Tightening Mon-AI-tary Policy Will Lead To A Pause In Monetary Policy Tightening

“Monetary and financial stability – can they be separated?”(Isabel Schnabel)

Summary:

· Nature indicates that the time, on the Polycrisis Chronometer, is One-Eighth To Midnight before Mother Nature strikes back.

· Mother N-AI-ture’s clock is ticking and may strike back unexpectedly.

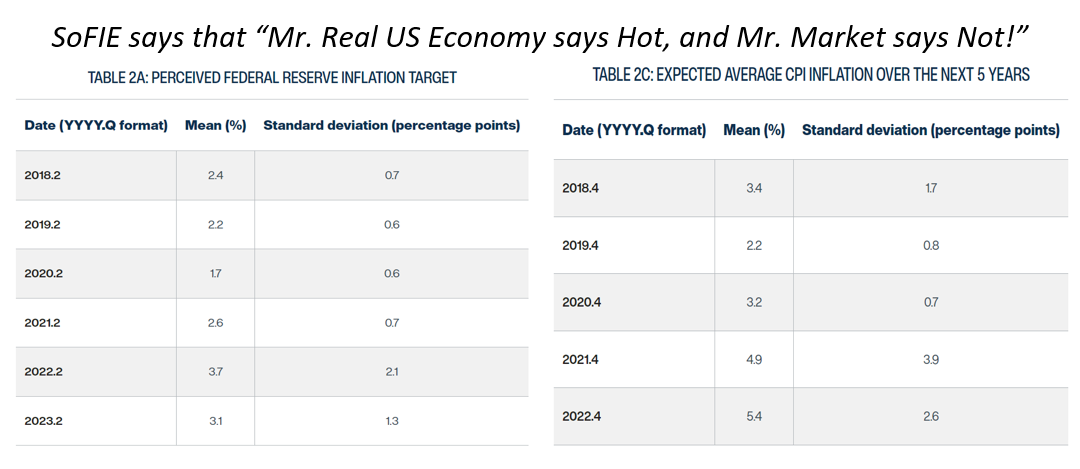

· SoFIE says that Mr. US Real Economy believes the Fed has embraced the IMF’s request for a new monetary policy framework.

· SoFIE , quarterly, reports the current dynamic equilibrium position of the dialectic between Mr. US Real Economy and Mr. Market about the rates of interest that the Fed calls R* and R**.

· SoFIE, currently, says that “Mr. Real US Economy says Hot, and Mr. Market says Not”, however, both gentlemen are fickle.

· Mon-AI-tary Policy tightening is, allegedly, a greater headwind, for the US Real Economy, than the FOMC’s monetary policy tightening.

· The FOMC will be forced to pause, while Mon-AI-tary Policy tightening runs its course.

· The real economic headwind, from Mon-AI-tary Policy tightening, is a Hurric-AI-ne Force tailwind, behind the “Great Rot-AI-tion”, that will drive capital flows into relatively attractive rising Re-AI-l US$ Yields.

· Having decoupled, from “NASDAIQ”, Crypto can now negatively correlate with the index.

· Rishi Borja’s evasion, of “Partygate” investigators, implies significant personal skin, in the “VIP Lane” game, which “Fast Tracked” circa £49 Billion of unaccounted-for spending.

· The ECB’s financial stability review is a guide, for the perplexed, to the financial crisis, that will celebrate the 25th anniversary of the Eurozone with banking sector consolidation.

· The ECB is already blaming the BOJ for the crisis that will lead to Eurozone banking sector consolidation.

· The exclusion of journalists, from OPEC+, confirms that there is no “+”.

Extracts

· US-AI Inc’s new “Hypergrowth Phase” is both a Polycrisis problem and a disinflationary solution.

(Source: the Author)

· Mr. Market’s “Great Rot-AI-tion” is decoupling NASDAQ from Crypto and Bricks and Mortar Stocks.

(Source: the Author)

· The ECB would like to celebrate its 25th anniversary with an existential crisis that challenges and ultimately expands the scale and longevity of the Eurozone.

· To evade Euthanasia, the ECB intends to sedate the Eurozone economy to perform a banking sector consolidation operation instead.

(Source: the Author)

· Thanks to Asian sanctions busters there’s no “+” in OPEC+.

(Source: the Author)