This “Chicken TACO” Tastes Like 2008 Aged Pork

"Those who fail to learn from history are doomed to repeat it."(Winston S. Churchill)

Summary:

· Inflation is everywhere and always a fiscal domination policy phenomenon for the insolvent Bank of England.

· Continued BOE QT selling realizes balance sheet losses, and makes them worse, by pushing up Gilt yields.

· The Bank of England needs more Gilts to provide income, to cover its balance sheet losses, but further purchases risk making the losses worse if further UK borrowing pushes up yields.

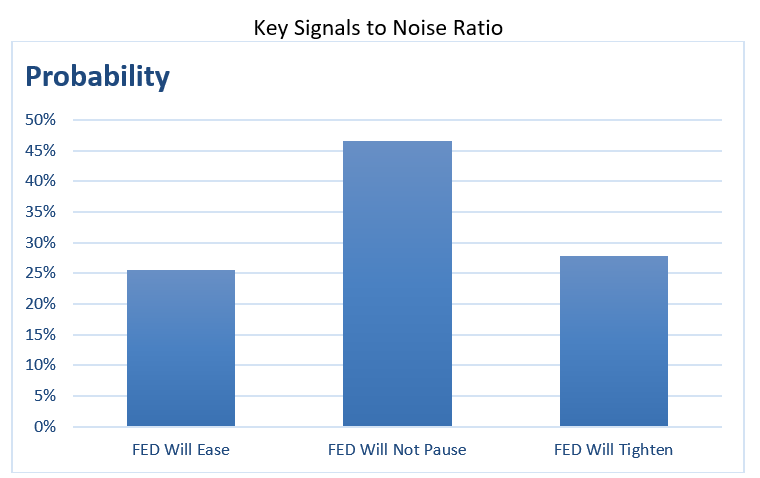

· Lorie Logan’s new monetary policy framework symmetrical definition of the employment mandate confirms the Key Signal that the Fed should currently have a tightening bias.

· Elon Musk confirms the Key Signal that the Fed should currently have a tightening bias.

· Musk’s exit verdict is that DOGE is an empty TACO shell that tastes the same as the Biden Pork Barrel.

· The algorithms that control the news cycle will now target the empty TACO shell, which tastes the same as the Biden Pork Barrel.

· US Big Tech plays Call of Duty by following the money, from the Trump Pork Barrel, into the Defence Sector.

· The credit negative DOGE GSE privatization model bubble has been structurally reinforced by the Fed’s get-out-of-jail card for the poster child (WFC) of the housing bubble-driven 2008 Credit Crunch.

· The 2008 Credit Crunch reprise will be structurally enabled by the Fed’s light-touch banking sector regulations.

· The NY Fed has confirmed that the US central bank is in the same predicament as the insolvent Bank of England.

Extracts

· Rachel Reeves is desperately gambling, with the Gilt Market, for growth to fill her fiscal black hole.

· The Bank of England is being fiscally dominated at the expense of the long-end of the Gilt Market.

(Source: the Author, March 10th 2025)

· Nasty Europeans are being targeted by the algorithms that control the news cycle.

(Source: the Author, May 31st 2025)

· Moody’s views the DOGE strategy to transfer the Federal businesses/liabilities, which it doesn’t cut, to newly overleveraged private capital as credit negative for the credit providers.

· The GSEs are first up for privatization after the Moody’s downgrade.

(Source: the Author, May 24th 2025)

· The DOGE GSE privatization model privatizes the profits with no taxpayer participation to compensate for a guarantee with an implicit bailout provision.

· Moody’s blues on the US credit rating will deepen on review of the DOGE GSE privatization model.

(Source: the Author, May 31st 2025)