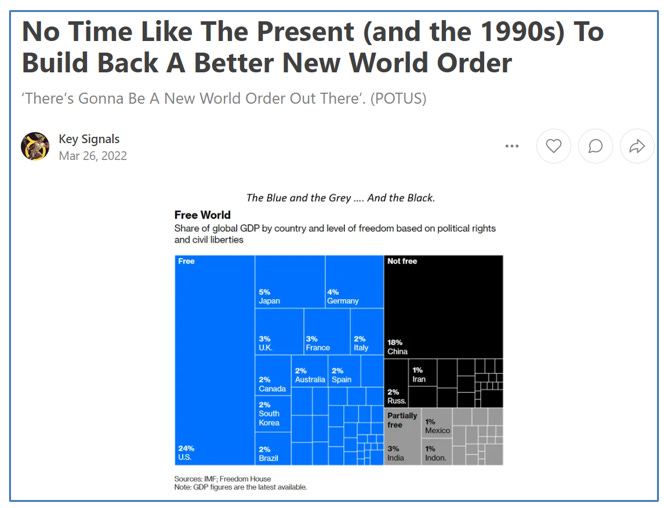

Trust in government and the media is at a new low. Trust is, empirically, still open for business, however. The Free World is, hence, poised to flourish, as trusted businessmen are freed from their distrusted politicians and captive media outlets. This message may come as a great shock to President Xi Jinping and President Putin.

Trust is, allegedly, higher in the Not-As-Free World. The author suspects that this high degree of trust is a symptom of the high degree of duress-inspired compliance by not-as-free regimes. Fear of the consequences inspires compliance and, hence, forced trust, until a massive event inspires collective distrust.

China’s recent Davos U-Turn is a classic example of how a seminal moment of distrust impacts the Not-As-Free. The Chinese people distrust the leadership’s COVID-Zero strategy, hence it has been dropped. The domestic capitulation has been sold to the Free World as a commitment to greater openness. This is, of course, a lie.

China’s recent U-Turn, on COVID-Zero, is a classic example. All data from not-as-free societies is, hence, of little empirical value other than to negatively correlate the level of trust with the level of freedom.

Free World sanctions on China, and divestment, are exacerbating the domestic problems. The abandonment of COVID-Zero, also, means that there are lots of people on the street, un-gainfully, unemployed in sanctioned industries that are off-shoring and “Friend-Shoring”. The Foreign Devil makes work for idle Chinese hands.

China’s Belt and Road is also constrained by sanctions and “Friend-Shoring”. Hence, the great wall of Chinese re-opening, erected at Davos, is an attempt by the Chinese leadership to conceal its weakness.

The sublime global message is, perhaps, therefore, that the conditions for victory, in the current Polycrisis, are those of higher relative trust. The victor doesn’t have to be totally trusted. He/she just has to be more trusted than his/her competitor. This is, hence, an advertising campaign battle between the fighting brands of the Free and Not-As-Free World. Policymakers eulogize this as a battle for hearts and minds. Edward Bernays debunked this noble lie with more prosaic marketing terms, even if the methods used were highly emotive. The Edelman Trust Barometer shows that the conditions for victory have become harder to achieve from an increasingly dissociated and suspicious audience.

Unfortunately, this advertising battle is lethal for some. The Some may run into the millions. The Some may have to run into the millions, in order, to convince the audience to comply with the victory conditions.

This global message, on Trust, is, however, music to the ears of President Biden, because he has been playing his syncretic New World Order Tune for some time. The global economy now appears to be resonating with the same frequency as this message from POTUS. This message is the triumph of the Free World over the Not-As-Free World. This resonance is Imperator POTUS, the putative Leader of the Free World. It is now time for the Federal Reserve to start resonating, to this tune, to deliver a domestic economic victory for POTUS in time for the Presidential election.

To be fair, to the Fed, the FOMC has been double-timing, its dash to tighten monetary policy conditions, to defeat Capitalism’s scourge, of inflation, in order to do the “Friend-Shoring” stimulus “Two-Step” to the cadence of the US Presidential election cycle.

Price discovery, of the thesis mood music, by Mr. Market, will provide a tailwind that propels the Free World and POTUS to their respective victories, over the Not-As-Free World, in 2023 and beyond. Business is overwhelmingly trusted, more than government, thus, Mr. Market is already voting with his feet. He just needs a tailwind, from that distrusted government. Who knows, maybe if that distrusted government provides this tailwind it will also feel the love again.

· It is logical to conclude that we are now living in the Managed Trade/Managed FX Regime thesis previously envisaged.

(Source: the Author)

This Free World Order thesis is, of course, fiction. The success of the Free World will be based on the G7 global architecture of Managed Trade and Managed FX rates.

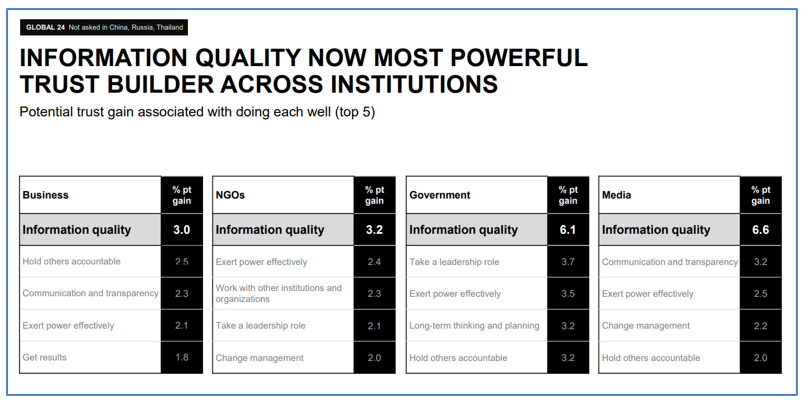

Based on the Edelman Trust Barometer, it is clear that policymakers and central bankers need to improve the quality of their messages, in order to rebuild trust and credible commitment.

This author suspects that the creation of a bull market, and easy, money will be the message sent, as consideration for trust purchase, in lieu of the necessary governance reforms. Currency debasement is, hence, the currency of the Free and Not-As-Free Worlds.

It is notable that Free World central bankers are amongst the least trusted. This observation is consistent with the currency debasement thesis job description.