Apophenia Now: A Blond Hair Rinse And Repeat Moment

“Our country needs America to show the world that our flag is still there, with liberty and justice for ALL.” (Nancy Pelosi)

Summary:

· The probable erosion of the “Friend-Shoring/Techno-Economic War” political dividend, for the Democrats, has been estimated at Davos.

· According to POTUS, and the rules of “Techno-Economic War”, Taiwan is not worth defending.

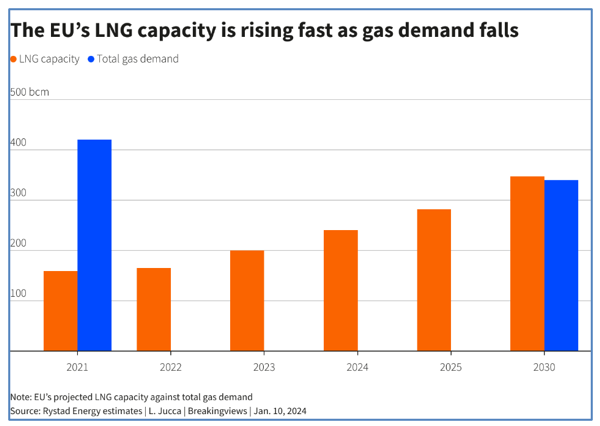

· NATO’s long-term disinflationary US-Scale hydrocarbon supply, and EU demand, are converging, together, and diverging from OPEC+ supply, basis 2030 delivery.

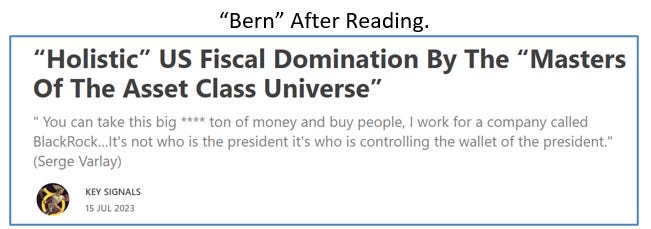

· The “Masters of the Asset Class Universe” feel the Bern.

· Biden and Trump have been Berned.

· The Chinese prequel, to the “Asian Debt Crisis rinse and repeat process”, has been framed in Davos.

· The “War of the Words”, to narrate the Polycrisis, has officially commenced at Davos.

· The “Asian Debt Crisis rinse and repeat process” show will be a series, of episodes, rather than a single blockbuster.

· President Trump has confirmed his “Manchurian Candidacy”.

Extracts

· The inequitable distribution, of the pecuniary return on investment, does not augur well for a substantial “Friend-Shoring/Techno-Economic War” political dividend for the Democrats.

· The Ricardian return on exogenous crisis memes, Desert Storm-to-date, does not augur well for a substantial “Friend-Shoring/Techno-Economic War” political dividend for the Democrats.

(Source: the Author)

· The upcoming Taiwan election begs the question, in America, of whether the nation is worth defending.

· The fallback to Japan answers the begging question of Taiwan.

(Source: the Author)

· The “Friend-Shored” supply chain basis, for the New New World Order Green Transition, is secured in US Dollar Terms.

· US scale hydrocarbon production undermines the competitive advantage, and pricing power, of OPEC+.

(Source: the Author)

· President Putin can’t run for President, and a war, on empty.

(Source: the Author)

· A larger Fed balance sheet will provide the taxpayer-backed assets to “layer” with the lossmaking “out-of-thin-air assets” currently causing the central bank’s insolvency.

· The Fed’s commitment, to a smaller balance sheet, means that Reserves and Assets will have to be managed, off balance sheet, by the “Masters of the Asset Class Universe”, going forward.

· US Monetary Policymaking, and Fiscal Policymaking, along with the elected executive policymaking function, will be ‘dominated’ by the non-elected “Masters of the Asset Class Universe”.

· Fiscal Domination, by the “Masters of the Asset Class Universe” is visible in the public domain.

(Source: the Author)

· The US Dollar ascends another BRIC in the Wall of Worry.

· The US Dollar transcends the “Uninvestable” Great Wall of China.

(Source: the Author)

· The Great Fraud of China is crumbling to reveal moral hazard and wealth confiscation.

· China’s attempted Global De-Dollarization has increased the global supply of, unwanted, Yuan and increased the global demand for scarce US Dollar Reserves, and, thereby, failed.

· The “highly likely” estimated probability that China will trigger an “Asian Debt Crisis rinse and repeat” is rising further.

· Mr. Market’s Editorial confirms that Emerging Markets’ financial instability, originating from China, is the lowest hanging fruit on the Tree of Liberty.

(Source: the Author)

· Xi Jinping “influences” the US Presidential election by expressing his preference for American Dictatorship, rather than American Democracy, as a “Techno-Economic War” adversary.

· Xi’s global preference supports his domestic position.

(Source: the Author)